In the ever-evolving global market, investors are constantly seeking opportunities to diversify their portfolios. One such opportunity lies in buying US stocks from Singapore. This guide will explore the benefits of this investment strategy, the process involved, and how you can get started.

Understanding the Singapore Market

Singapore, often referred to as the "Lion City," is a financial hub in Southeast Asia. It boasts a robust and stable economy, making it an attractive destination for international investors. The Singapore Stock Exchange (SGX) is one of the most advanced in the region, offering a wide array of investment options, including US stocks.

Benefits of Buying US Stocks from Singapore

Diversification: Investing in US stocks from Singapore allows investors to diversify their portfolios geographically. This is crucial in mitigating risks associated with economic downturns in any single region.

Ease of Access: Singapore offers a straightforward process for buying US stocks. The SGX has established partnerships with major US stock exchanges, making it easier for investors to trade.

Tax Advantages: Singapore has a favorable tax environment for investors. The country does not impose capital gains tax on stocks, which can be a significant advantage for investors looking to maximize their returns.

Currency Strength: The Singapore dollar (SGD) is one of the most stable currencies in the world. This can be beneficial when investing in US stocks, as fluctuations in currency exchange rates can be minimized.

How to Buy US Stocks from Singapore

Open a Brokerage Account: The first step is to open a brokerage account with a reputable firm that offers trading services in US stocks. Many Singaporean brokerage firms provide this service, including DBS Vickers, Maybank Kim Eng, and Phillip Securities.

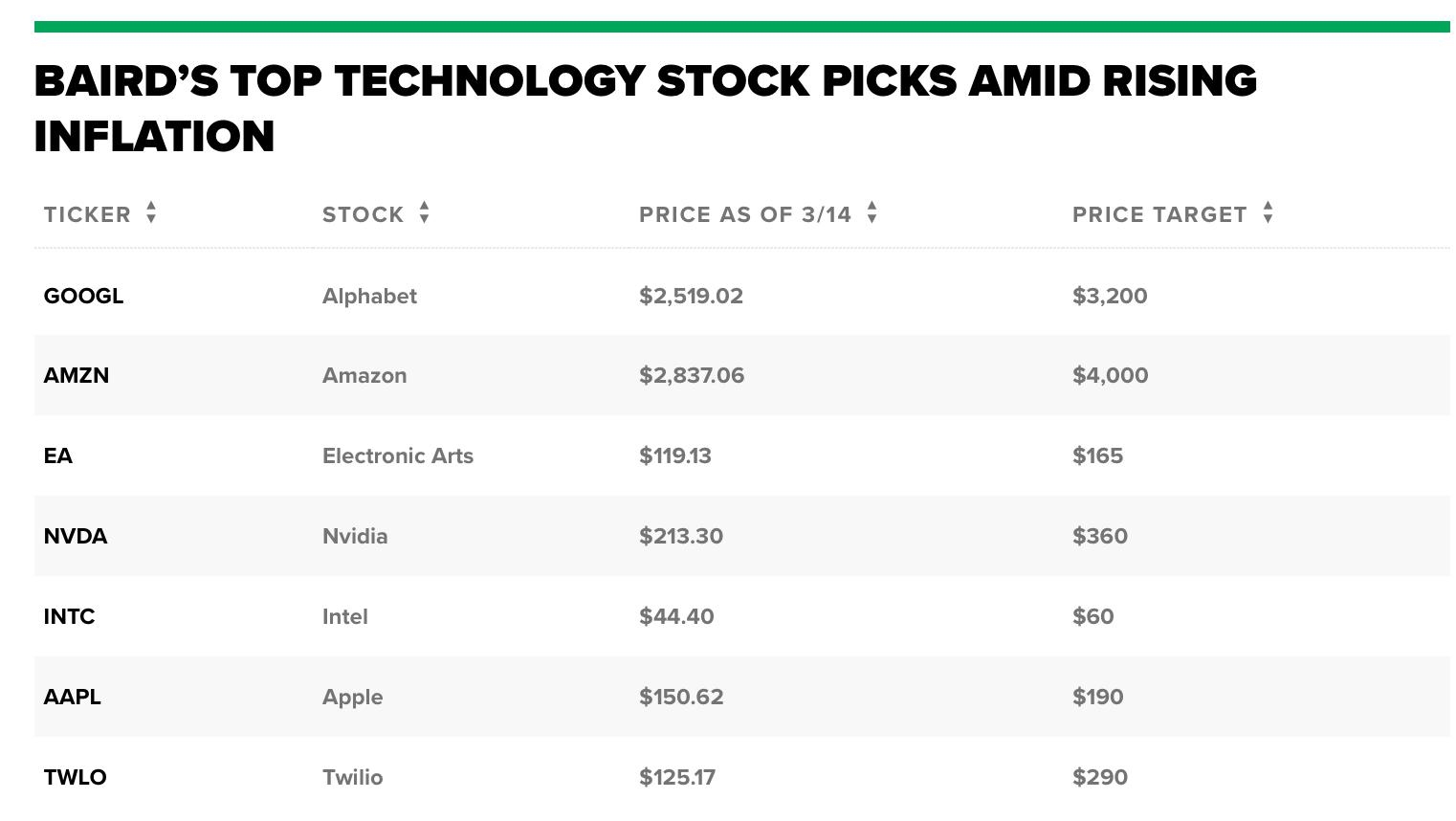

Research and Analyze: Conduct thorough research on the US stocks you are interested in. Analyze financial statements, market trends, and other relevant factors to make informed decisions.

Place Your Order: Once you have identified the stocks you want to buy, place your order through your brokerage account. You can choose from various order types, such as market orders, limit orders, and stop orders.

Monitor Your Investments: Regularly monitor your investments to stay informed about market trends and company performance. This will help you make informed decisions about buying, selling, or holding onto your stocks.

Case Study: Investing in Apple Inc. (AAPL) through SGX

Let's consider a hypothetical scenario where an investor decides to buy shares of Apple Inc. (AAPL) from Singapore. The investor opens a brokerage account with DBS Vickers, conducts thorough research on AAPL, and decides to purchase 100 shares at $150 per share.

Over the next year, the investor monitors AAPL's performance and notices a steady increase in its stock price. After a year, the stock price reaches

Conclusion

Buying US stocks from Singapore offers numerous benefits, including diversification, ease of access, tax advantages, and currency strength. By following the steps outlined in this guide, investors can take advantage of this strategic investment opportunity. Remember to conduct thorough research and monitor your investments regularly to maximize your returns.

Nelasa Stock US: The Ultimate Guide to Unde? us flag stock