In the fast-paced world of finance, staying ahead of the curve is crucial. One of the key tools investors use to gauge market trends is the pre-market indices. These indices provide a snapshot of market sentiment before the trading day begins, offering valuable insights into potential market movements. In this article, we'll delve into what pre-market indices are, how they work, and their significance in the financial world.

What Are Pre-Market Indices?

Pre-market indices are a collection of stocks that trade before the regular trading session opens. These indices are designed to reflect the overall market sentiment and potential market movements for the upcoming trading day. The most popular pre-market indices include the S&P 500, the Dow Jones Industrial Average, and the NASDAQ Composite.

How Do Pre-Market Indices Work?

Pre-market trading occurs between 4:00 AM and 9:30 AM Eastern Time, providing investors with a glimpse into market trends before the official trading day begins. During this time, traders can buy and sell stocks, and the pre-market indices are calculated based on the prices of these transactions.

The calculation of pre-market indices is similar to that of regular trading indices. For example, the S&P 500 pre-market index is calculated by taking the average price of the 500 largest companies in the United States. As more pre-market transactions occur, the index updates in real-time, reflecting the latest market sentiment.

The Significance of Pre-Market Indices

Pre-market indices offer several benefits to investors and traders:

Market Sentiment: By analyzing pre-market indices, investors can gain insights into market sentiment and potential market movements. If the pre-market indices are rising, it may indicate a positive market outlook, while falling indices may suggest a bearish sentiment.

Risk Management: Pre-market indices can help investors manage their risk by providing early warnings of potential market movements. For example, if the pre-market indices show a significant drop, investors may decide to adjust their portfolios accordingly.

Trading Opportunities: The pre-market session offers traders the opportunity to enter or exit positions before the regular trading day begins. This can be particularly beneficial for active traders looking to capitalize on market movements.

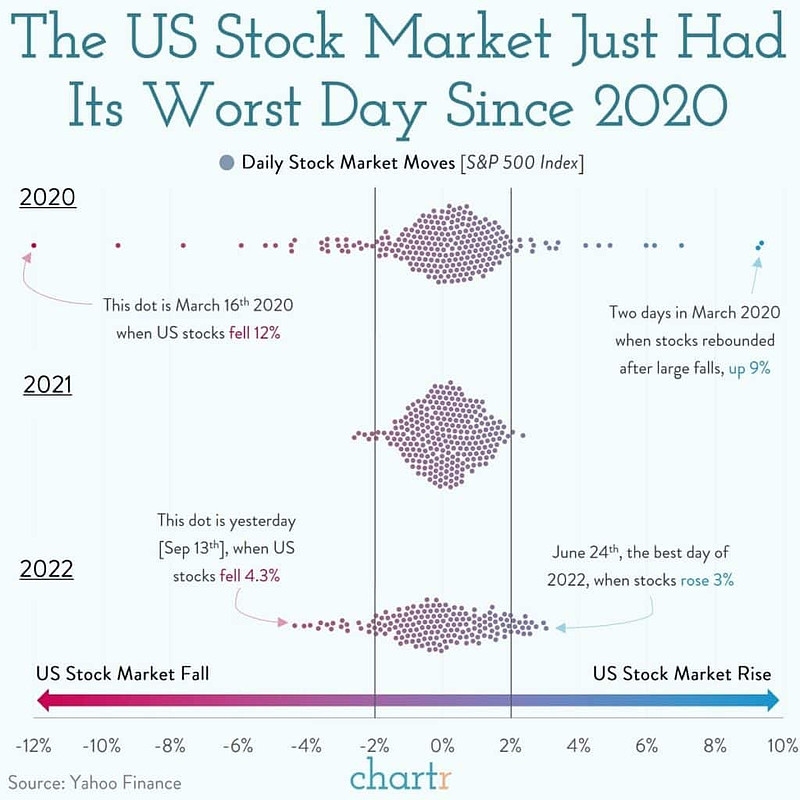

Case Study: Pre-Market Indices and the 2020 Stock Market Crash

One notable example of the impact of pre-market indices on the stock market is the 2020 stock market crash. On March 9, 2020, the S&P 500 pre-market index opened at 2,440.86, indicating a bearish sentiment. As the day progressed, the index continued to fall, reaching a low of 2,237.40. This drop was a precursor to the broader market's decline, which led to the COVID-19 stock market crash.

Conclusion

Pre-market indices are a valuable tool for investors and traders looking to stay ahead of the market. By providing insights into market sentiment and potential market movements, these indices can help investors make informed decisions and manage their risk effectively. As the financial world continues to evolve, understanding pre-market indices will become increasingly important for anyone involved in the stock market.

Beyond Meat Stock: The Game-Changer in Plan? new york stock exchange