The stock market within the United States is one of the most dynamic and influential financial markets in the world. With a rich history and a plethora of opportunities, it's crucial for investors to understand its nuances. This article delves into the key aspects of the US stock market, highlighting its structure, major exchanges, and influential factors.

Structure of the US Stock Market

The US stock market is structured around several key exchanges and over-the-counter (OTC) markets. The most prominent exchanges include the New York Stock Exchange (NYSE), NASDAQ, and the American Stock Exchange (AMEX). Each of these exchanges operates under its unique set of rules and regulations, contributing to the diverse nature of the market.

New York Stock Exchange (NYSE)

Established in 1792, the NYSE is the oldest and most well-known stock exchange in the US. It is known for its iconic trading floor, where brokers and traders execute transactions in a traditional open-outcry system. The NYSE primarily lists large, well-established companies with high market capitalization.

NASDAQ

The NASDAQ Stock Market, founded in 1971, is the largest electronic stock exchange in the world by market capitalization. It is home to many technology and biotechnology companies. The NASDAQ operates on an electronic platform, allowing for fast and efficient trading.

American Stock Exchange (AMEX)

The AMEX, now known as NYSE American, is a smaller exchange that lists a variety of companies, including some small-cap and mid-cap stocks. It is known for its focus on niche sectors and smaller companies.

Over-the-Counter (OTC) Markets

The OTC markets are a decentralized network of markets where securities are traded without a centralized exchange. These markets include the OTC Bulletin Board (OBB) and the OTCQX. Companies listed on these markets are typically smaller and less established than those on the major exchanges.

Influential Factors

Several factors influence the US stock market, including economic indicators, political events, and corporate earnings reports. Here are some of the key factors:

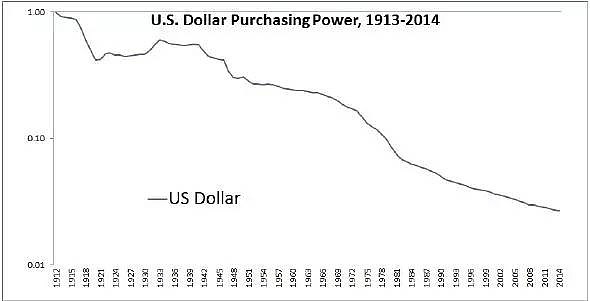

- Economic Indicators: Economic indicators such as GDP, unemployment rate, and inflation rates can significantly impact the stock market. For example, a strong GDP growth rate can indicate a healthy economy, potentially leading to higher stock prices.

- Political Events: Political events, such as elections or policy changes, can also affect the stock market. For instance, a policy change that benefits a particular industry can lead to an increase in stock prices for companies within that industry.

- Corporate Earnings Reports: Corporate earnings reports are a key indicator of a company's financial health. Positive earnings reports can boost stock prices, while negative reports can lead to declines.

Case Study: Facebook's Initial Public Offering (IPO)

One notable case study in the US stock market is Facebook's initial public offering (IPO) in 2012. At the time, Facebook was the largest social media company in the world, and its IPO was highly anticipated. However, the stock opened at

In conclusion, the US stock market is a dynamic and influential financial market with various exchanges, influential factors, and opportunities. Understanding its structure and key aspects can help investors make informed decisions. As always, it's crucial to conduct thorough research and consult with a financial advisor before making any investment decisions.

How Many People Invest in the Stock Market ? stock chap