In the dynamic world of investing, keeping an eye on performing US stocks is crucial for investors seeking growth and stability. Whether you're a seasoned trader or a beginner venturing into the stock market, understanding which stocks are performing well can make a significant difference in your portfolio. This guide will delve into the factors that drive stock performance, highlight some of the top-performing US stocks, and provide insights into how to identify potential winners.

Identifying Top-Performing US Stocks

Several key factors can indicate a stock's potential for strong performance. These include:

- Financial Health: Look for companies with solid financial statements, including consistent revenue growth, a strong balance sheet, and healthy profit margins.

- Market Trends: Pay attention to industry trends and economic indicators that may impact specific sectors or the overall market.

- Management Team: A company with a strong and experienced management team is more likely to navigate challenges and capitalize on opportunities.

- Dividends: Companies that consistently pay dividends can be a sign of stability and long-term potential.

Top-Performing US Stocks to Watch

Here are some examples of top-performing US stocks across various sectors:

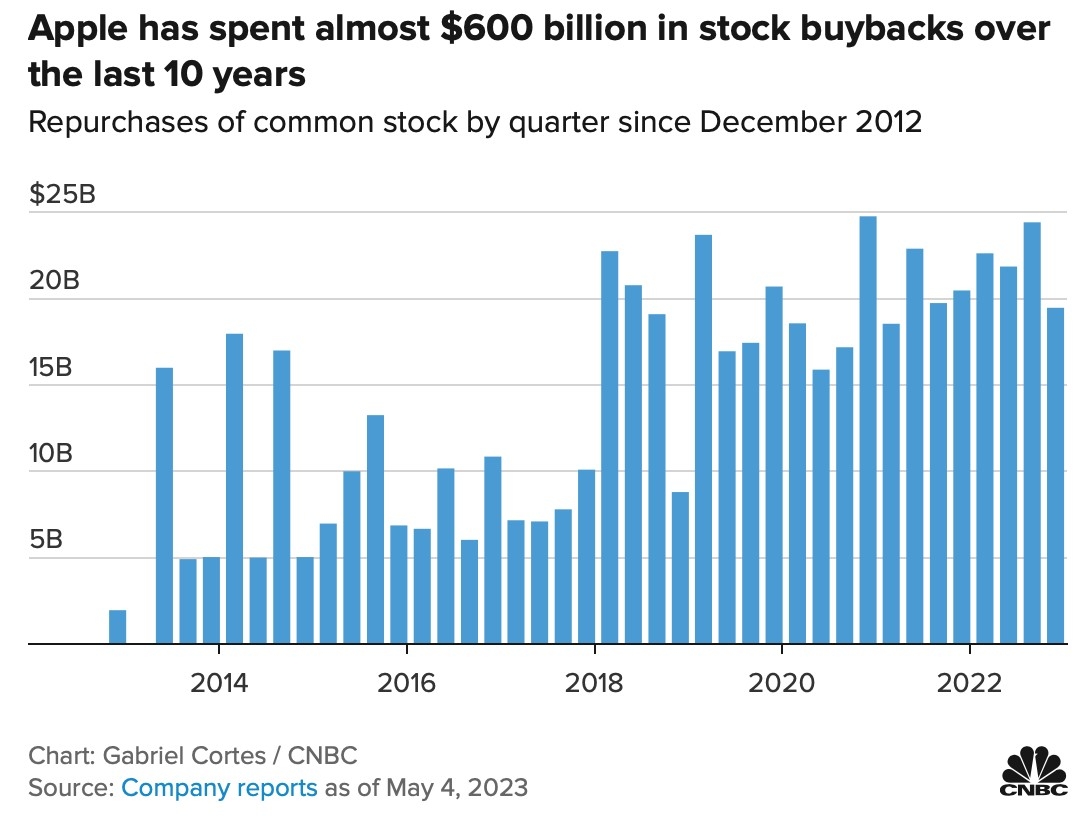

- Technology: Companies like Apple (AAPL) and Amazon (AMZN) have consistently outperformed the market, driven by innovation and strong consumer demand.

- Healthcare: Johnson & Johnson (JNJ) and Merck & Co. (MRK) are leaders in the healthcare sector, benefiting from the ongoing demand for pharmaceuticals and medical devices.

- Energy: Exxon Mobil (XOM) and Chevron (CVX) are major players in the energy sector, benefiting from increased demand for oil and gas.

- Consumer Goods: Procter & Gamble (PG) and Coca-Cola (KO) are household names in the consumer goods sector, offering stability and growth potential.

How to Identify Potential Winners

To identify potential winners among performing US stocks, consider the following strategies:

- Technical Analysis: Analyze stock charts and technical indicators to identify trends and patterns that may indicate future price movements.

- Fundamental Analysis: Evaluate a company's financial statements, industry position, and management team to determine its long-term potential.

- Market Research: Stay informed about industry trends and economic indicators that may impact specific sectors or the overall market.

- Diversification: Spread your investments across various sectors and asset classes to reduce risk.

Case Study: Tesla (TSLA)

One notable example of a stock that has performed exceptionally well is Tesla (TSLA). As a leader in electric vehicles and renewable energy, Tesla has seen significant growth driven by factors such as innovation, strong demand for electric vehicles, and a supportive regulatory environment. By focusing on these factors, investors have been able to capitalize on Tesla's strong performance.

In conclusion, keeping an eye on performing US stocks is essential for investors looking to grow their portfolios. By understanding the factors that drive stock performance, analyzing key sectors, and utilizing various strategies, investors can identify potential winners and make informed investment decisions. Remember to stay informed, diversify your portfolio, and seek professional advice when needed.

How Many People Invest in the Stock Market ? us flag stock