In the ever-evolving global economic landscape, tariffs have become a pivotal factor influencing the US stock market. The imposition of tariffs by the United States on various goods and services can have profound implications for investors and the broader market. This article delves into how tariffs impact the US stock market, analyzing the potential risks and opportunities they present.

Understanding Tariffs

Tariffs are taxes imposed on imported goods, designed to protect domestic industries from foreign competition. While tariffs can benefit certain domestic industries, they often lead to higher prices for consumers and can spark trade wars, negatively impacting global economic stability.

The Impact of Tariffs on the US Stock Market

Sector-Specific Effects: Automotive and Manufacturing Industries are particularly vulnerable to tariffs. For instance, the imposition of tariffs on steel and aluminum by the Trump administration has had a significant impact on these sectors, leading to increased costs and reduced profitability for companies like Ford and General Motors.

Global Supply Chains: The US stock market is heavily dependent on global supply chains. Tariffs can disrupt these chains, leading to higher production costs and supply shortages. This was evident during the trade war between the United States and China, where companies like Apple faced production delays and increased costs.

Consumer Prices: Increased tariffs lead to higher prices for consumers, which can dampen consumer spending and economic growth. This, in turn, can negatively impact the stock market, as companies experience reduced revenue and profitability.

Market Volatility: Tariffs can introduce uncertainty into the market, leading to increased volatility. Investors often react to tariff news by selling off stocks, leading to market downturns. This was evident during the trade war between the United States and China, where the stock market experienced significant volatility.

Opportunities for Certain Industries: While tariffs can have a negative impact on the stock market, they can also present opportunities for certain industries. For instance, companies that specialize in domestic manufacturing or offer alternative products may benefit from increased demand due to higher import prices.

Case Studies

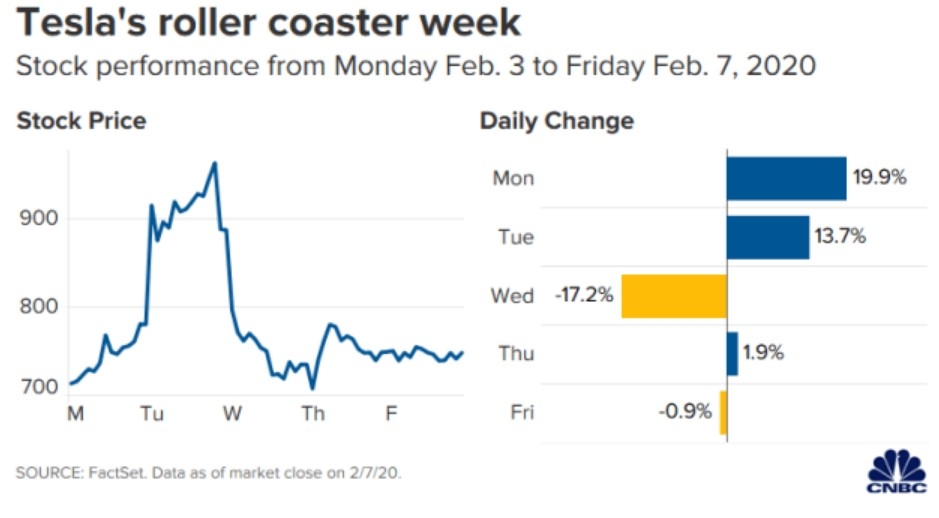

Tesla: Tesla, an electric vehicle manufacturer, has faced challenges due to tariffs on batteries and other components. However, the company has also seen increased demand for its products in markets where import tariffs are high, such as China.

Caterpillar: Caterpillar, a heavy equipment manufacturer, has experienced increased costs due to tariffs on steel and aluminum. However, the company has diversified its operations, focusing on domestic production and exports to non-tariffed markets.

Conclusion

Tariffs have become a significant factor influencing the US stock market. While they can pose risks and volatility, they also present opportunities for certain industries. Investors should carefully monitor tariff developments and consider their impact on their investment portfolios.

How Many People Invest in the Stock Market ? stock chap