Are you interested in investing in Convatec, a leading medical device company? If so, you'll need to know the stock symbol, which is crucial for monitoring its performance and making informed investment decisions. In this article, we'll explore everything you need to know about Convatec's stock symbol, including its history, current market performance, and potential investment opportunities.

What is Convatec's Stock Symbol?

The stock symbol for Convatec is CVT. This symbol is used on stock exchanges, such as the New York Stock Exchange (NYSE), to identify Convatec's shares. Investors can easily track the company's stock price, trading volume, and other financial metrics using this symbol.

Convatec's History and Background

Convatec, founded in 1979, is a global medical device company specializing in the development, manufacturing, and marketing of innovative products for the management of chronic wounds, skin injuries, and Continence Care. The company's headquarters are located in Skillman, New Jersey, USA.

Over the years, Convatec has grown significantly through strategic acquisitions and organic growth. In 2016, Convatec acquired Smith & Nephew's Wound Management business, further expanding its product portfolio and market presence.

Convatec's Market Performance

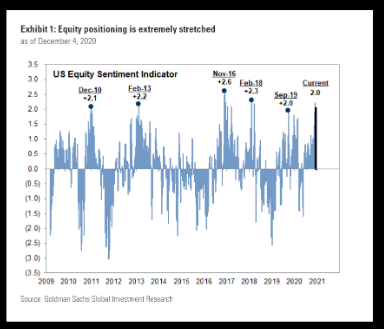

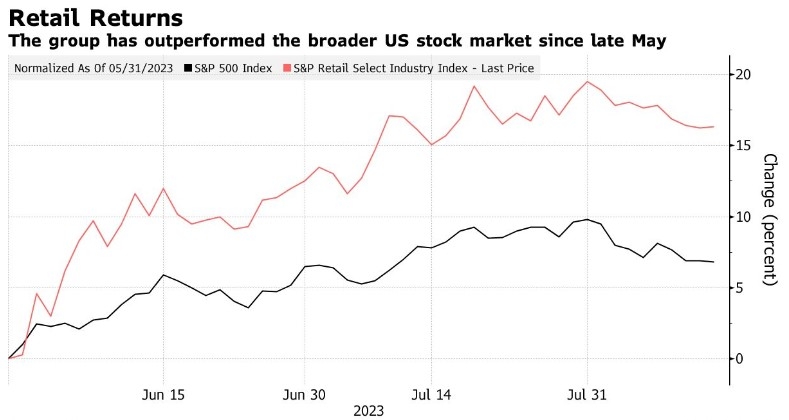

Convatec has demonstrated strong financial performance over the years, with consistent revenue growth and profitability. The company's stock has also experienced significant volatility, reflecting market trends and investor sentiment.

As of the latest available data, Convatec's stock price has been fluctuating within a range of

Investment Opportunities in CVT Stock

Investing in CVT stock can be an attractive opportunity for investors seeking exposure to the medical device industry. Here are some key factors to consider when evaluating CVT stock:

- Growth Potential: Convatec has a strong pipeline of innovative products and a growing market presence, making it a promising investment for long-term growth.

- Strong Financial Performance: Convatec has demonstrated consistent revenue growth and profitability, with a solid balance sheet and strong cash flow.

- Dividend Yield: Convatec offers a dividend yield of approximately 1.5%, providing investors with a modest income stream.

However, it's important to conduct thorough research and consider your own investment goals and risk tolerance before investing in CVT stock.

Case Study: Convatec's Acquisition of Smith & Nephew's Wound Management Business

In 2016, Convatec acquired Smith & Nephew's Wound Management business for $4.1 billion. This acquisition significantly expanded Convatec's product portfolio and market presence, enhancing its competitive position in the medical device industry.

The acquisition has been a successful venture for Convatec, contributing to its revenue growth and market share expansion. This case study demonstrates Convatec's strategic focus on acquiring complementary businesses to drive growth and innovation.

Conclusion

Convatec's stock symbol, CVT, represents a promising investment opportunity in the medical device industry. With a strong track record of innovation, financial performance, and growth potential, CVT stock could be an attractive addition to your investment portfolio. However, it's important to conduct thorough research and consider your own investment goals and risk tolerance before making any investment decisions.

http stocks.us.reuters.com stocks fulldescr? stock chap