Understanding the Israeli Market on US Platforms

In the ever-evolving global financial landscape, Israeli stocks have found a significant presence on US exchanges. This article delves into the intricacies of investing in Israeli stocks through US platforms, offering insights into the market dynamics, key players, and potential benefits.

The Israeli Stock Market: A Brief Overview

The Israeli stock market, known as the Tel Aviv Stock Exchange (TASE), is one of the most advanced and technologically advanced in the world. It boasts a diverse range of companies, from established multinationals to promising startups. The TASE is a gateway for investors to tap into the dynamic and innovative Israeli economy.

Why Invest in Israeli Stocks on US Exchanges?

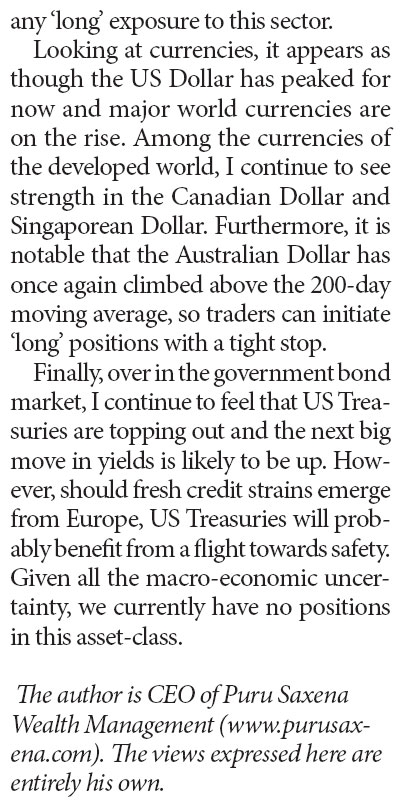

- Diversification: Incorporating Israeli stocks into your portfolio can provide diversification benefits, as the Israeli market often moves independently of major global markets.

- Innovation and Technology: Israel is renowned for its technological advancements, with many of its companies operating in cutting-edge sectors such as cybersecurity, biotechnology, and renewable energy.

- Economic Stability: Despite geopolitical challenges, Israel has maintained economic stability, making it an attractive destination for foreign investment.

How to Invest in Israeli Stocks on US Exchanges

- Direct Investment: Investors can purchase Israeli stocks directly through US exchanges. Many Israeli companies are listed on US exchanges, such as the NASDAQ and the New York Stock Exchange (NYSE).

- ETFs and Mutual Funds: Exchange-Traded Funds (ETFs) and mutual funds focused on Israeli stocks provide a convenient way to invest in the market without the need for direct stock purchases.

- Brokerage Accounts: Opening a brokerage account with a US-based broker that offers access to Israeli stocks is essential for direct investment.

Key Israeli Stocks on US Exchanges

- Check Point Software Technologies (CHKP): A leading provider of cybersecurity solutions, Check Point is a prominent Israeli company listed on the NASDAQ.

- Teva Pharmaceutical Industries (TEVA): A global pharmaceutical company, Teva is listed on both the NYSE and the TASE.

- Mobileye (MBLY): Acquired by Intel, Mobileye is a leader in autonomous driving technology and is listed on the NASDAQ.

Case Study: Check Point Software Technologies

Check Point Software Technologies, a cybersecurity company, offers a compelling example of the potential of Israeli stocks on US exchanges. Since its initial public offering (IPO) on the NASDAQ in 2001, Check Point has experienced significant growth, showcasing the market potential of Israeli technology companies.

Conclusion

Investing in Israeli stocks on US exchanges presents unique opportunities for diversification and exposure to innovative sectors. By understanding the market dynamics and key players, investors can make informed decisions and potentially benefit from the dynamic Israeli economy.

Understanding the Us Stock Board Lot System? stock chap