In recent years, the US stock market has been a hot topic of discussion, with many investors and financial experts debating whether it's currently experiencing a bubble. This article delves into the factors contributing to the market's growth, potential risks, and historical context to provide a comprehensive analysis.

Market Growth and Factors Contributing to the Rise

The US stock market has seen significant growth over the past decade, with the S&P 500 index reaching record highs. Several factors have contributed to this growth:

- Low Interest Rates: The Federal Reserve's low-interest-rate policy has made borrowing cheaper, leading to increased investment in the stock market.

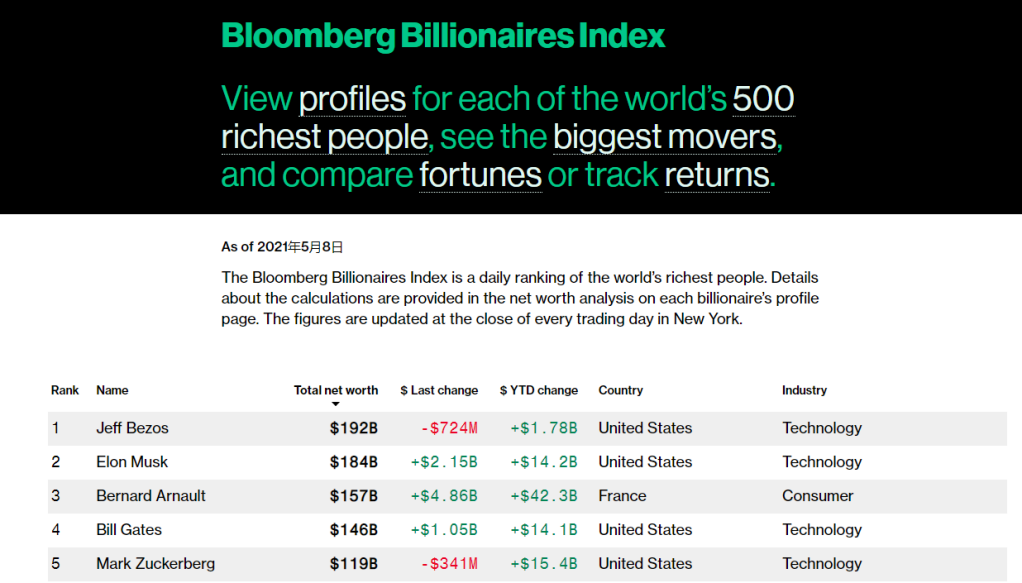

- Corporate Earnings: Many companies have reported strong earnings, which has supported stock prices.

- Technological Advancements: The rise of technology has created new industries and opportunities, driving investment in these sectors.

Potential Risks and Concerns

Despite the market's growth, some experts argue that it may be experiencing a bubble. Here are some of the potential risks and concerns:

- Valuation Levels: The stock market is currently trading at historically high valuations, which some experts believe may be unsustainable.

- Excessive Debt: Many companies have taken on excessive debt to fund share buybacks and acquisitions, which may pose a risk if the economy weakens.

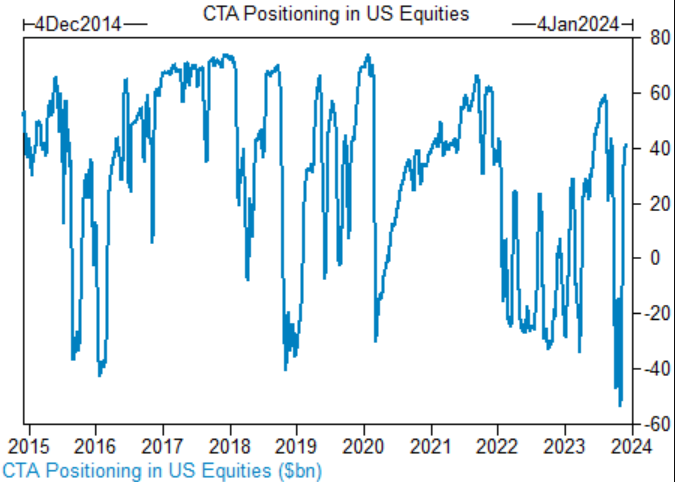

- Speculative Investing: The rise of retail investors using platforms like Robinhood has led to increased speculative trading, which may contribute to market volatility.

Historical Context

To understand the current market conditions, it's important to look at historical context. Previous stock market bubbles, such as the dot-com bubble of the late 1990s and the housing bubble of the mid-2000s, were characterized by excessive optimism and speculative investing. While the current market may share some similarities, it also has distinct differences.

Case Studies

To illustrate the potential risks of a bubble, let's look at a few case studies:

- Tech Stocks: The rapid growth of tech stocks in the late 1990s led to the dot-com bubble, which eventually burst. Many investors lost significant amounts of money.

- Housing Market: The housing bubble of the mid-2000s was driven by low-interest rates and excessive lending. When the bubble burst, the housing market collapsed, leading to a global financial crisis.

Conclusion

While it's difficult to predict the future of the US stock market, it's important to be aware of the potential risks and concerns. While the market may continue to grow, it's crucial for investors to exercise caution and avoid excessive speculation. By understanding historical context and considering the current market conditions, investors can make more informed decisions.

Chris Stock Leap Us: How This Entrepreneur ? stock chap