The year 2025 marks a pivotal moment in the debate over the US stock market bubble. With the market reaching new highs, investors and analysts are increasingly questioning whether the current bull run is a sign of an impending bubble or simply a reflection of economic strength. This article delves into the key arguments and evidence surrounding this debate, providing a comprehensive overview of the current state of the US stock market.

Economic Growth and Corporate Profits

One of the main arguments against the existence of a stock market bubble is the strong economic growth and robust corporate profits. The US economy has been growing at a steady pace, with unemployment rates at historic lows. Additionally, corporate profits have been on the rise, driven by factors such as globalization, technological advancements, and tax cuts.

Valuation Metrics

However, many analysts argue that the current valuation metrics suggest that the stock market is overvalued. The price-to-earnings (P/E) ratio, a common measure of stock market valuation, is currently at levels not seen since the dot-com bubble of the late 1990s. This has led some to believe that the market is ripe for a correction.

The Role of Central Banks

Central banks, particularly the Federal Reserve, play a crucial role in the stock market bubble debate. With interest rates at historic lows, central banks have been accused of inflating asset prices by keeping borrowing costs low. This has led to a situation where investors are chasing yield, pushing stock prices higher.

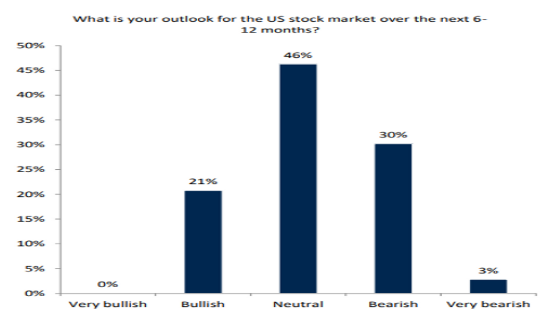

Market Sentiment and Speculation

Market sentiment and speculation also play a significant role in the debate. The rise of passive investing, particularly through exchange-traded funds (ETFs), has led to increased market liquidity and volatility. This has some investors concerned that the market is becoming increasingly speculative, increasing the risk of a bubble burst.

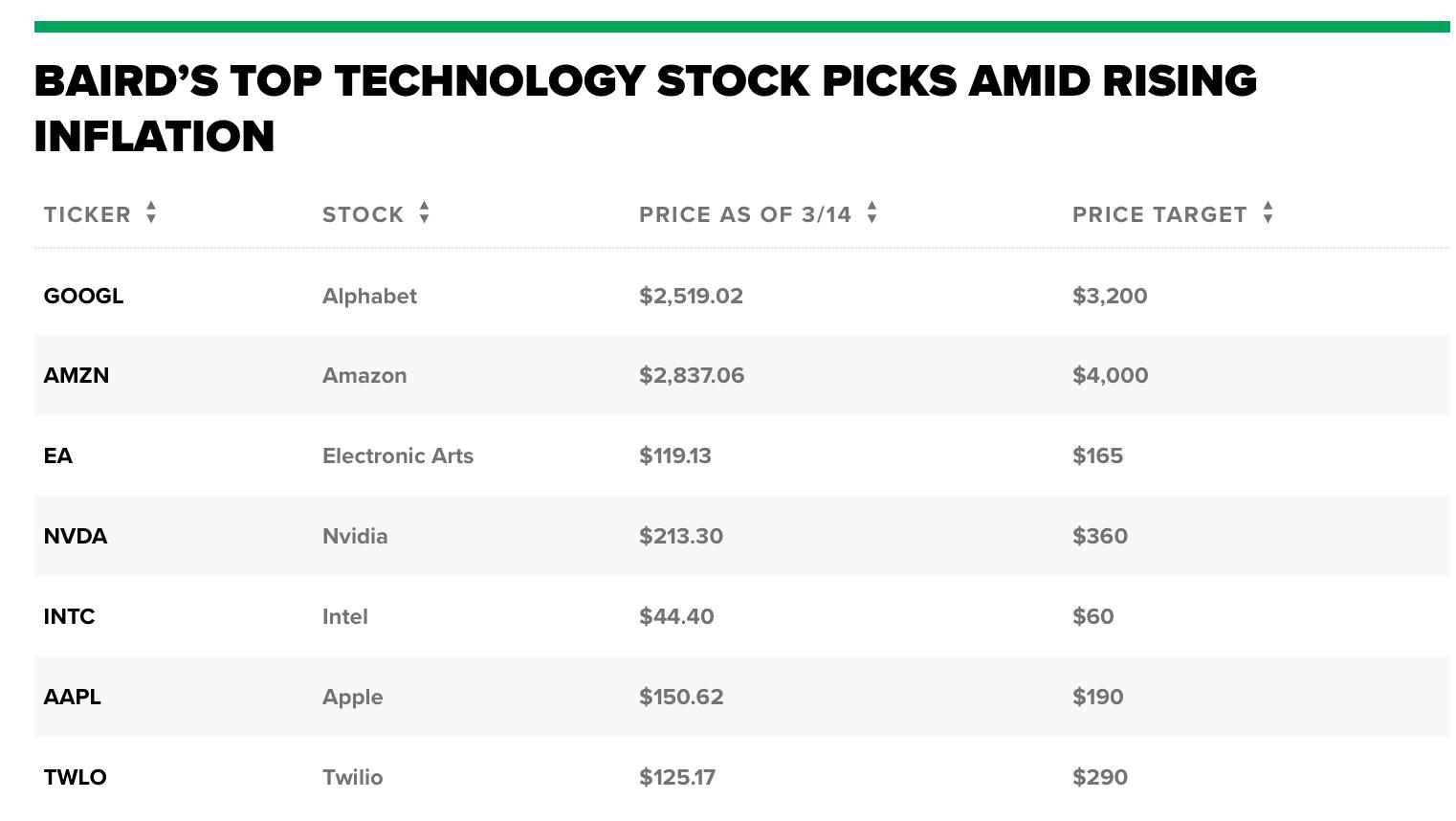

Case Study: Tech Stocks

One of the most notable examples of speculation in the current market is the tech sector. Companies like Apple, Amazon, and Google have seen their stock prices soar to unprecedented levels. While these companies are undeniably successful, some argue that their valuations are no longer justified by their fundamentals.

The Impact of Inflation

Another key factor in the stock market bubble debate is inflation. With the Federal Reserve raising interest rates to combat rising inflation, some investors are concerned that this could lead to a market correction. Historically, rising interest rates have been a precursor to market downturns.

Conclusion

The debate over the US stock market bubble in 2025 is complex and multifaceted. While economic growth and corporate profits may suggest a strong market, valuation metrics and speculation raise concerns about the potential for a bubble burst. As investors and analysts continue to weigh the evidence, one thing is clear: the stock market remains a volatile and unpredictable place.

Understanding the Power of iShares Core S&a? stock chap