The US dollar has been experiencing a weakening trend in recent years, raising questions among investors about the potential impact on their investments, particularly in US stocks. As we approach 2024, this question becomes even more pressing. In this article, we will explore the factors to consider when deciding whether to invest in US stocks despite the weakening dollar.

Understanding the Weakening Dollar

A weakening dollar means that the value of the US currency is decreasing compared to other currencies. This can be caused by various factors, including economic policies, trade imbalances, and market sentiment. When the dollar weakens, it can lead to higher import prices, inflation, and a decrease in the purchasing power of US consumers.

Impact on US Stocks

Despite the challenges posed by a weakening dollar, investing in US stocks can still be a viable option. Here are some key points to consider:

1. Strong Market Performance

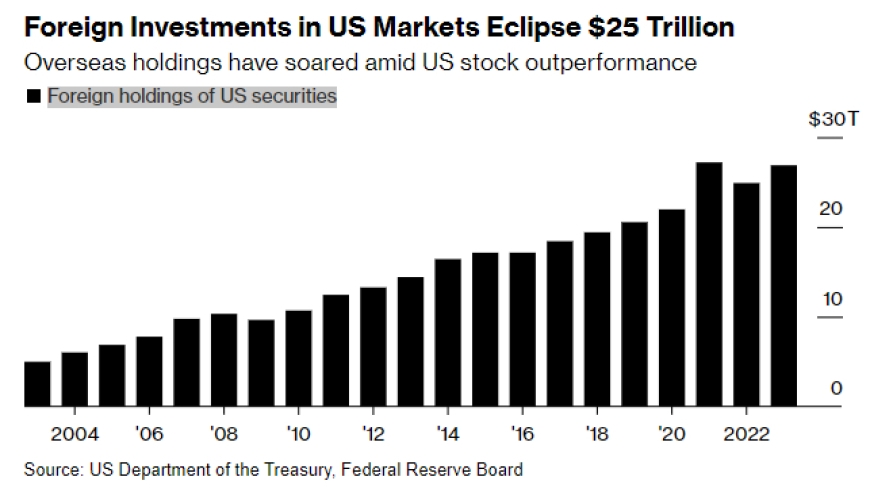

The US stock market has historically shown resilience, even during periods of dollar weakness. Over the long term, US stocks have provided strong returns for investors. This is partly due to the strong economic fundamentals of the United States, including a robust GDP growth, low unemployment rates, and a diversified industrial base.

2. Diversification Benefits

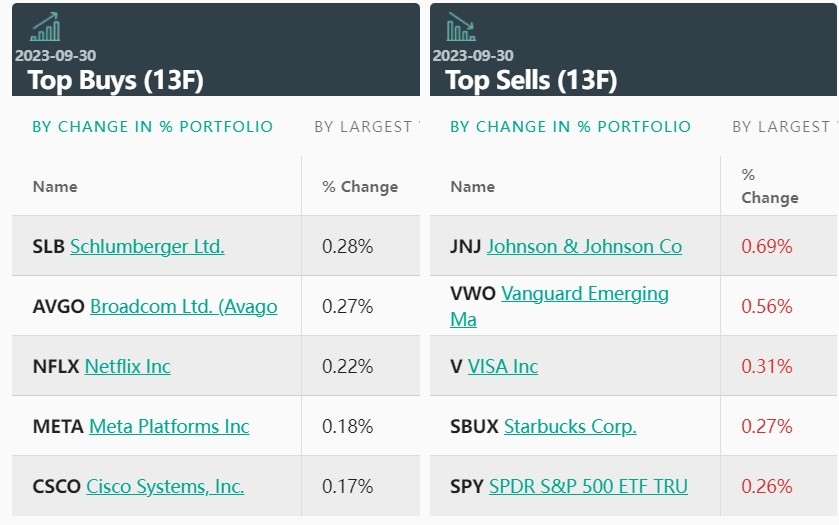

Investing in US stocks can offer diversification benefits to your portfolio. While a weakening dollar may impact the value of your returns when converted back to your local currency, a well-diversified portfolio can help mitigate this risk. By investing in companies across various sectors and geographical regions, you can reduce your exposure to any single market or currency risk.

3. Strong Corporate Earnings

Many US companies have global operations, generating revenue in various currencies. When the dollar weakens, these companies may see an increase in their earnings when converted back to US dollars. This can potentially lead to higher profits and dividends for shareholders.

4. Technological Advancements

The United States is a global leader in technology, with numerous innovative companies based here. Investing in US tech stocks can offer exposure to some of the fastest-growing industries, such as artificial intelligence, cloud computing, and biotechnology.

Case Studies

To illustrate the potential benefits of investing in US stocks despite a weakening dollar, let's consider a few case studies:

- Apple Inc.: Despite the weakening dollar, Apple has continued to see strong sales and earnings growth. The company's global operations have helped offset the impact of a weaker dollar on its revenue.

- Microsoft Corporation: Similar to Apple, Microsoft has a strong global presence and has seen its earnings increase when converted back to US dollars.

- Tesla, Inc.: As a leader in the electric vehicle market, Tesla has seen significant growth in its sales and revenue, partially due to its global operations.

Conclusion

Investing in US stocks despite a weakening dollar can still be a viable option for investors. By considering the factors mentioned above and maintaining a well-diversified portfolio, you can potentially mitigate the risks associated with a weaker dollar. However, it's essential to conduct thorough research and consult with a financial advisor before making any investment decisions.

Should I Buy US Oil Stocks Now?? new york stock exchange