The United States has long been the world's economic powerhouse, but its increasing debt levels have raised concerns about the stability of its financial markets. One of the most significant areas affected by this debt crisis is the stock market. This article delves into how the U.S. debt impact on the stock market can affect investors and the overall economy.

Understanding the Debt Situation

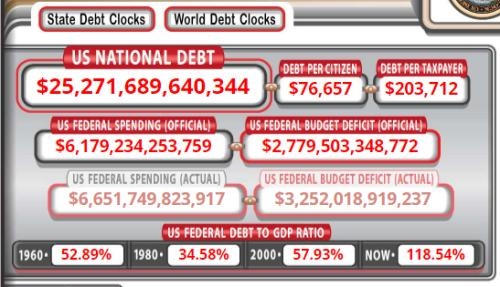

The U.S. national debt has soared to unprecedented levels over the past few years. As of 2021, the debt stands at over $28 trillion, a significant portion of which is held by foreign investors. The primary drivers of this debt include government spending, tax cuts, and interest payments on existing debt.

The Debt Ceiling: A Ticking Time Bomb

The U.S. government faces a critical deadline each year when it needs to raise the debt ceiling to continue funding its operations. If the debt ceiling is not raised, the government could default on its obligations, which would have catastrophic consequences for the stock market and the economy.

Impact on Stock Market

The U.S. debt crisis has several direct and indirect impacts on the stock market:

Interest Rates: When the government borrows money, it pays interest on the debt. As the debt increases, so does the interest payments. This can lead to higher interest rates, which can negatively impact the stock market by increasing borrowing costs for companies and consumers.

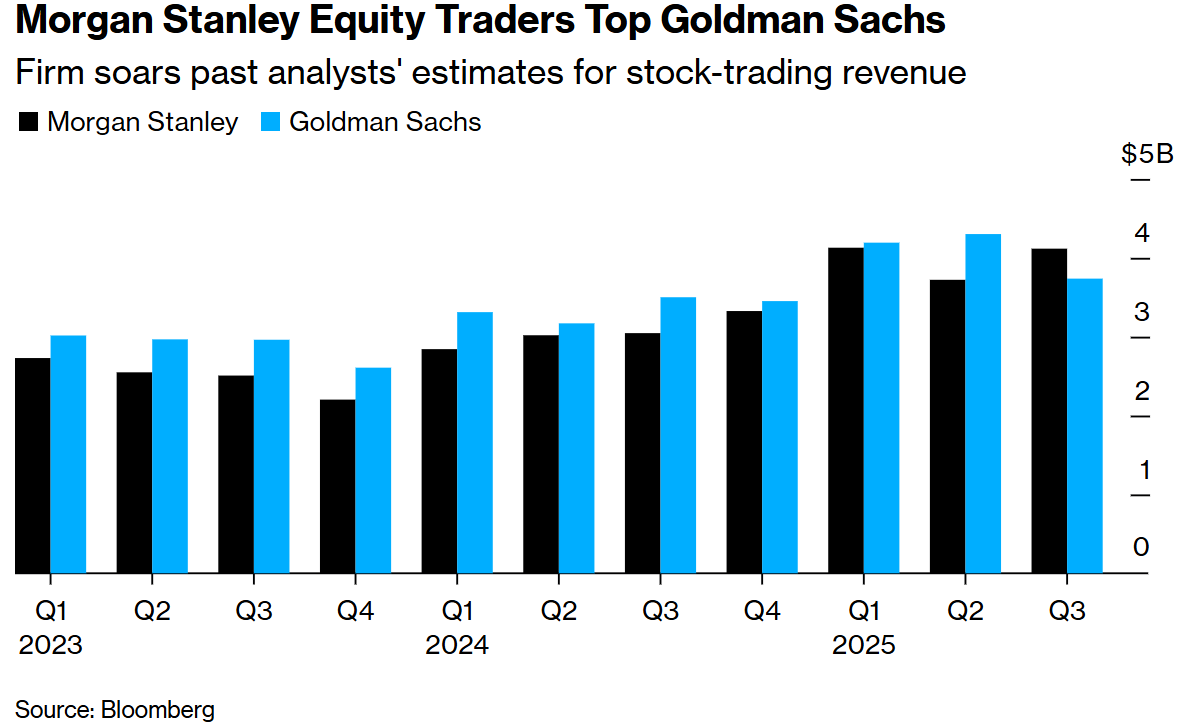

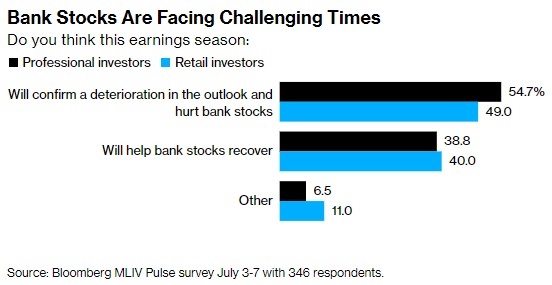

Investor Sentiment: The uncertainty surrounding the debt crisis can cause investors to become nervous and sell off their stocks, leading to market volatility. This can result in a decrease in stock prices and a loss of investor confidence.

Economic Growth: High levels of debt can slow economic growth. This is because the government needs to allocate a significant portion of its budget to pay off interest on the debt, leaving fewer resources for other spending. Slower economic growth can lead to lower corporate earnings, which can negatively impact stock prices.

Case Study: The 2011 Debt Ceiling Crisis

In 2011, the U.S. government faced a major debt ceiling crisis. The situation was so serious that Standard & Poor's downgraded the U.S. credit rating for the first time in history. This event caused the stock market to plummet, with the S&P 500 losing over 6% of its value in just one day. The crisis also led to increased uncertainty and volatility in the market, which took months to stabilize.

Conclusion

The U.S. debt crisis is a significant concern for investors and the economy. The potential impacts on the stock market, including higher interest rates, decreased investor confidence, and slower economic growth, are reasons why the situation should not be taken lightly. It is crucial for investors to stay informed about the debt situation and consider its potential impacts on their investments.

How Many People Invest in the Stock Market ? stock chap