In the world of finance, the stock markets of Europe and the United States have long been major players. Both markets offer unique opportunities and challenges for investors. In this article, we'll delve into a comprehensive analysis of the European and US stock markets, comparing their performance, market composition, and future outlook.

Performance Analysis

Over the past decade, the performance of the European and US stock markets has been quite different. The S&P 500, a widely followed index representing the top 500 companies in the US, has seen significant growth. In contrast, the STOXX Europe 600, which tracks the largest companies in Europe, has experienced mixed results.

The S&P 500 has returned an average of 11.2% annually over the past 10 years, while the STOXX Europe 600 has returned an average of 5.3% annually. This difference can be attributed to several factors, including economic conditions, market composition, and regulatory differences.

Market Composition

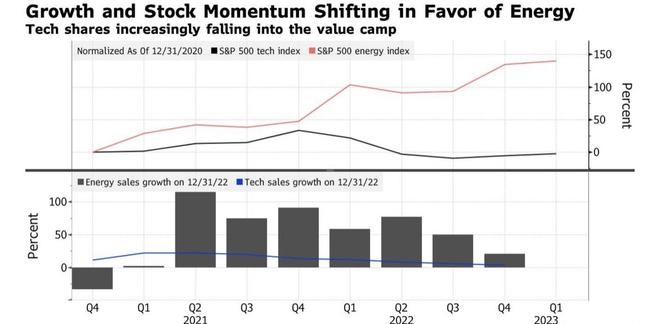

The composition of the European and US stock markets also differs significantly. The S&P 500 is dominated by technology, healthcare, and consumer discretionary sectors, while the STOXX Europe 600 is more evenly distributed across various sectors, including financials, energy, and utilities.

Technology companies, such as Apple and Microsoft, have been major drivers of the S&P 500's growth. In contrast, European markets have struggled to keep pace with the rapid growth of technology companies, leading to a more diversified sector composition.

Regulatory Differences

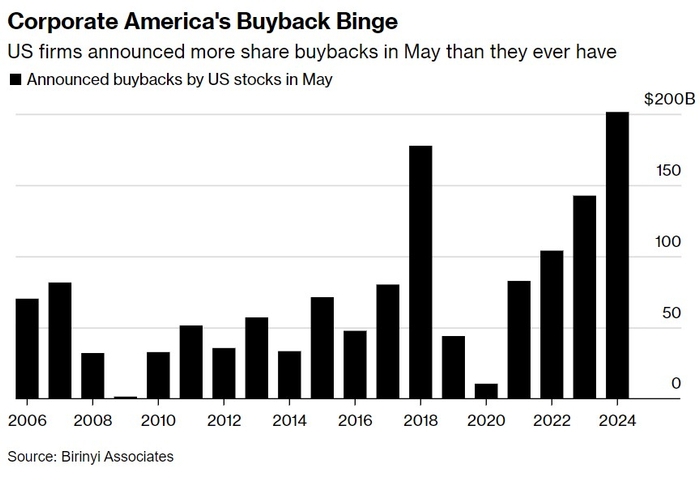

Regulatory differences between the US and Europe have also played a role in the performance of their stock markets. The US has a more flexible regulatory environment, which has allowed for greater innovation and growth in certain sectors. Europe, on the other hand, has a more stringent regulatory framework, which can be a barrier to growth.

For example, the EU's General Data Protection Regulation (GDPR) has had a significant impact on technology companies operating in Europe. This has led to increased costs and a slower pace of innovation compared to the US.

Future Outlook

Looking ahead, the future of the European and US stock markets remains uncertain. Several factors could impact their performance, including economic conditions, geopolitical events, and regulatory changes.

Economic conditions are a key factor. The US economy has been growing at a steady pace, which could continue to drive the S&P 500 higher. In Europe, however, economic growth has been slower, which could limit the performance of the STOXX Europe 600.

Case Studies

To illustrate the differences between the European and US stock markets, let's consider two case studies: Apple and Volkswagen.

Apple, a technology company listed on the S&P 500, has seen significant growth over the past decade. In contrast, Volkswagen, a German automaker listed on the STOXX Europe 600, has struggled to keep pace with the rapid growth of technology companies.

Conclusion

In conclusion, the European and US stock markets offer unique opportunities and challenges for investors. While the S&P 500 has seen significant growth, the STOXX Europe 600 has struggled to keep pace. Factors such as economic conditions, market composition, and regulatory differences have contributed to this divergence. As investors, it's important to understand these differences and consider them when making investment decisions.

How to Read the Code of US Stock Market: A ? us flag stock