Understanding the DJIA and Its Significance

The Dow Jones Industrial Average (DJIA), often simply referred to as the "Dow," is one of the most widely followed stock market indices in the United States. It represents the performance of 30 large, publicly traded companies in leading industries of the economy. Over the past decade, the DJIA has seen significant fluctuations, reflecting both market optimism and uncertainty. This article delves into the DJIA's performance over the last 10 years, analyzing key trends and factors that have influenced its trajectory.

Market Performance Overview

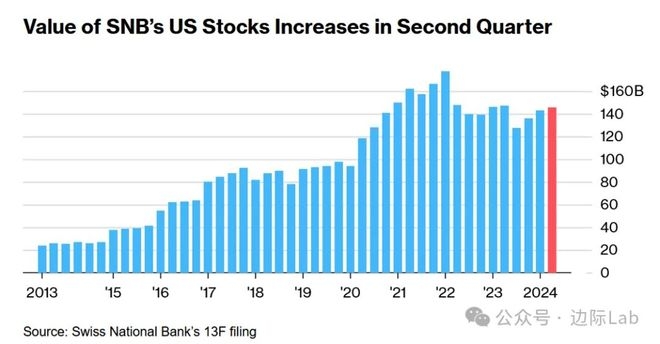

Since 2013, the DJIA has experienced a remarkable upward trend. As of the end of 2022, the index had more than doubled from its pre-financial crisis levels. This period has been marked by several notable milestones:

- Recovery from the Financial Crisis: The DJIA experienced a sharp decline during the 2008 financial crisis, dropping below 6,500 points. Over the next few years, the index gradually recovered, reaching pre-crisis levels by early 2013.

- Record Highs: The DJIA has set numerous record highs over the past decade, with the most recent being in January 2022, surpassing 36,000 points.

Key Factors Influencing the DJIA

Several factors have contributed to the DJIA's performance over the last 10 years:

- Economic Growth: The U.S. economy has experienced steady growth, with low unemployment rates and modest inflation. This has supported corporate earnings and contributed to the overall rise in stock prices.

- Monetary Policy: The Federal Reserve's accommodative monetary policy, including low interest rates and quantitative easing, has provided a supportive environment for the stock market.

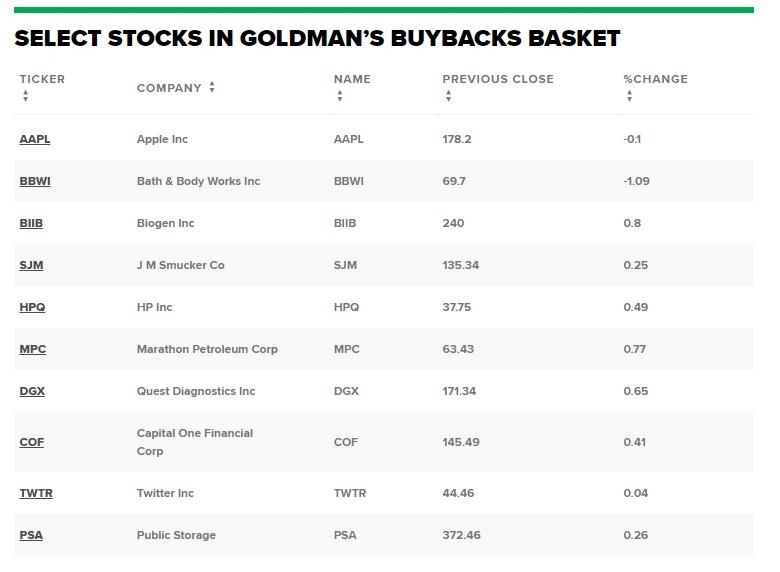

- Technological Advancements: The rise of technology companies has had a significant impact on the DJIA, with companies like Apple, Microsoft, and Amazon contributing to the index's growth.

- Global Economic Conditions: The DJIA's performance has also been influenced by global economic conditions, including trade tensions and geopolitical events.

Case Studies

- Apple's Impact: Apple, the largest company by market capitalization in the world, has been a major driver of the DJIA's growth. Its consistent revenue growth and innovative products have contributed to its success and, in turn, the index's performance.

- COVID-19 Pandemic: The COVID-19 pandemic caused significant disruptions to the global economy and the stock market. However, the DJIA quickly recovered, driven by strong corporate earnings and government stimulus measures.

Conclusion

The DJIA's performance over the last 10 years has been impressive, reflecting the resilience and growth of the U.S. economy. While there have been challenges along the way, the index's upward trajectory underscores the importance of economic fundamentals and technological advancements in driving stock market performance. As we look ahead, it will be interesting to see how the DJIA continues to evolve and respond to the ever-changing global economic landscape.

Can a Non-US Citizen Trade US Stocks? A Com? us flag stock