In the fast-paced world of financial markets, understanding the S&P 500 daily closing prices can be a game-changer for investors. This index, representing the 500 largest companies in the U.S., serves as a key indicator of market trends and economic health. By delving into the daily closing prices, investors can gain valuable insights into market movements and make informed decisions. Let's explore the significance of S&P 500 daily closing prices and how they can impact your investment strategy.

Understanding the S&P 500

The S&P 500 is a widely followed stock market index that tracks the performance of 500 large companies across various sectors. These companies are chosen based on their market capitalization, financial stability, and overall market representation. The index is designed to provide a snapshot of the broader market, making it an essential tool for investors seeking to gauge market trends.

The Importance of Daily Closing Prices

Daily closing prices play a crucial role in analyzing the S&P 500. These prices reflect the market's sentiment towards the index and its constituent companies. By examining the closing prices, investors can identify trends, patterns, and potential opportunities.

Identifying Trends

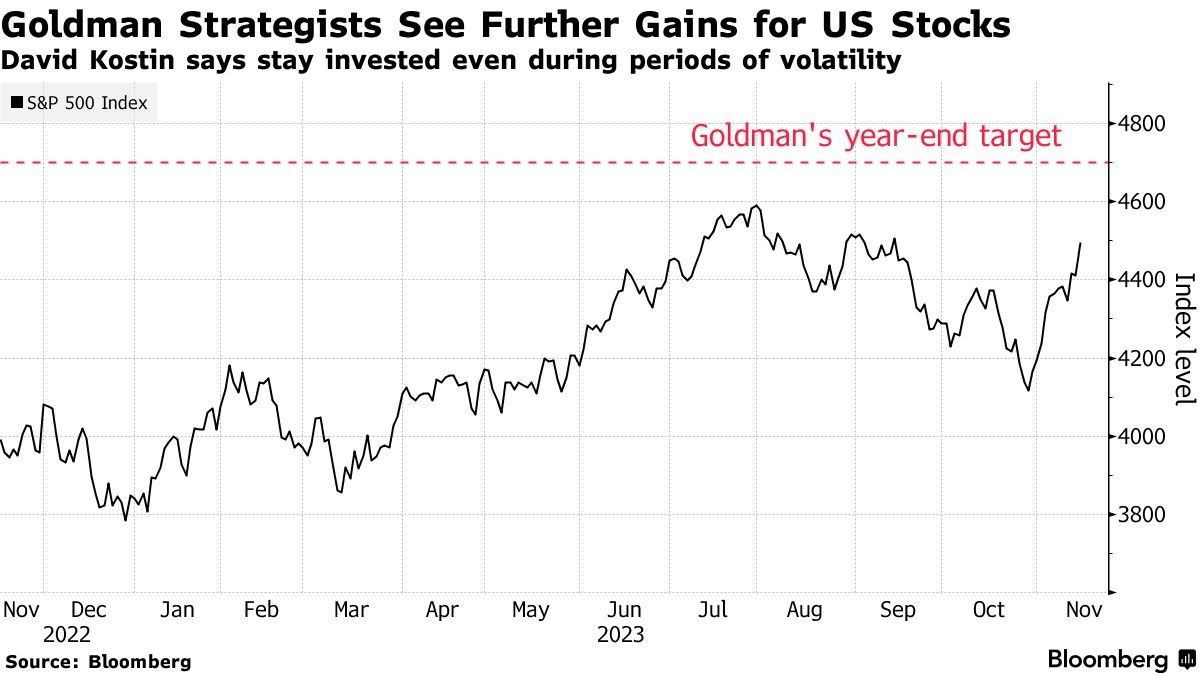

One of the primary uses of S&P 500 daily closing prices is to identify trends. By analyzing the movement of the index over time, investors can determine whether the market is in an uptrend, downtrend, or sideways trend. This information is crucial for making informed decisions about when to buy, sell, or hold stocks.

For example, if the S&P 500 has been consistently rising over the past few months, it may indicate a strong market sentiment and a favorable environment for investing. Conversely, if the index has been falling, it may suggest a bearish market and a need for caution.

Spotting Patterns

Another valuable aspect of S&P 500 daily closing prices is the ability to spot patterns. Patterns such as head and shoulders, triangles, and flags can provide clues about future market movements. By recognizing these patterns, investors can anticipate potential price movements and adjust their strategies accordingly.

For instance, a head and shoulders pattern, which resembles a human head and shoulders, often indicates a reversal in trend. When this pattern appears in the S&P 500, it may signal that the market is about to turn bearish.

Analyzing Volatility

Volatility is another critical factor to consider when analyzing S&P 500 daily closing prices. High volatility can indicate uncertainty in the market, while low volatility may suggest stability. By understanding the level of volatility, investors can better manage their risk and adjust their strategies accordingly.

For example, during periods of high volatility, investors may choose to reduce their exposure to the market or invest in less volatile assets such as bonds or gold.

Case Studies

To illustrate the importance of S&P 500 daily closing prices, let's consider a few case studies:

2020 Market Crash: In March 2020, the S&P 500 experienced a historic crash due to the COVID-19 pandemic. By analyzing the daily closing prices, investors could have identified the market's panic and adjusted their strategies accordingly.

2021 Market Recovery: After the crash, the S&P 500 began to recover. Investors who monitored the daily closing prices and recognized the uptrend could have capitalized on this opportunity by investing in the market.

By understanding the S&P 500 daily closing prices, investors can gain valuable insights into market trends, spot patterns, and analyze volatility. This knowledge can help investors make informed decisions and navigate the complexities of the financial markets.

Top US Cannabis Stocks: Investing Opportuni? stock chap