In today's globalized economy, investing in international stocks has become increasingly popular. The US International Stock Index is a vital tool for investors looking to diversify their portfolios and capitalize on global market trends. This article delves into the intricacies of the US International Stock Index, its components, and how it can impact your investment decisions.

What is the US International Stock Index?

The US International Stock Index is a benchmark that tracks the performance of a basket of international stocks listed on U.S. exchanges. It provides investors with a snapshot of the global market's health and potential opportunities. This index is designed to reflect the performance of companies from various countries, including Europe, Asia, and Latin America.

Components of the US International Stock Index

The US International Stock Index includes a diverse range of companies across various sectors. Some of the key components of this index are:

- Technology: Companies like Apple and Microsoft, which have a significant presence in the global market.

- Healthcare: Leading pharmaceutical companies such as Pfizer and Johnson & Johnson.

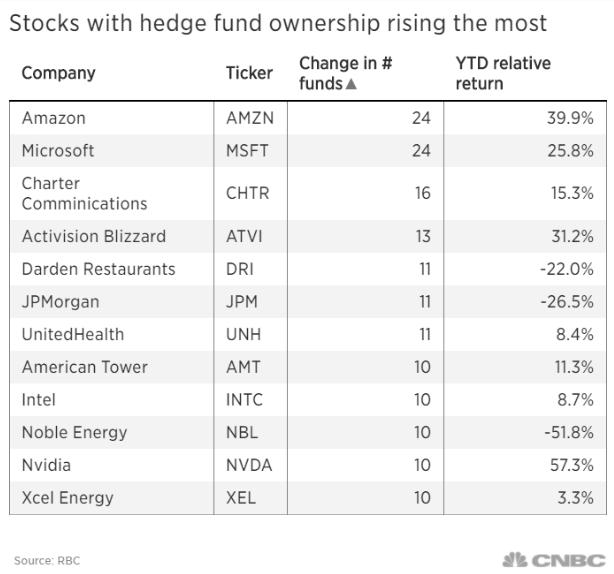

- Financials: Major banks and financial institutions like JPMorgan Chase and Goldman Sachs.

- Consumer Goods: Brands like Procter & Gamble and Coca-Cola, which have a global footprint.

Benefits of Investing in the US International Stock Index

Investing in the US International Stock Index offers several benefits:

- Diversification: By investing in a basket of international stocks, investors can reduce their exposure to any single market or sector.

- Access to Global Markets: This index provides access to some of the fastest-growing markets in the world, allowing investors to capitalize on emerging trends.

- Potential for Higher Returns: Historically, international stocks have outperformed domestic stocks, offering investors the potential for higher returns.

Case Study: Investing in the US International Stock Index

Consider a hypothetical scenario where an investor decides to allocate 20% of their portfolio to the US International Stock Index. Over the next five years, this index delivers an average annual return of 8%. By contrast, the S&P 500, a benchmark for the U.S. stock market, returns an average of 6% over the same period.

In this example, the investor's decision to invest in the US International Stock Index contributed to a higher overall return, showcasing the potential benefits of diversifying internationally.

Conclusion

The US International Stock Index is a valuable tool for investors looking to diversify their portfolios and capitalize on global market trends. By understanding its components and benefits, investors can make informed decisions and potentially achieve higher returns. As the global economy continues to evolve, investing in international stocks may become an essential component of a well-diversified investment strategy.

How Many People Invest in the Stock Market ? new york stock exchange