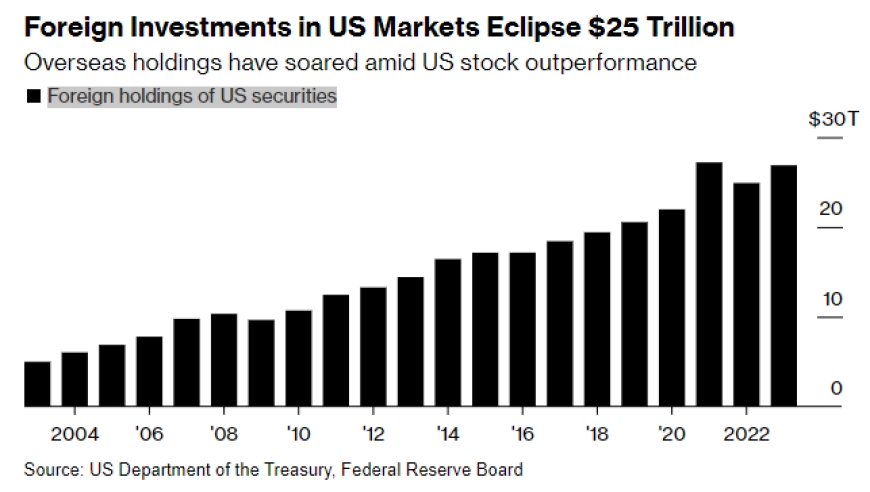

In recent years, there has been a notable increase in Israel's investment in U.S. stocks. This trend has raised eyebrows among investors and economists alike, sparking debates about the implications for both countries' financial markets. In this article, we'll explore the reasons behind Israel's growing interest in U.S. stocks and the potential impact on the global economy.

Understanding the Investment Trend

The surge in Israel's investment in U.S. stocks can be attributed to several factors. Firstly, the Israeli economy has experienced significant growth, bolstered by a highly skilled workforce, innovative startups, and a strong tech sector. As a result, Israeli investors have been looking for new opportunities to diversify their portfolios and tap into the promising growth potential of the U.S. stock market.

U.S. Stocks: An Attractive Investment Destination

Several factors make U.S. stocks an attractive investment destination for Israeli investors. The U.S. stock market is one of the largest and most liquid in the world, offering a wide range of investment opportunities across various sectors. Additionally, the U.S. economy has been characterized by strong growth and low inflation, which has made U.S. stocks more appealing.

Technological Synergy

One of the main reasons for Israel's interest in U.S. stocks is the country's thriving technology industry. Israel is home to numerous tech companies, many of which have expanded into the U.S. market. As a result, Israeli investors are eager to invest in U.S. tech stocks, capitalizing on the synergies between the two countries' technology sectors.

Case Study: Mobileye and Intel

A prime example of this synergy is the acquisition of Israeli startup Mobileye by Intel. Mobileye, a leader in autonomous driving technology, was acquired by Intel for a staggering $15.3 billion. This deal showcased the potential for Israeli startups to attract significant investments from U.S. companies, ultimately leading to increased Israeli investment in U.S. stocks.

The Role of Economic Policies

The U.S. government's economic policies have also played a role in attracting Israeli investors. The Trump administration's tax cuts and pro-business stance have made the U.S. stock market even more appealing to foreign investors. Moreover, the U.S. government's support for innovation and entrepreneurship has encouraged Israeli investors to explore new investment opportunities.

Potential Risks

While there are many benefits to Israel's investment in U.S. stocks, there are also potential risks. Fluctuations in the U.S. stock market could impact Israeli investors, and geopolitical tensions between the two countries could further complicate the investment landscape. Additionally, the potential devaluation of the shekel against the dollar could affect the returns on Israeli investments in U.S. stocks.

Conclusion

Israel's growing investment in U.S. stocks is a testament to the strong economic ties between the two countries. While there are risks involved, the potential benefits for Israeli investors are substantial. As the relationship between Israel and the U.S. continues to evolve, it's likely that this trend will persist, creating new opportunities for growth and innovation on both sides.

How Many People Invest in the Stock Market ? stock chap