In today's digital age, the concept of "dot.con" has evolved from a mere internet suffix to a thriving market sector. The US market stock, specifically those associated with dot.con companies, has emerged as a digital goldmine for investors and entrepreneurs alike. This article delves into the world of dot.con US market stock, highlighting key trends, opportunities, and challenges.

Understanding Dot.con US Market Stock

To begin with, let's clarify what we mean by "dot.con" in the context of the US market stock. The term refers to companies operating in the technology sector, primarily focusing on internet-based services, software, and digital platforms. These companies often have a ".com" domain extension, indicating their online presence and digital-centric business models.

Trends Shaping the Dot.con US Market Stock

The dot.con US market stock has witnessed several significant trends over the past few years:

Rise of E-commerce: The growth of e-commerce has been a major driver for dot.con companies. With the increasing preference for online shopping, companies like Amazon, eBay, and Alibaba have seen substantial growth in their stock prices.

Digital Transformation: Many traditional industries are undergoing digital transformation, leading to a surge in demand for technology solutions. This trend has benefited dot.con companies that specialize in cloud computing, cybersecurity, and data analytics.

Adoption of Remote Work: The COVID-19 pandemic accelerated the adoption of remote work, further boosting the demand for collaboration tools, project management software, and communication platforms. Companies like Zoom, Slack, and Microsoft Teams have seen their stock prices soar as a result.

Investment in Technology: The dot.con US market stock has attracted significant investment from venture capitalists and private equity firms. This funding has enabled these companies to innovate, expand their market presence, and achieve rapid growth.

Opportunities in Dot.con US Market Stock

Several opportunities exist for investors and entrepreneurs in the dot.con US market stock:

High Growth Potential: Many dot.con companies are in their early stages of growth, offering high potential for capital appreciation. Investors can capitalize on this growth by investing in promising startups and emerging companies.

Diversification: Investing in dot.con US market stock allows investors to diversify their portfolios, as these companies operate in various sectors, including e-commerce, software, and technology services.

Innovation and Technology: The dot.con sector is known for its rapid innovation and technological advancements. Investing in these companies provides exposure to cutting-edge technologies and future trends.

Challenges in Dot.con US Market Stock

Despite the numerous opportunities, the dot.con US market stock also presents certain challenges:

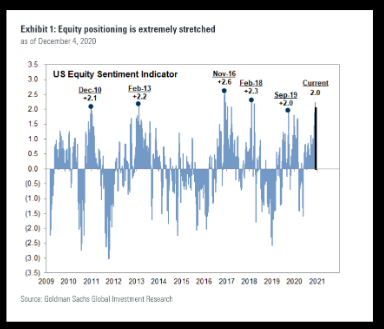

Market Volatility: The dot.con sector is known for its high volatility, with stock prices experiencing significant fluctuations. This volatility can be attributed to various factors, including economic conditions, regulatory changes, and technological disruptions.

Competition: The dot.con sector is highly competitive, with numerous companies vying for market share. This competition can lead to intense price wars and erode profitability.

Regulatory Risks: The dot.con sector is subject to stringent regulations, particularly in areas like data privacy and cybersecurity. Non-compliance with these regulations can result in substantial fines and legal issues.

Case Studies: Successful Dot.con US Market Stock Companies

Several dot.con US market stock companies have achieved remarkable success:

Amazon: Founded in 1994, Amazon has become the world's largest online retailer, offering a wide range of products and services. Its stock has seen significant growth over the years, making it a favorite among investors.

Apple: Apple, known for its innovative products and services, has seen substantial growth in its stock price, particularly due to its success in the smartphone and computer markets.

Microsoft: Microsoft has diversified its portfolio, with significant success in areas like cloud computing, software, and gaming. Its stock has experienced steady growth over the years.

In conclusion, the dot.con US market stock represents a digital goldmine with immense potential for growth and innovation. While it comes with its challenges, the opportunities it presents make it a compelling sector for investors and entrepreneurs alike. By understanding the trends, opportunities, and challenges, one can make informed decisions and capitalize on this dynamic market.

S&P Year-to-Date Performance: A Com? new york stock exchange