Introduction

In the world of financial markets, large stock drops are a common occurrence, often causing panic and concern among investors. Understanding the reasons behind these drops and the strategies for recovery is crucial for anyone looking to navigate the complexities of the stock market. This article delves into the factors that contribute to significant stock declines and offers insights into how investors can brace themselves for such market fluctuations.

Common Causes of Large Stock Drops

Economic Indicators: Economic downturns, such as rising unemployment rates or slowing GDP growth, can lead to a large stock drop. Investors often react to these indicators by selling off their stocks, causing prices to plummet.

Company-Specific Issues: Issues within a particular company, such as poor earnings reports, product recalls, or legal problems, can trigger a significant stock drop. This is particularly true if the company is a major player in its industry.

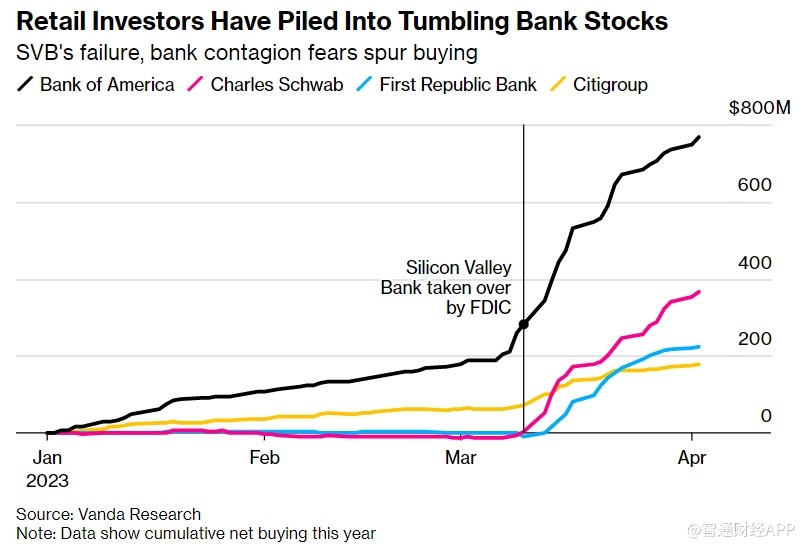

Market Sentiment: The overall mood of the market can also cause large stock drops. For instance, fears of a financial crisis or geopolitical tensions can lead to widespread selling, regardless of the underlying fundamentals of individual stocks.

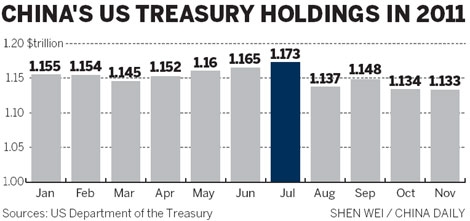

Regulatory Changes: Changes in regulations, such as new tax laws or stricter financial oversight, can impact the performance of certain sectors, leading to a large stock drop in those areas.

Technological Advances: Rapid technological advancements can disrupt entire industries, causing a large stock drop for companies that fail to adapt.

Recovery Strategies for Investors

Diversification: One of the best ways to mitigate the impact of large stock drops is through diversification. By spreading investments across various sectors and asset classes, investors can reduce their exposure to any single stock or sector.

Long-Term Perspective: It's important to remember that large stock drops are often temporary. By maintaining a long-term perspective, investors can ride out the volatility and potentially benefit from lower stock prices.

Stay Informed: Keeping up-to-date with economic news, company earnings reports, and market trends can help investors make informed decisions during times of large stock drops.

Risk Management: Implementing risk management strategies, such as stop-loss orders, can help limit potential losses during large stock drops.

Seek Professional Advice: Consulting with a financial advisor can provide valuable insights and guidance during times of market volatility.

Case Studies

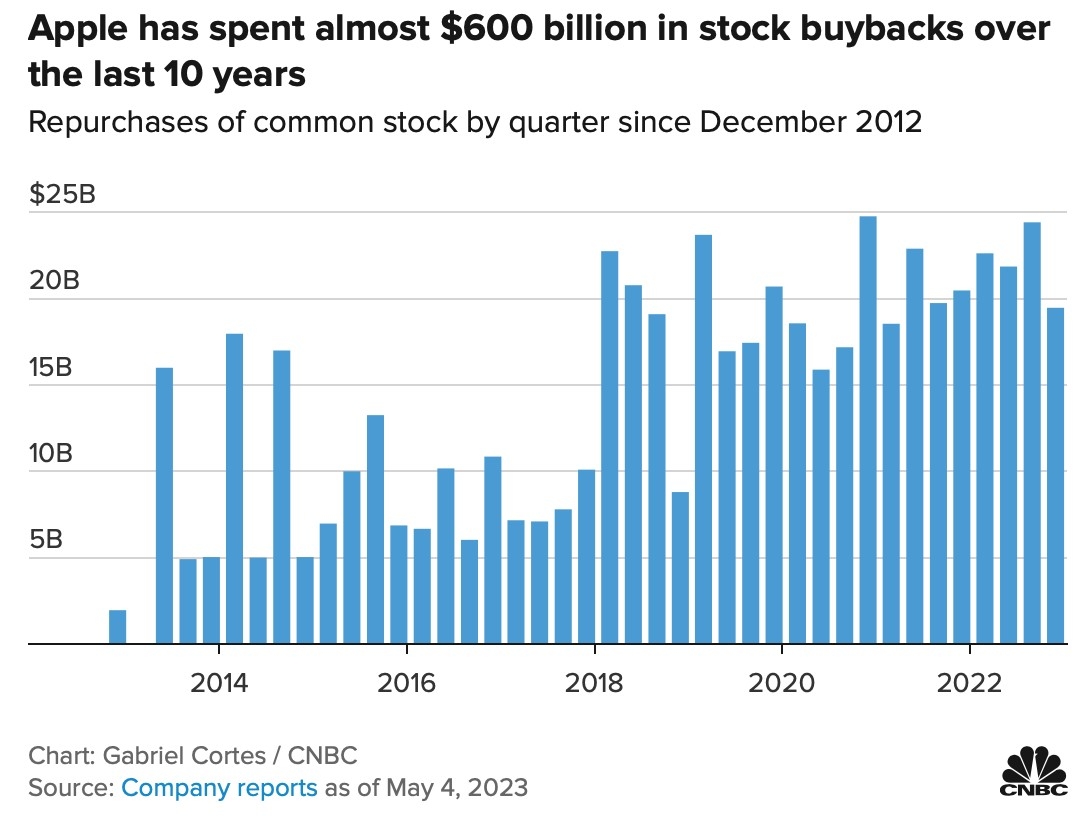

Tech Stock Decline in 2022: In 2022, the tech sector experienced a significant large stock drop, driven by concerns about inflation and rising interest rates. Companies like Apple and Microsoft saw their stock prices decline by more than 20% in a matter of weeks. However, many investors who maintained a long-term perspective and diversified their portfolios were able to minimize their losses.

Financial Crisis of 2008: The financial crisis of 2008 saw a large stock drop across all sectors, with the S&P 500 falling by nearly 50% from its peak. Investors who remained diversified and sought professional advice were better equipped to navigate the turbulent market and recover their investments over time.

Conclusion

Large stock drops are an inevitable part of the stock market, but understanding the causes and implementing effective recovery strategies can help investors navigate these challenging times. By staying informed, diversifying their portfolios, and maintaining a long-term perspective, investors can minimize the impact of large stock drops and potentially benefit from the opportunities that arise during market downturns.

Delek US Stock News: Latest Updates and Ana? new york stock exchange