In the dynamic world of finance, keeping an eye on stock prices is crucial for investors. If you're looking to invest in Bank of Montreal (BMO), understanding the current stock price and its trends is essential. In this article, we delve into the BMO stock price in the US, offering insights and analysis to help you make informed decisions.

Understanding BMO Stock

Bank of Montreal, commonly known as BMO, is a leading financial institution in Canada. Its stock, BMO stock price US, is traded on major exchanges in the United States, making it accessible to investors worldwide. The stock symbol for BMO in the US is BMO, and it is often referred to as "BMO stock price US" by investors.

Current BMO Stock Price

As of the latest data available, the BMO stock price US is approximately $80.50 per share. However, it's important to note that stock prices fluctuate constantly due to market conditions, investor sentiment, and corporate news.

Factors Influencing BMO Stock Price

Several factors can influence the BMO stock price US. Here are some key factors to consider:

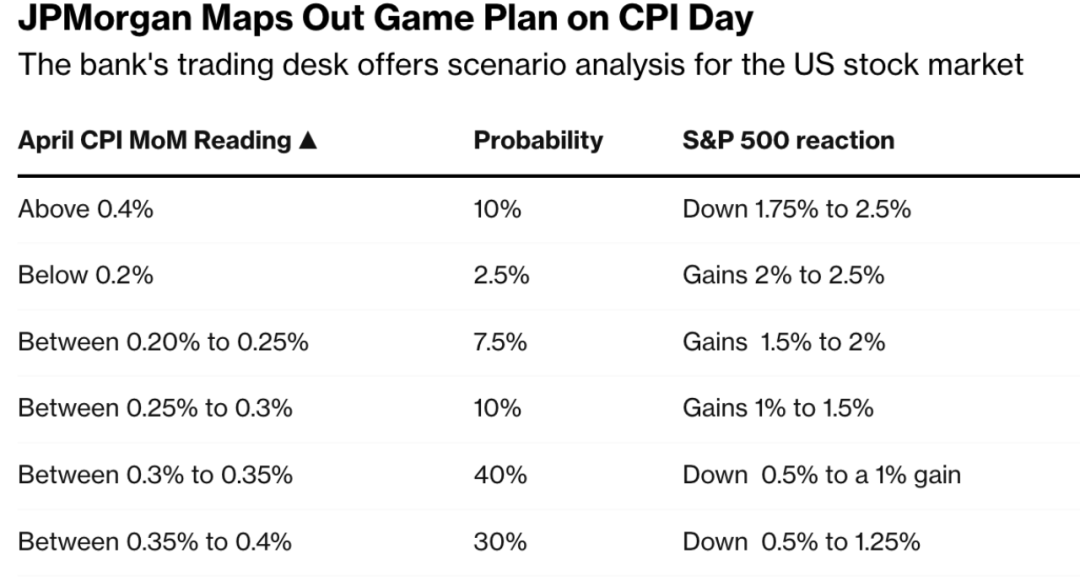

Economic Indicators: Economic reports and indicators, such as GDP growth, unemployment rates, and inflation, can impact the stock price. A strong economy often leads to higher stock prices, while economic downturns can have the opposite effect.

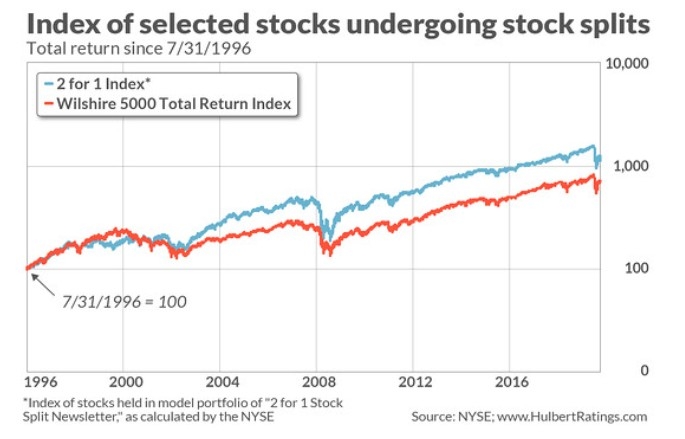

Market Trends: The broader market trends, such as the stock market's overall performance, can also influence the BMO stock price US. If the market is experiencing a bull run, it's likely that BMO's stock price will also rise.

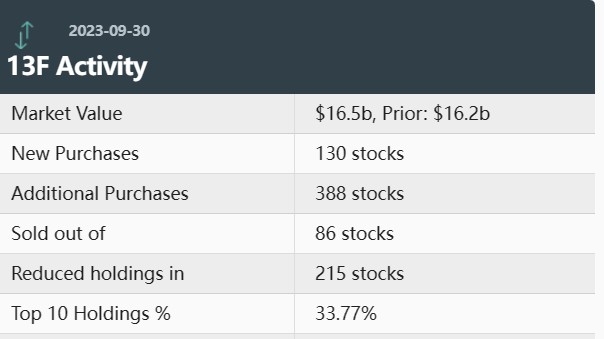

Company Performance: BMO's financial performance, including earnings reports, revenue growth, and profitability, plays a significant role in determining its stock price. Strong financial results can lead to increased investor confidence and higher stock prices.

Regulatory Changes: Changes in financial regulations can impact the profitability of banks and, consequently, their stock prices. It's important to stay informed about any regulatory developments that could affect BMO.

Geopolitical Factors: Global events, such as political instability or trade disputes, can also influence the BMO stock price US. These events can create uncertainty in the market, leading to volatility in stock prices.

BMO Stock Price Trends

Analyzing the trends in the BMO stock price US can provide valuable insights for investors. Over the past year, the stock has shown a consistent upward trend, reflecting the company's strong performance and the overall market's positive sentiment.

Investment Opportunities

For investors considering adding BMO stock to their portfolio, it's important to analyze the stock's valuation and growth prospects. The current price-to-earnings (P/E) ratio for BMO is around 12.5, which is considered reasonable given the company's financial stability and growth potential.

Conclusion

Understanding the BMO stock price US is essential for investors looking to invest in this financial giant. By considering the factors that influence the stock price and analyzing the company's performance and market trends, investors can make informed decisions. As always, it's important to do thorough research and consult with a financial advisor before making any investment decisions.

Understanding the Ishares US Preferred Stoc? stock chap