The Dow Jones Industrial Average, often simply referred to as the Dow, is one of the most closely watched stock market indices in the world. As we approach November 2024, investors are eager to understand the potential trends and developments that may impact the Dow. This article delves into the key factors that could shape the Dow Jones in November 2024, providing valuable insights for investors.

Economic Indicators to Watch

One of the primary factors influencing the Dow Jones is the state of the economy. In November 2024, investors should keep a close eye on several key economic indicators:

- GDP Growth: The rate of GDP growth can provide insights into the overall health of the economy. A strong GDP growth rate is typically positive for the stock market, as it suggests a robust economy and potentially higher corporate earnings.

- Unemployment Rate: The unemployment rate is another critical indicator. A declining unemployment rate can indicate a strong labor market, which is generally positive for stocks.

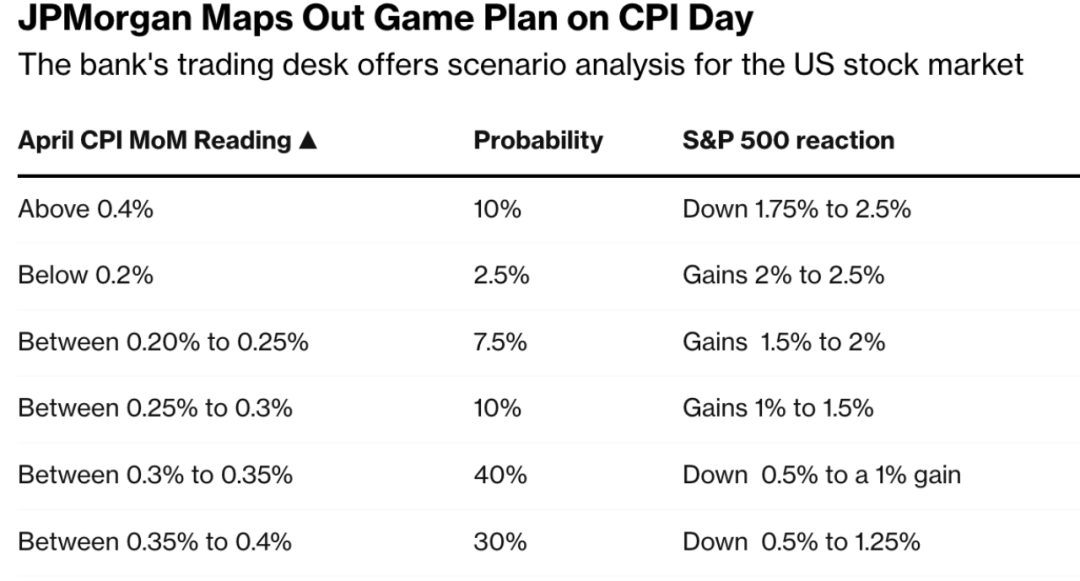

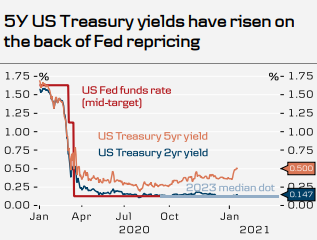

- Inflation: Inflation can have a significant impact on the stock market. High inflation can erode purchasing power and lead to lower corporate profits. Conversely, low inflation can be beneficial for stocks.

Market Sentiment and Geopolitical Factors

Market sentiment and geopolitical events can also play a crucial role in shaping the Dow Jones. In November 2024, investors should be aware of the following:

- Market Sentiment: The overall mood of investors can drive stock prices. Positive sentiment can lead to higher stock prices, while negative sentiment can result in declines.

- Geopolitical Events: Events such as elections, trade disputes, and geopolitical tensions can create uncertainty in the market, leading to volatility in the Dow Jones.

Sector Performance

The performance of different sectors within the Dow Jones can also provide valuable insights into potential trends. In November 2024, investors should pay attention to the following sectors:

- Technology: The technology sector has been a significant driver of the Dow Jones in recent years. Companies like Apple and Microsoft have a significant impact on the index.

- Energy: The energy sector can be volatile, but it is also a major component of the Dow Jones. Companies like ExxonMobil and Chevron can influence the index's performance.

- Financials: The financial sector, including banks and insurance companies, is another key component of the Dow Jones. Companies like JPMorgan Chase and Goldman Sachs can have a significant impact on the index.

Case Studies

To illustrate the potential impact of these factors on the Dow Jones, let's consider a few case studies:

- 2020 Economic Downturn: In 2020, the COVID-19 pandemic led to a significant economic downturn. The Dow Jones experienced a sharp decline, but it eventually recovered as the economy began to reopen. This example highlights the importance of economic indicators and market sentiment in shaping the Dow Jones.

- 2016 US Presidential Election: The 2016 US presidential election created significant uncertainty in the market. The Dow Jones experienced volatility in the lead-up to the election, but it eventually stabilized after the results were announced. This example demonstrates the impact of geopolitical events on the Dow Jones.

Conclusion

As we approach November 2024, investors should closely monitor economic indicators, market sentiment, geopolitical events, and sector performance to gain insights into the potential trends and developments that may impact the Dow Jones. By staying informed and prepared, investors can make more informed decisions and potentially navigate the stock market's ups and downs.

Is the US Stock Market Closed? Everything Y? new york stock exchange