Throughout history, the U.S. stock market has experienced various cycles, including periods of recession. Understanding how the stock market performs during these downturns is crucial for investors looking to navigate the volatile landscape. This article delves into the patterns and trends of stock market performance during U.S. recessions, providing valuable insights for investors.

Historical Stock Market Performance During Recessions

Historically, the stock market has often been a leading indicator of economic downturns. When the economy starts to slow down, the stock market typically follows suit. This correlation is evident in past recessions, where stock market performance has often been negative or lackluster.

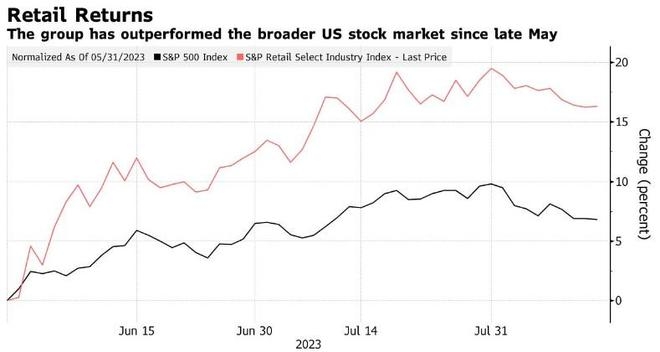

For instance, during the 2007-2009 recession, the S&P 500 index plummeted by nearly 50%. This was a result of a combination of factors, including the bursting of the housing bubble, the financial crisis, and a decline in consumer spending. Similarly, during the 1981-1982 recession, the S&P 500 index fell by approximately 21%.

However, it's important to note that the stock market doesn't always decline during recessions. In some cases, the market has actually experienced positive returns. This can be attributed to various factors, such as aggressive monetary policy, government intervention, or a shift in investor sentiment.

Key Factors Influencing Stock Market Performance During Recessions

Several key factors can influence stock market performance during recessions:

Monetary Policy: The Federal Reserve plays a crucial role in managing the economy during recessions. By adjusting interest rates and implementing quantitative easing, the Fed can stimulate economic growth and stabilize the stock market.

Government Intervention: During recessions, the government often implements various measures to stimulate the economy. This can include tax cuts, increased government spending, and bailouts for struggling industries. These measures can help boost investor confidence and support stock market performance.

Investor Sentiment: Investor sentiment can significantly impact stock market performance during recessions. When investors are optimistic about the future, they are more likely to invest in the stock market, even during economic downturns.

Sector Performance: Different sectors respond differently to recessions. For example, consumer discretionary and technology sectors tend to be more resilient during downturns, while sectors like financials and real estate may suffer more.

Case Studies: Stock Market Performance During Past Recessions

To illustrate the varying performance of the stock market during recessions, let's examine a few case studies:

2007-2009 Recession: As mentioned earlier, the S&P 500 index plummeted by nearly 50% during this period. However, some companies, such as Apple and Google, actually experienced significant growth during this time.

1981-1982 Recession: Despite the overall decline in the stock market, companies like Coca-Cola and Microsoft saw their stock prices rise during this recession.

2001 Recession: This recession, which followed the dot-com bubble burst, saw the S&P 500 index fall by approximately 31%. However, companies like Amazon and eBay managed to thrive during this period.

Conclusion

Understanding stock market performance during U.S. recessions is crucial for investors looking to navigate the volatile landscape. While the stock market doesn't always decline during recessions, it's important to be aware of the various factors that can influence performance. By staying informed and being prepared, investors can make more informed decisions and potentially capitalize on opportunities during these challenging times.

List of US Stock Market Crashes: A Comprehe? stock chap