Are you looking to expand your investment portfolio beyond the U.S. borders? Investing in Indian stocks from the United States can be a lucrative opportunity, especially considering the rapid growth of the Indian economy. In this article, we'll explore the feasibility of investing in Indian stocks from the U.S., the process involved, and the potential risks and rewards.

Understanding the Indian Stock Market

The Indian stock market, known as the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE), is one of the fastest-growing markets in the world. It offers a diverse range of sectors, including technology, healthcare, finance, and consumer goods. Investing in Indian stocks can provide exposure to a growing economy and potentially high returns.

Eligibility and Requirements

To invest in Indian stocks from the U.S., you need to meet certain requirements:

- A U.S. Bank Account: You'll need a U.S. bank account to transfer funds for your investments.

- A Trading Account: You'll need to open a trading account with a brokerage firm that offers access to the Indian stock market.

- Knowledge of Indian Markets: It's crucial to have a basic understanding of the Indian stock market and its unique characteristics.

How to Invest in Indian Stocks from the U.S.

- Choose a Brokerage Firm: Select a brokerage firm that offers access to the Indian stock market. Some popular options include TD Ameritrade, E*TRADE, and Fidelity.

- Open a Trading Account: Once you've chosen a brokerage firm, open a trading account. You'll need to provide personal information and proof of identity.

- Fund Your Account: Transfer funds from your U.S. bank account to your trading account.

- Research and Analyze: Conduct thorough research on Indian stocks and sectors. Use financial websites, reports, and news sources to stay informed.

- Place Orders: Once you've identified potential investments, place your orders through your brokerage firm.

Risks and Rewards

Investing in Indian stocks from the U.S. comes with its own set of risks and rewards:

Risks:

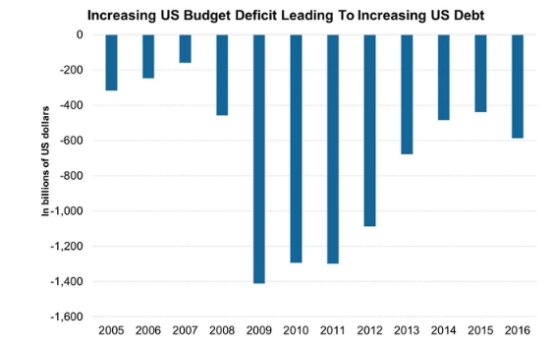

- Currency Fluctuations: Changes in the exchange rate can impact your investment returns.

- Political and Economic Instability: India's political and economic environment can be unpredictable, affecting stock prices.

- Regulatory Changes: Changes in regulations can impact the Indian stock market and your investments.

Rewards:

- Potential High Returns: The Indian stock market has shown significant growth over the years, offering potential high returns.

- Diversification: Investing in Indian stocks can diversify your portfolio and reduce risk.

- Economic Growth: The Indian economy is expected to grow rapidly, providing long-term investment opportunities.

Case Study:

Consider the case of a U.S. investor who invested

Conclusion

Investing in Indian stocks from the U.S. can be a rewarding experience, provided you conduct thorough research and understand the risks involved. By following the steps outlined in this article, you can start investing in Indian stocks and potentially benefit from the growth of the Indian economy.

How Many People Invest in the Stock Market ? us flag stock