In the ever-evolving world of finance, understanding the intricacies of stock prices is crucial for investors looking to make informed decisions. Among the myriad of stocks available, Indian stocks have caught the attention of many due to their potential for high returns. In this article, we delve into the factors that influence the Ind stock price, offering insights that can help you navigate the complex landscape of the Indian stock market.

Understanding the Indian Stock Market

The Indian stock market, also known as the BSE (Bombay Stock Exchange) and the NSE (National Stock Exchange), is one of the fastest-growing markets in the world. It offers a wide range of opportunities for investors, from blue-chip companies to emerging startups. However, with this diversity comes complexity, making it essential to understand the key factors that affect stock prices.

1. Economic Indicators

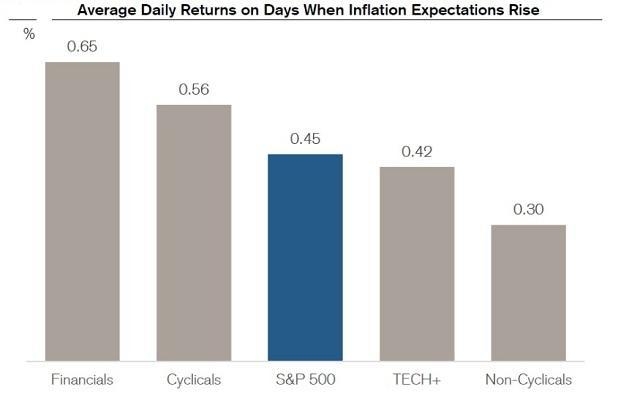

One of the primary drivers of stock prices is the overall economic health of the country. Key indicators such as GDP growth, inflation rates, and interest rates play a crucial role in shaping investor sentiment. For instance, a strong GDP growth rate can lead to increased corporate earnings, thereby driving up stock prices. Conversely, high inflation or rising interest rates can have a negative impact on the market.

2. Company Performance

The financial performance of individual companies is another critical factor that influences stock prices. Investors closely monitor metrics such as revenue growth, profit margins, and earnings per share (EPS). Companies that consistently deliver strong financial results are more likely to see their stock prices rise.

3. Market Sentiment

Market sentiment refers to the overall mood or outlook of investors in the market. It can be influenced by various factors, including news, rumors, and economic events. Positive sentiment can lead to a rally in the market, while negative sentiment can trigger a sell-off. It's important to stay informed and keep an eye on market sentiment to make informed decisions.

4. Foreign Investment

Foreign investment plays a significant role in the Indian stock market. Foreign institutional investors (FIIs) and non-resident Indians (NRIs) often invest in Indian stocks, bringing in capital and potentially driving up prices. Conversely, a withdrawal of foreign investment can lead to a decline in stock prices.

5. Sectoral Trends

Different sectors within the Indian stock market perform differently based on various factors, such as regulatory changes, technological advancements, and consumer demand. For example, the IT sector has traditionally been a high-growth area, while the real estate sector has faced challenges due to regulatory hurdles.

Case Study: Reliance Industries

To illustrate the impact of these factors on stock prices, let's consider the case of Reliance Industries, one of India's largest and most influential companies. In 2020, Reliance Industries announced a massive investment in the digital sector, leading to a significant surge in its stock price. This move was driven by strong economic growth in the digital sector and the company's commitment to innovation.

Conclusion

Understanding the factors that influence the Ind stock price is essential for investors looking to succeed in the Indian stock market. By staying informed about economic indicators, company performance, market sentiment, foreign investment, and sectoral trends, you can make more informed decisions and potentially maximize your returns. Keep in mind that investing in the stock market always involves risks, so it's important to do your research and consult with a financial advisor if needed.

Best Momentum Stocks in the US Market: Rece? new york stock exchange