The year 2025 marks a pivotal moment in the history of the US stock market, with a significant crash occurring in April. This article delves into the reasons behind this crash, analyzing the factors that contributed to its occurrence and the potential long-term implications it may have on the economy.

Economic Factors

One of the primary reasons for the 2025 stock market crash was the inflationary pressures that had been building up for several years. The Federal Reserve had been struggling to keep inflation in check, but the increasing cost of living and rising prices for goods and services eventually took a toll on investor confidence.

Monetary Policy

The Federal Reserve's monetary policy played a crucial role in the crash. The central bank had been raising interest rates to combat inflation, but the rapid increase in rates had a disastrous effect on the stock market. As borrowing costs rose, companies found it harder to finance their operations, leading to a decline in their share prices.

Technological Advances

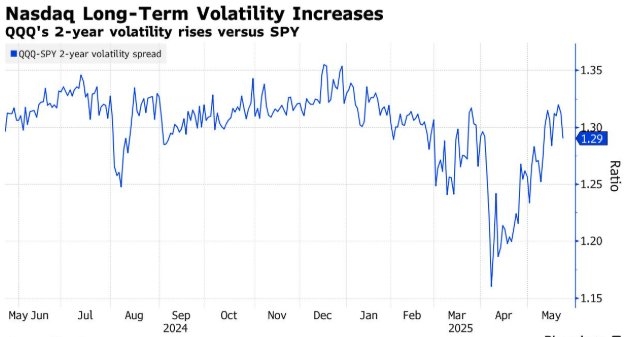

The rapid pace of technological advancements also contributed to the crash. While innovation is generally a positive force in the economy, the rapid pace of change in the tech sector had created a speculative bubble. Investors had become overly optimistic about the future prospects of tech companies, leading to overvalued stocks and a subsequent burst of the bubble.

Political Factors

Political instability and uncertainty also played a role in the crash. The US was facing a contentious presidential election, and the potential for a change in government had investors on edge. The fear of policy changes and the possibility of increased regulation had a chilling effect on the stock market.

Case Study: Tech Sector Collapse

One of the most significant impacts of the crash was felt in the tech sector. Companies like Apple, Google, and Facebook saw their share prices plummet as investors fled from the sector. This collapse was largely due to the speculative bubble mentioned earlier, but it also highlighted the vulnerability of the tech sector to economic downturns.

Impact on the Economy

The stock market crash had far-reaching implications for the US economy. The decline in stock prices led to a loss of wealth for millions of investors, and the subsequent decrease in consumer spending had a negative impact on businesses. The crash also led to a reduction in investment as companies became more cautious about their financial future.

Conclusion

The April 2025 US stock market crash was a complex event with multiple contributing factors. The combination of economic, monetary, technological, and political factors led to a significant downturn in the stock market, with long-term implications for the US economy. As investors and policymakers reflect on this event, it serves as a reminder of the importance of balancing innovation and regulation, as well as the need for sound economic policies.

How Many People Invest in the Stock Market ? us flag stock