In today's globalized world, investors are increasingly looking beyond their borders for investment opportunities. One popular question that has emerged among Indian investors is whether they can trade US stocks from India. The answer is a resounding yes, and this article will delve into the intricacies of trading US stocks from India, including the benefits, the process, and some tips for success.

Understanding the Process

To trade US stocks from India, you need to follow a few straightforward steps. Firstly, you'll need to open a brokerage account with a US-based brokerage firm. There are several reputable brokerage firms that cater to international clients, such as TD Ameritrade, E*TRADE, and Charles Schwab.

Once you have your brokerage account set up, you can fund it with Indian rupees or any other currency accepted by the brokerage firm. It's important to note that you may incur currency conversion fees and exchange rate differences when transferring funds.

Benefits of Trading US Stocks from India

Trading US stocks from India offers several benefits, including:

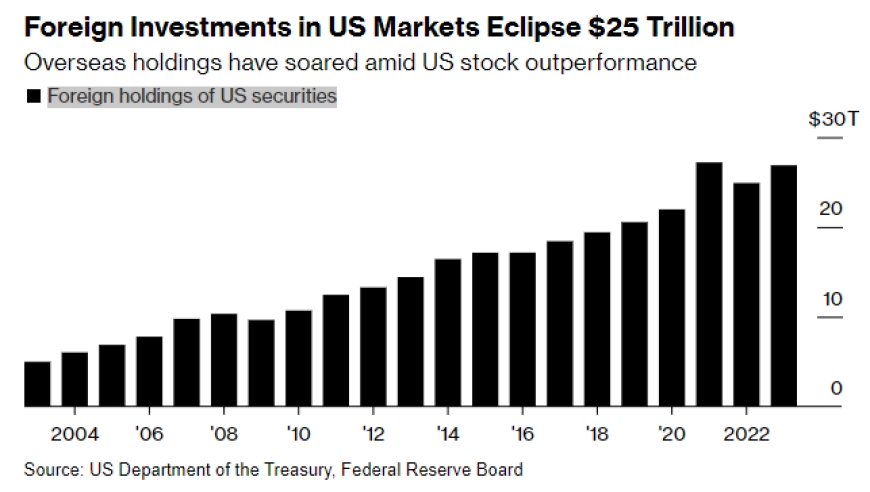

- Diversification: The US stock market is one of the largest and most diversified in the world, offering exposure to a wide range of sectors and industries.

- Higher Returns: Historically, the US stock market has provided higher returns compared to the Indian stock market.

- Technology and Innovation: The US is home to some of the world's most innovative companies, such as Apple, Google, and Microsoft.

- Access to IPOs: As an Indian investor, you can participate in the initial public offerings (IPOs) of US companies, which can be highly lucrative.

Tips for Success

To succeed in trading US stocks from India, consider the following tips:

- Do Your Research: Before investing in any US stock, conduct thorough research to understand the company's fundamentals, financials, and market trends.

- Understand the Risks: The US stock market can be volatile, so it's important to understand the risks involved and have a well-defined investment strategy.

- Stay Informed: Keep up with the latest news and developments in the US stock market to make informed investment decisions.

- Use Stop-Loss Orders: Implement stop-loss orders to limit potential losses.

Case Study: Investing in Apple from India

Let's consider a hypothetical scenario where an Indian investor wants to invest in Apple (AAPL) from India. The investor follows the steps outlined above and successfully opens a brokerage account with a US-based brokerage firm. After conducting thorough research, the investor decides to purchase 100 shares of Apple at $150 per share.

A few months later, the stock price of Apple increases to

In conclusion, trading US stocks from India is not only possible but also offers several benefits. By following the steps outlined in this article and adopting a disciplined approach, Indian investors can successfully navigate the US stock market and potentially achieve their investment goals.

How Many People Invest in the Stock Market ? stock chap