In 2020, the US stock market faced unprecedented challenges due to the global COVID-19 pandemic. However, despite the initial shock, the market demonstrated remarkable resilience and recovery. This article delves into the key factors that influenced the US stock market in 2020 and highlights some of the notable trends and events that shaped the year.

The Initial Shock and Market Decline

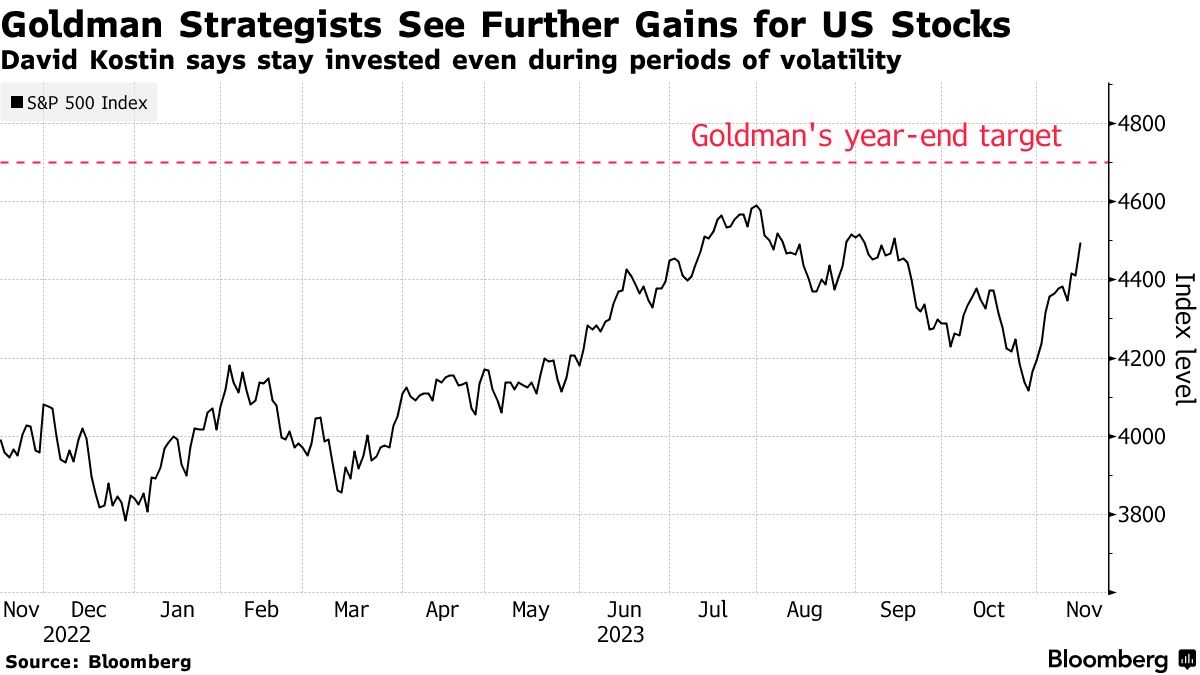

As the pandemic began to spread across the globe, investors were caught off guard. The stock market experienced a sharp decline, with the S&P 500 falling by nearly 30% in the first few months of the year. This decline was primarily driven by concerns about the economic impact of the pandemic, as well as the rapid spread of the virus.

Government Stimulus and Market Recovery

However, the market's decline was short-lived. The US government, along with other global governments, implemented a series of stimulus measures to support the economy. These measures included direct payments to individuals, unemployment benefits, and aid to businesses. The stimulus packages helped to stabilize the market and pave the way for a strong recovery.

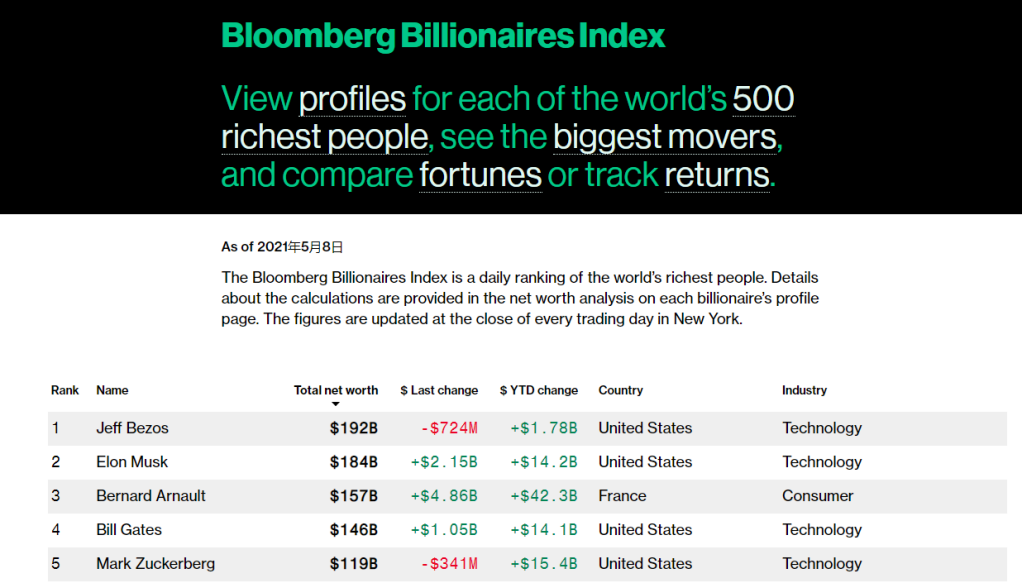

Tech Stocks Leading the Charge

One of the most notable trends in the 2020 US stock market was the surge in tech stocks. Companies like Apple, Amazon, Google, and Facebook saw their share prices soar, driven by strong earnings reports and increased demand for their products and services. These companies also played a crucial role in the broader market's recovery, as they accounted for a significant portion of the S&P 500's gains.

The Impact of the Election

The US presidential election also had a significant impact on the stock market in 2020. As the election approached, investors were concerned about the potential for market volatility. However, once the election results were announced, the market quickly stabilized and continued its upward trend.

Sector Performance

In terms of sector performance, the technology sector was the clear winner in 2020. The healthcare sector also performed well, driven by increased demand for medical supplies and treatments during the pandemic. On the other hand, sectors like energy and financials were hit hard by the pandemic, as the global economy slowed down.

Case Study: Tesla's Record-Breaking Year

One of the most remarkable stories of 2020 was the rise of Tesla. The electric vehicle manufacturer saw its share price soar by more than 700% in the year, making it one of the best-performing stocks of all time. Tesla's success was driven by strong sales of its vehicles and a growing market for electric vehicles. The company's CEO, Elon Musk, also played a significant role in driving investor confidence.

Conclusion

In conclusion, the 2020 US stock market was a year of resilience and recovery. Despite the initial shock of the pandemic, the market demonstrated remarkable strength and adaptability. The surge in tech stocks and the government's stimulus measures were key factors in the market's recovery. As we move forward, it will be interesting to see how the market continues to evolve and adapt to new challenges and opportunities.

Maximize Your Investment Potential: Underst? stock chap