In the vast and dynamic world of the US stock market, each individual stock presents its own unique set of opportunities and challenges. Whether you are a seasoned investor or just starting out, understanding the intricacies of per stock analysis is crucial. This article delves into the key aspects of per stock US market analysis, highlighting the factors that influence stock performance and providing insights into identifying potential investment opportunities.

Understanding Per Stock Analysis

Per stock analysis refers to the examination of individual stocks within the broader context of the US stock market. This analysis involves assessing various factors such as financial performance, market trends, industry dynamics, and macroeconomic conditions. By thoroughly analyzing these elements, investors can make informed decisions regarding their investment portfolios.

Financial Performance

One of the most critical aspects of per stock analysis is evaluating a company's financial performance. This includes examining key financial ratios such as price-to-earnings (P/E), price-to-book (P/B), and earnings per share (EPS). A company with strong financial performance, indicated by consistent growth in revenue and earnings, is more likely to generate positive returns for investors.

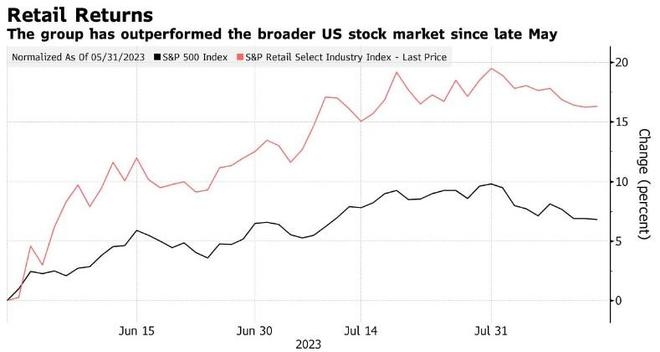

Market Trends

Keeping abreast of market trends is essential when analyzing individual stocks. By understanding the overall direction of the market, investors can make better decisions regarding when to buy or sell. For instance, if the market is trending upward, it may be a good time to invest in stocks that are outperforming the market.

Industry Dynamics

Industry dynamics play a significant role in the performance of individual stocks. Analyzing the competitive landscape, regulatory environment, and technological advancements within a specific industry can provide valuable insights into a stock's potential. Companies operating in growing industries with strong competitive advantages are more likely to generate sustainable returns.

Macroeconomic Conditions

Macroeconomic conditions, such as interest rates, inflation, and economic growth, can also impact individual stocks. For instance, a rise in interest rates may negatively affect companies with high debt levels, while economic growth can benefit stocks across various sectors.

Identifying Investment Opportunities

To identify potential investment opportunities within the per stock US market, investors should consider the following:

- Value Investing: This approach involves identifying undervalued stocks with strong fundamentals. By purchasing these stocks at a lower price than their intrinsic value, investors can benefit from the potential for future price appreciation.

- Growth Investing: Growth investors focus on companies with high potential for future earnings growth. These companies often trade at higher valuations but can offer significant returns over the long term.

- Dividend Investing: Dividend-paying stocks can provide investors with a steady stream of income. Companies with a strong track record of paying dividends and increasing them over time are often attractive investment options.

Case Study: Apple Inc.

Consider Apple Inc. (AAPL), one of the most successful companies in the tech industry. Over the past decade, Apple has consistently demonstrated strong financial performance, driven by its innovative products and services. By analyzing its financial statements, investors can see that Apple has a robust revenue stream and a strong balance sheet. Additionally, the company's market position in the tech industry is unparalleled, making it a solid investment opportunity.

In conclusion, per stock US market analysis requires a thorough understanding of various factors such as financial performance, market trends, industry dynamics, and macroeconomic conditions. By following a systematic approach and staying informed about these elements, investors can identify potential opportunities within the per stock US market and make informed investment decisions.

US Navy Stock Programs: Streamlining Acquis? stock chap