In the world of investing, the term "penny stocks" often sparks intrigue and excitement. Specifically, US oil penny stocks have become a popular topic among investors seeking high-risk, high-reward opportunities. This article delves into the world of US oil penny stocks, exploring what they are, how to identify promising ones, and the potential risks involved.

What Are US Oil Penny Stocks?

US oil penny stocks are shares of companies that trade at very low prices, typically below $5 per share. These companies are often involved in the oil and gas industry, ranging from exploration and production to refining and distribution. While penny stocks are known for their volatility, they also offer the potential for significant returns.

Identifying Promising US Oil Penny Stocks

When searching for promising US oil penny stocks, it's crucial to conduct thorough research. Here are some key factors to consider:

Management Team: Look for companies with experienced and reputable management teams. A strong management team can make a significant difference in a company's success.

Exploration and Production: Focus on companies with promising oil and gas reserves and a solid track record in exploration and production.

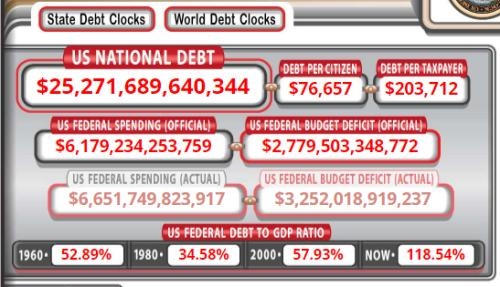

Financial Health: Analyze a company's financial statements, including revenue, profit margins, and debt levels. Companies with strong financial health are more likely to succeed.

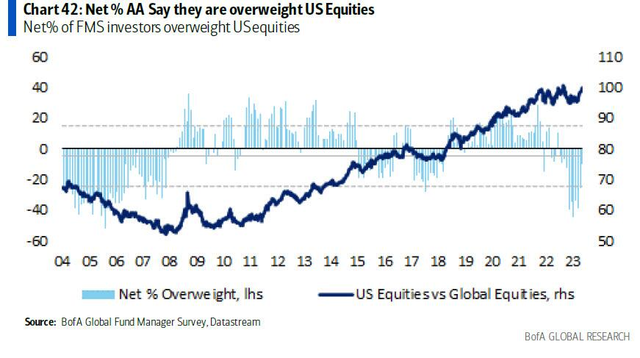

Market Trends: Stay updated on market trends and news in the oil and gas industry. Companies that align with current trends are more likely to thrive.

Dividends: Some US oil penny stocks may offer dividends, providing investors with additional income potential.

Case Study: Company X

Let's take a look at a hypothetical example of a promising US oil penny stock: Company X. Company X has a strong management team, significant oil and gas reserves, and a solid financial track record. The company has also aligned with current market trends, making it an attractive investment opportunity.

Potential Risks of Investing in US Oil Penny Stocks

While US oil penny stocks offer potential for high returns, they also come with significant risks:

Market Volatility: The stock prices of penny stocks can be highly volatile, making them unsuitable for risk-averse investors.

Lack of Regulators Oversight: Penny stocks often operate with less regulatory oversight, which can increase the risk of fraudulent activities.

Liquidity Issues: Penny stocks may have limited liquidity, making it challenging to buy or sell shares at desired prices.

Operational Risks: The oil and gas industry is subject to various operational risks, including environmental concerns and geopolitical events.

In conclusion, US oil penny stocks can be a lucrative investment opportunity for those willing to take on the associated risks. By conducting thorough research and staying informed about market trends, investors can identify promising companies and potentially reap significant returns. However, it's crucial to exercise caution and be prepared for the potential downsides of investing in this high-risk, high-reward sector.

How Many People Invest in the Stock Market ? stock chap