In the ever-evolving world of finance, the US Consumer Stock Index stands as a vital indicator of market trends and consumer behavior. This article delves into the intricacies of the US Consumer Stock Index, providing a comprehensive guide for investors and enthusiasts alike.

What is the US Consumer Stock Index?

The US Consumer Stock Index, often abbreviated as the USCIX, is a composite index that tracks the performance of companies involved in the consumer sector. This index includes a diverse range of companies, from retail giants to consumer goods manufacturers, offering a holistic view of consumer spending trends in the United States.

How is the USCIX Calculated?

The USCIX is calculated using a market capitalization-weighted methodology. This means that the weight of each company in the index is proportional to its market value. The index is designed to reflect the overall performance of the consumer sector, providing investors with a clear picture of market trends.

Key Components of the USCIX

The USCIX includes a variety of companies across different sectors of the consumer industry. Some of the key components include:

- Retailers: Companies like Walmart, Amazon, and Target, which are at the forefront of the retail industry.

- Consumer Goods Manufacturers: Companies like Procter & Gamble, Johnson & Johnson, and Coca-Cola, which produce a wide range of consumer goods.

- Consumer Services: Companies like Visa, Mastercard, and Amazon Web Services, which provide essential services to consumers.

Why is the USCIX Important?

The USCIX is a crucial tool for investors and analysts due to its ability to reflect broader market trends and consumer behavior. By tracking the performance of companies in the consumer sector, the USCIX provides valuable insights into the following:

- Consumer Spending Trends: The USCIX can indicate whether consumers are spending more or less, which can be a sign of economic health or weakness.

- Market Sentiment: The performance of the USCIX can reflect investor sentiment towards the consumer sector, providing valuable information for investment decisions.

- Economic Indicators: The USCIX can serve as an economic indicator, offering insights into the overall health of the economy.

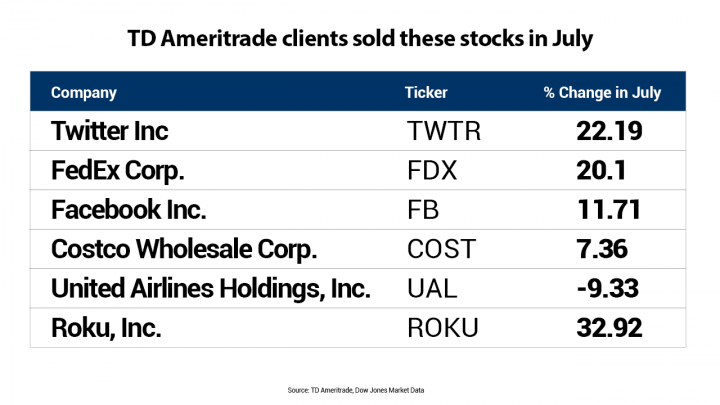

Case Study: The Impact of the COVID-19 Pandemic on the USCIX

The COVID-19 pandemic had a significant impact on the USCIX. Initially, the index experienced a sharp decline as consumer spending decreased due to lockdowns and economic uncertainty. However, as the pandemic progressed, certain sectors within the consumer industry, such as e-commerce and healthcare, saw significant growth. This shift in consumer behavior was reflected in the USCIX, which began to recover as these sectors gained momentum.

Conclusion

The US Consumer Stock Index is a powerful tool for understanding market trends and consumer behavior. By tracking the performance of companies in the consumer sector, the USCIX provides valuable insights for investors and analysts. Whether you're a seasoned investor or just starting out, understanding the USCIX can help you make informed investment decisions and stay ahead of market trends.

2025 Memorial Day US Stock Market Holiday: ? new york stock exchange