As we delve into the heart of June 2025, the US stock market stands as a beacon of resilience and growth. This article provides a comprehensive summary of the current state of the US stock market, highlighting key trends, sectors, and individual stocks that have been making waves.

Market Overview

The US stock market has experienced a robust recovery since the onset of the pandemic. The S&P 500, a widely followed index, has reached new all-time highs, driven by strong corporate earnings and a favorable economic outlook. The market's performance can be attributed to several factors:

- Economic Recovery: The US economy has shown significant signs of recovery, with unemployment rates falling and consumer spending on the rise.

- Corporate Earnings: Many companies have reported strong earnings, with some sectors outperforming others.

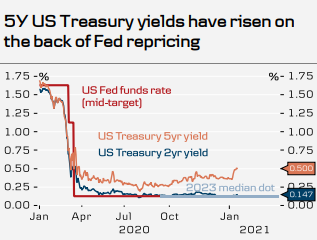

- Monetary Policy: The Federal Reserve has maintained a supportive monetary policy, keeping interest rates low and encouraging investment.

Key Sectors

Several sectors have emerged as leaders in the US stock market this year:

- Technology: The technology sector remains a dominant force, with companies like Apple, Microsoft, and Amazon leading the pack.

- Healthcare: The healthcare sector has seen significant growth, driven by the increasing demand for healthcare services and advancements in medical technology.

- Energy: The energy sector has experienced a resurgence, thanks to the rise in renewable energy sources and increased oil production.

Individual Stocks

Several individual stocks have made headlines in the US stock market:

- Tesla (TSLA): Tesla has continued to dominate the electric vehicle market, with its innovative products and strong growth prospects.

- Meta Platforms (META): Once known as Facebook, Meta has expanded its presence in the metaverse and virtual reality, driving significant growth.

- NVIDIA (NVDA): NVIDIA has emerged as a leader in the semiconductor industry, with its graphics processing units (GPUs) finding applications in various sectors.

Case Study: Amazon (AMZN)

Amazon, the e-commerce giant, has been a driving force behind the US stock market's growth. The company has expanded its offerings beyond online retail to include cloud computing, streaming services, and logistics. Here's a closer look at Amazon's performance:

- Revenue Growth: Amazon's revenue has grown consistently over the years, with the company generating over $400 billion in revenue in 2024.

- Market Capitalization: Amazon's market capitalization has reached an all-time high, making it one of the most valuable companies in the world.

- Investor Sentiment: Investors remain bullish on Amazon, with the stock trading at a premium.

Conclusion

The US stock market has demonstrated remarkable resilience and growth in June 2025. With a favorable economic outlook and strong corporate earnings, the market is poised to continue its upward trajectory. As investors, it's crucial to stay informed about the latest trends and sectors to make informed investment decisions.

How Many People Invest in the Stock Market ? new york stock exchange