Embarking on the journey to trade US stocks from abroad can be an exciting and potentially lucrative endeavor. However, it's crucial to understand the nuances and requirements involved. This guide will provide you with the essential information you need to start trading US stocks from any corner of the world.

Understanding the Basics

Before diving into the specifics, it's important to grasp the basics of trading US stocks from abroad. Essentially, you'll need a brokerage account in the United States that allows you to trade stocks listed on American exchanges. This can be achieved through online brokers that cater to international clients.

Choosing the Right Broker

Selecting the right brokerage is the first step in trading US stocks from abroad. Look for brokers that offer:

- Low Fees: Be cautious of hidden fees, such as account maintenance fees or transaction fees.

- Quality of Service: Ensure the broker provides reliable customer support and a user-friendly trading platform.

- Regulatory Compliance: Choose a broker that is registered with the appropriate regulatory authorities, such as the Securities and Exchange Commission (SEC) or the Financial Industry Regulatory Authority (FINRA).

Opening a Brokerage Account

To open a brokerage account, you'll typically need to provide the following information:

- Personal Information: Name, address, date of birth, and Social Security number or equivalent.

- Financial Information: Bank account details for funding and withdrawal purposes.

- Identification: A government-issued photo ID, such as a passport or driver's license.

Once your account is set up, you can begin trading US stocks.

Understanding Risk

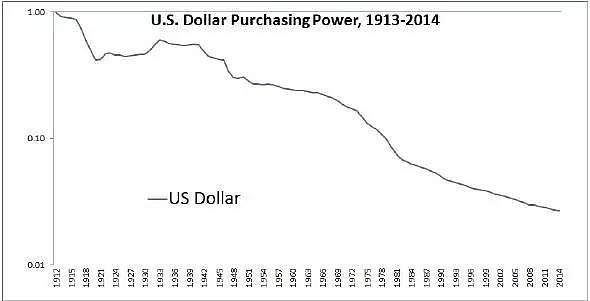

Trading stocks carries inherent risks, regardless of your location. It's important to understand these risks and develop a risk management strategy. This includes:

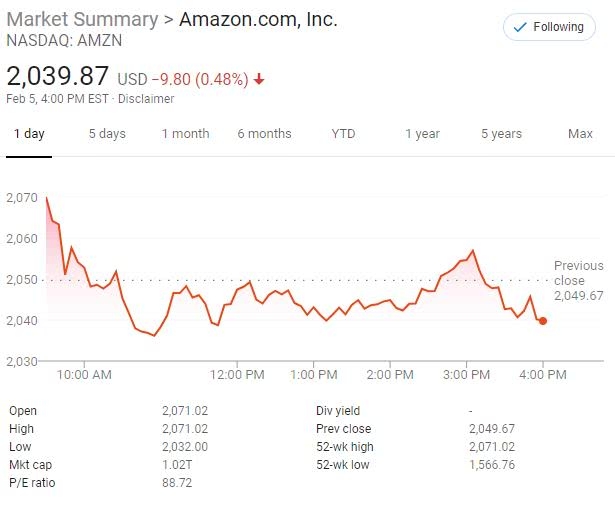

- Market Volatility: Stock prices can fluctuate significantly, leading to potential gains or losses.

- Liquidity: Some stocks may be less liquid, making it challenging to buy or sell at desired prices.

- Regulatory Changes: Changes in regulations can impact the market and your investments.

Tax Implications

When trading US stocks from abroad, it's essential to consider the tax implications. Generally, you'll need to report your foreign income to the IRS. However, certain tax treaties may apply, reducing your tax liability.

Case Studies

Let's take a look at two case studies to illustrate the process of trading US stocks from abroad:

Case Study 1: John, a German Investor

John, a German investor, decides to trade US stocks from abroad. He opens an account with a reputable online broker and funds it with his German bank account. After thorough research, he buys shares of a well-known US technology company. Over time, the stock appreciates, and John decides to sell, realizing a profit.

Case Study 2: Maria, an Australian Trader

Maria, an Australian trader, is interested in the US stock market. She finds a broker that caters to international clients and opens an account. After analyzing market trends, she identifies a promising US healthcare company and purchases shares. The stock performs well, and Maria successfully exits her position, earning a substantial profit.

Conclusion

Trading US stocks from abroad can be a rewarding investment strategy. By choosing the right broker, understanding the risks, and staying informed, you can navigate the US stock market successfully. Remember to research thoroughly and consult with a financial advisor if needed.

How Many People Invest in the Stock Market ? new york stock exchange