Investing in the stock market can be an exciting yet challenging endeavor. With numerous stocks available, it's crucial to understand the factors that influence their prices. In this article, we will delve into the specifics of the MTZPY US stock price, providing valuable insights for investors looking to gain a better understanding of this particular stock.

What is MTZPY?

MTZPY, also known as Montezuma Minerals, Inc., is a company that focuses on the exploration, development, and mining of minerals. The stock is listed on the US stock exchange, making it accessible to investors worldwide.

Factors Affecting the MTZPY US Stock Price

Several factors contribute to the fluctuation of the MTZPY US stock price. Understanding these factors is crucial for making informed investment decisions. Here are some key factors to consider:

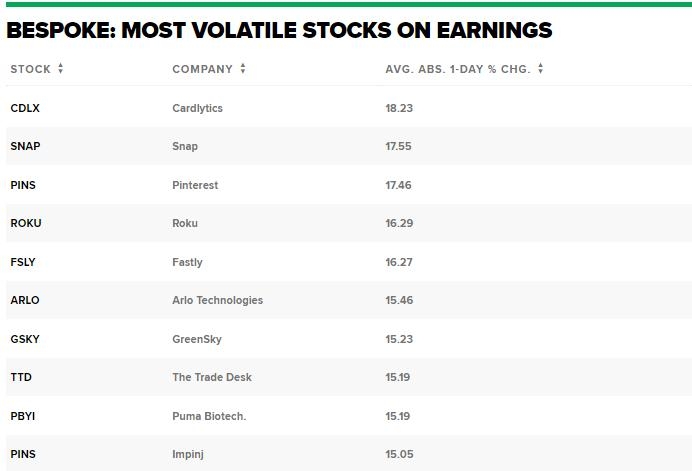

- Market Sentiment: The overall mood of the market can significantly impact stock prices. Positive news, such as an increase in demand for the company's products or positive earnings reports, can drive up the stock price, while negative news can cause it to fall.

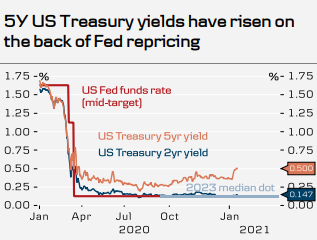

- Economic Conditions: Economic indicators, such as GDP growth, inflation, and interest rates, can influence the stock price. For example, a strong economy may lead to higher demand for the company's products, driving up the stock price.

- Industry Trends: The mining industry's performance can have a direct impact on MTZPY's stock price. Factors such as changes in mineral prices, technological advancements, and regulatory changes can all affect the industry and, subsequently, the stock.

- Company Performance: The financial performance of Montezuma Minerals, including its revenue, earnings, and cash flow, plays a crucial role in determining the stock price. Positive performance can lead to a higher stock price, while negative performance can cause it to fall.

- Supply and Demand: The supply of MTZPY stock and the demand from investors can impact its price. If there is more supply than demand, the stock price may decrease, and vice versa.

Analyzing the MTZPY US Stock Price

To analyze the MTZPY US stock price, investors can look at various metrics and ratios. Some key metrics to consider include:

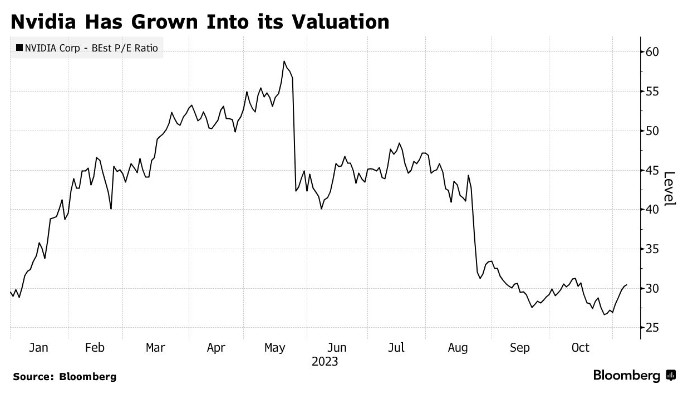

- Price-to-Earnings (P/E) Ratio: This ratio compares the stock price to the company's earnings per share. A higher P/E ratio indicates that the stock is more expensive relative to its earnings.

- Price-to-Book (P/B) Ratio: This ratio compares the stock price to the company's book value per share. A higher P/B ratio suggests that the stock is overvalued, while a lower P/B ratio may indicate that it is undervalued.

- Earnings Per Share (EPS): EPS measures the company's profit divided by its number of outstanding shares. An increase in EPS can lead to a higher stock price.

Case Studies

To provide a clearer picture of the MTZPY US stock price, let's look at two case studies:

- Case Study 1: In 2022, Montezuma Minerals reported a significant increase in its revenue and earnings. This news led to a surge in the stock price, as investors saw it as a sign of the company's strong performance and future growth potential.

- Case Study 2: In 2023, the mining industry experienced a downturn due to regulatory changes and lower demand for minerals. This situation negatively impacted Montezuma Minerals' stock price, as investors were concerned about the company's future prospects.

By analyzing these case studies, investors can better understand how various factors can affect the MTZPY US stock price.

Conclusion

Understanding the MTZPY US stock price requires analyzing various factors, including market sentiment, economic conditions, industry trends, and company performance. By considering these factors and utilizing relevant metrics, investors can make informed decisions and potentially benefit from their investments in Montezuma Minerals, Inc.

US Stock Close: A Comprehensive Analysis of? new york stock exchange