In today's fast-paced financial world, investing in the stock market can seem daunting, especially for beginners. However, with the right approach and knowledge, investing in U.S. stocks can be a rewarding experience. This article aims to provide you with a comprehensive guide on how to stake us stock, including key strategies and tips for success.

Understanding the Stock Market

Before diving into the specifics of staking us stock, it's essential to understand the basics of the stock market. Stocks represent ownership in a company, and when you buy a stock, you're essentially purchasing a small piece of that company. The value of a stock can fluctuate based on various factors, including the company's financial performance, market trends, and economic conditions.

Choosing the Right Stocks

1. Research and Analyze

One of the first steps in staking us stock is to conduct thorough research. Look for companies with strong financials, a solid track record, and a clear competitive advantage. Analyze their financial statements, including their income statement, balance sheet, and cash flow statement, to assess their financial health.

2. Consider Industry Trends

In addition to analyzing individual companies, it's crucial to consider broader industry trends. Look for industries with strong growth potential, such as technology, healthcare, and renewable energy.

3. Diversify Your Portfolio

Diversification is key to mitigating risk in your stock investments. By spreading your investments across different sectors and asset classes, you can minimize the impact of any single stock's performance on your overall portfolio.

Strategies for Staking Us Stock

1. Long-Term Investing

Long-term investing, also known as buy-and-hold investing, involves purchasing stocks and holding them for an extended period. This strategy is ideal for investors with a long-term perspective and a tolerance for volatility.

2. Dividend Investing

Dividend investing involves purchasing stocks that pay regular dividends to shareholders. This strategy can provide a steady stream of income and can be particularly appealing for risk-averse investors.

3. Growth Investing

Growth investing involves investing in companies with high growth potential. These companies often reinvest their earnings into expanding their business, which can lead to significant capital gains over time.

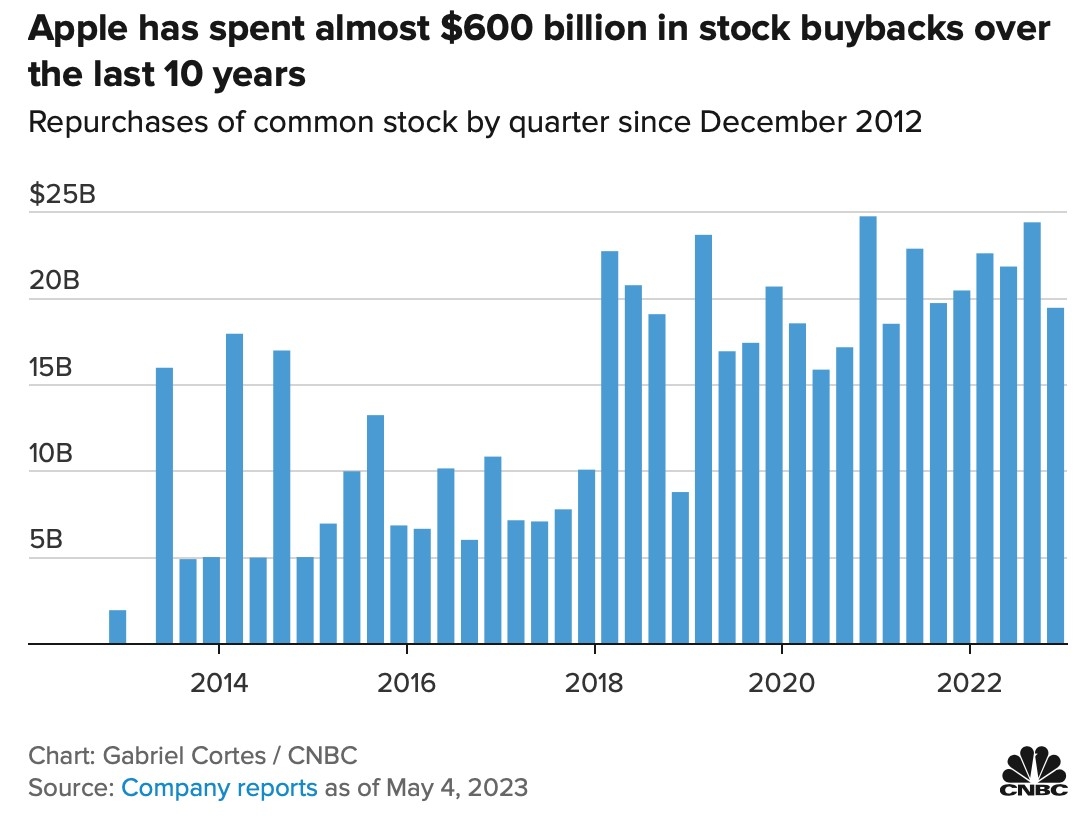

Case Study: Apple Inc.

To illustrate the potential of staking us stock, let's consider the case of Apple Inc. (AAPL). Since its initial public offering (IPO) in 1980, Apple has become one of the world's most valuable companies. Over the years, Apple has consistently delivered strong financial performance and has rewarded its shareholders with significant capital gains and dividends.

By understanding the company's business model, product offerings, and competitive position, investors could have identified Apple as a promising investment opportunity. As of the latest financial results, Apple's revenue and earnings have continued to grow, validating the company's strong fundamentals.

Final Thoughts

Staking us stock can be a lucrative investment strategy for those who are willing to do their homework and stay informed about market trends. By following the tips outlined in this article, you can increase your chances of success in the stock market.

Remember, investing in stocks carries inherent risks, so it's crucial to do your research and consult with a financial advisor if needed. With the right approach, however, staking us stock can be a rewarding way to grow your wealth.

"Best Performing US Stocks Over th? new york stock exchange