The global share market is a dynamic and ever-evolving landscape, offering investors a world of opportunities and challenges. To stay ahead in this competitive market, it's crucial to have access to real-time insights and analysis. This article delves into the live global share market, providing a comprehensive overview of its current state, key trends, and strategies for successful investment.

Understanding the Live Global Share Market

The live global share market encompasses all the financial exchanges across the world, including stock exchanges in the United States, Europe, Asia, and Australia. This vast network of exchanges allows investors to trade shares of companies from various industries and geographical locations.

Key Indicators of the Live Global Share Market

To understand the live global share market, it's essential to track key indicators, such as:

- Stock Indices: These are a compilation of shares from a particular market or sector, providing a snapshot of the overall market performance. Common indices include the S&P 500, Dow Jones, NASDAQ, FTSE 100, and Nikkei 225.

- Market Capitalization: This refers to the total value of all the shares of a particular company or market. It helps investors gauge the size and stability of a company or market.

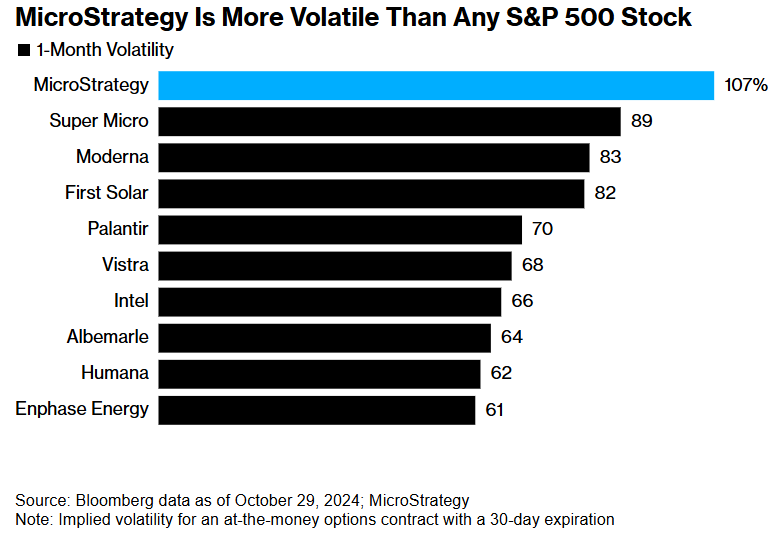

- Volatility: This measures the degree of price fluctuations in the market. High volatility can indicate uncertainty and risk, while low volatility suggests stability.

Trends in the Live Global Share Market

Several key trends are shaping the live global share market:

- Technological Innovation: The rapid pace of technological innovation is driving growth in sectors such as artificial intelligence, biotechnology, and renewable energy.

- Globalization: The increasing interconnectedness of the global economy is creating new opportunities for companies and investors.

- Economic Policies: Government policies, such as tax reforms and monetary stimulus, can significantly impact the live global share market.

Strategies for Investing in the Live Global Share Market

To succeed in the live global share market, investors should consider the following strategies:

- Diversification: Investing in a variety of assets can help reduce risk and increase returns.

- Research and Analysis: Conduct thorough research and analysis before investing in any stock or market.

- Risk Management: Understand your risk tolerance and develop a strategy to manage potential losses.

- Stay Informed: Keep up-to-date with the latest market trends, news, and analysis.

Case Study: Apple Inc.

A prime example of a company thriving in the live global share market is Apple Inc. Over the past few years, Apple has seen significant growth, driven by its innovative products and services. By continuously reinventing itself and adapting to market trends, Apple has become a leader in the technology sector, attracting investors worldwide.

Conclusion

The live global share market is a complex and dynamic environment, but with the right strategies and insights, investors can navigate its challenges and capitalize on its opportunities. By staying informed and adapting to the latest trends, investors can achieve long-term success in the global share market.

"Stock Screener Momentum: Unveilin? stock chap