In the world of finance, the terms "gold," "US money," and "stock" are often thrown around as investment options. But what do they truly mean, and how can you effectively use them to maximize your wealth? This article delves into the intricacies of each, offering insights into how they can work together to create a robust investment strategy.

Understanding Gold

Gold has long been considered a safe haven investment. Its value tends to remain stable, even during economic downturns. This makes it an attractive option for investors looking to diversify their portfolios. When markets are volatile, gold can act as a hedge against inflation and currency devaluation.

The Role of US Money

US money, or the US dollar, is the world's primary reserve currency. Its stability and reliability make it a popular choice for international transactions and investments. Holding US money can provide a sense of security, as it is less likely to be affected by the economic turmoil in other countries.

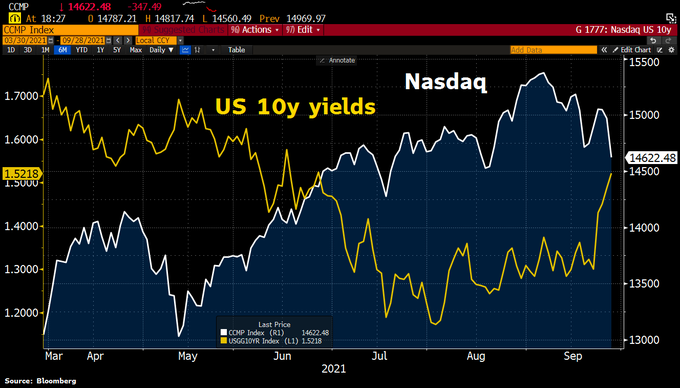

Stock Market Insights

The stock market is a place where investors can buy and sell shares of public companies. It offers the potential for high returns, but it also comes with higher risk. Understanding the stock market and selecting the right stocks can be challenging, but it is essential for anyone looking to grow their wealth.

Combining Gold, US Money, and Stocks

So, how can you effectively combine these three elements to create a well-rounded investment strategy? Here are some key points to consider:

1. Diversification

Diversification is key to managing risk. By investing in different asset classes, such as gold, US money, and stocks, you can protect yourself from the volatility of any single market. This approach can help ensure that your investments remain stable and grow over time.

2. Asset Allocation

Asset allocation refers to the process of dividing your investments among different asset classes based on your risk tolerance and investment goals. For example, if you are risk-averse, you may choose to allocate a larger portion of your portfolio to gold and US money, while a more aggressive investor might lean towards stocks.

3. Timing and Patience

Timing the market can be difficult, but patience is key. By staying invested for the long term, you can ride out market fluctuations and benefit from the growth of your investments. This is particularly important when investing in stocks, as they tend to offer higher returns over time.

Case Study: John's Investment Strategy

John, a 35-year-old software engineer, was looking to grow his wealth. He decided to combine gold, US money, and stocks in his investment strategy. Initially, he allocated 30% of his portfolio to gold, 40% to US money, and 30% to stocks. Over the next five years, he remained patient and diversified his investments.

As a result, John's portfolio grew significantly. His gold investments protected him during market downturns, while his stocks provided higher returns during market upswings. By the end of the five-year period, John's portfolio was worth over $500,000, a substantial increase from its original value.

Conclusion

Incorporating gold, US money, and stocks into your investment strategy can be a powerful way to grow your wealth. By understanding the unique benefits of each asset class and diversifying your investments, you can create a well-rounded portfolio that is less susceptible to market volatility. Remember, patience and a long-term perspective are key to success in the world of investing.

How Many People Invest in the Stock Market ? stock chap