The stock market is a volatile place, and today, it's evident with a noticeable fall in US stocks. This article delves into the reasons behind the decline, its implications for investors, and how you can navigate through such turbulent times.

Reasons for Today's Stock Market Fall

The stock market's decline can be attributed to several factors. The most significant among them include:

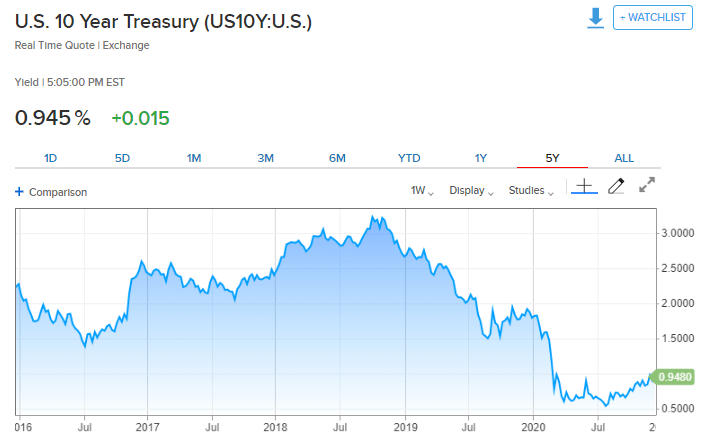

- Economic Concerns: The ongoing trade tensions between the United States and China have raised concerns about the global economy. Investors are worried about the potential impact of tariffs on consumer spending and corporate profits.

- Inflation: The rising inflation rate has also contributed to the stock market's fall. As the cost of living increases, consumers may cut back on spending, leading to lower corporate earnings.

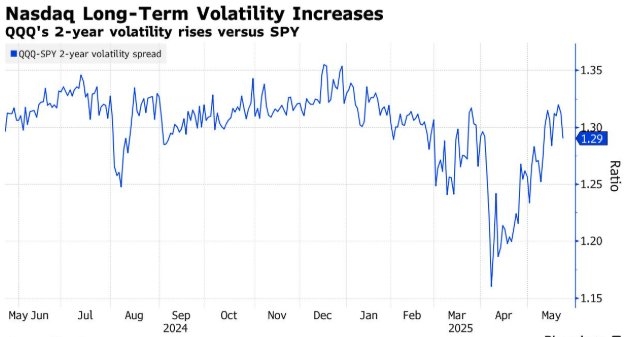

- Tech Stocks: The technology sector, which has been a major driver of the stock market's growth, has seen a significant decline. This is primarily due to concerns about valuation and the increasing regulatory scrutiny on big tech companies.

Implications for Investors

The fall in US stocks can have several implications for investors:

- Risk Management: It's crucial to ensure that your portfolio is well-diversified and that you have a robust risk management strategy in place.

- Opportunities: While the current market conditions may be challenging, they also present opportunities for investors who are willing to take on risk.

- Long-Term Perspective: It's essential to maintain a long-term perspective and not get swayed by short-term market fluctuations.

Navigating Turbulent Times

Here are some tips to help you navigate through turbulent times:

- Stay Informed: Keep yourself updated with the latest market news and economic indicators.

- Review Your Portfolio: Ensure that your portfolio aligns with your investment goals and risk tolerance.

- Avoid Emotional Decisions: Don't let emotions drive your investment decisions. Stick to your investment strategy and avoid making impulsive moves.

Case Studies

Let's look at a couple of case studies to understand the impact of today's stock market fall:

- Tech Giant: A leading tech company saw its stock price decline by 10% in a single day. While this was a significant drop, the company's long-term prospects remain strong. Investors who had a long-term perspective and stayed invested in the company's stock ended up benefiting from the subsequent rally.

- Retail Sector: The retail sector has been hit hard by the stock market's fall. Companies that have a strong online presence and a robust business model have managed to hold their ground. Investors who focused on these companies have seen better returns compared to those who invested in companies with a weak online presence.

In conclusion, today's stock market fall is a reminder of the volatility inherent in the market. However, by staying informed, reviewing your portfolio, and maintaining a long-term perspective, you can navigate through turbulent times and achieve your investment goals.

The Ultimate Guide to Buying US Stocks from? stock chap