In the Philippines, investing in US stocks has become increasingly popular among investors looking to diversify their portfolios. The American stock market is known for its robustness and offers a wide range of investment opportunities. This guide will walk you through the process of buying US stocks from the Philippines, ensuring you make informed decisions.

Understanding the Basics

Before diving into the process, it’s crucial to understand the basics of US stocks. A stock represents a share of ownership in a company. When you buy a stock, you become a shareholder, entitled to a portion of the company’s profits. The value of a stock can fluctuate based on various factors, including the company’s performance, market conditions, and economic indicators.

Choosing a Broker

The first step in buying US stocks is to choose a reliable broker. A broker acts as an intermediary between you and the stock market, facilitating the buying and selling of stocks. When selecting a broker, consider the following factors:

- Regulation and Reputation: Ensure the broker is regulated by a reputable financial authority.

- Fees and Commissions: Compare the fees and commissions charged by different brokers.

- Platform and Tools: Look for a broker with a user-friendly platform and comprehensive investment tools.

Some popular brokers for buying US stocks from the Philippines include TD Ameritrade, E*TRADE, and Charles Schwab.

Opening an Account

Once you’ve chosen a broker, you’ll need to open an account. The process typically involves the following steps:

- Fill out an Application: Provide personal information, including your name, address, and contact details.

- Proof of Identity: Submit identification documents, such as a passport or driver’s license.

- Proof of Residence: Provide proof of residence, such as a utility bill or bank statement.

- Fund Your Account: Transfer funds from your Philippine bank account to your brokerage account.

Navigating the Platform

Once your account is funded, you can start buying US stocks. Most brokers offer an online platform that allows you to view stock prices, place orders, and track your investments. Here’s a brief overview of the key features:

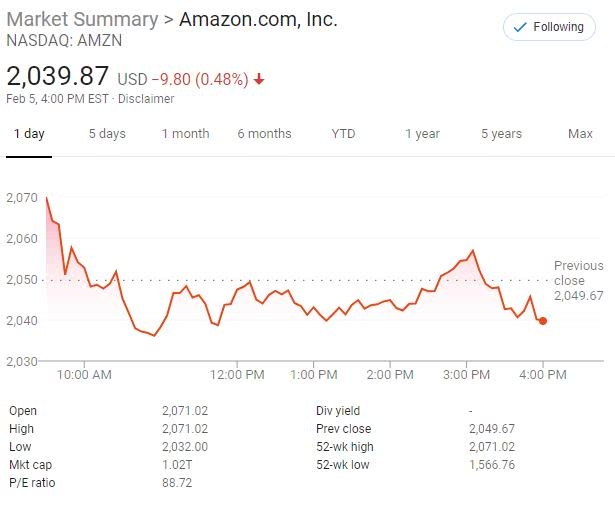

- Stock Quotes: View real-time stock prices and historical data.

- Order Types: Place different types of orders, such as market orders, limit orders, and stop orders.

- Portfolio Tracking: Monitor your investments and view performance metrics.

- Research Tools: Access financial news, analysis, and market data.

Investment Strategies

When buying US stocks, it’s essential to have a clear investment strategy. Here are some popular strategies:

- Dividend Investing: Invest in companies that pay regular dividends.

- Growth Investing: Focus on companies with high growth potential.

- Value Investing: Look for undervalued companies with strong fundamentals.

Case Study: Investing in Apple (AAPL)

Let’s say you want to invest in Apple (AAPL), one of the most popular tech companies in the world. Here’s how you can do it:

- Research: Analyze Apple’s financial statements, market trends, and competitive landscape.

- Place an Order: Open your brokerage account, select Apple (AAPL), and place a market order to buy shares.

- Monitor Your Investment: Keep track of Apple’s performance and market conditions.

Conclusion

Buying US stocks from the Philippines can be a rewarding investment opportunity. By following this guide, you can navigate the process and make informed decisions. Remember to do your research, choose a reliable broker, and develop a clear investment strategy. Happy investing!

How Many People Invest in the Stock Market ? stock chap