In the vast world of investment, discerning which US stocks to invest in can be a daunting task. That's where Goldman Sachs, one of the world's leading financial institutions, comes into play. With their unparalleled expertise and extensive market research, Goldman Sachs has identified some top US stocks that are poised for significant growth. In this article, we delve into the insights from Goldman Sachs and explore the potential of these stocks for investment success.

Understanding Goldman Sachs' Investment Strategy

Goldman Sachs is renowned for its astute investment strategy, which involves meticulous analysis and a deep understanding of market trends. The firm's research team carefully evaluates various factors, including financial performance, industry outlook, and macroeconomic conditions, to identify stocks with high growth potential.

Top US Stocks Recommended by Goldman Sachs

- Apple Inc. (AAPL)

Goldman Sachs has a bullish outlook on Apple Inc., one of the most valuable companies in the world. With its strong position in the technology sector, Apple continues to dominate the smartphone, computer, and wearable device markets. The firm believes that Apple's robust product pipeline, including the upcoming iPhone 15, will drive further growth.

- Tesla, Inc. (TSLA)

Tesla, the electric vehicle (EV) pioneer, has been a favorite of Goldman Sachs. The firm believes that the increasing demand for EVs and the growing infrastructure for charging stations will fuel Tesla's growth. Moreover, Tesla's recent expansion into new markets, such as China and Europe, presents significant opportunities for further growth.

- Meta Platforms, Inc. (META)

Goldman Sachs has a positive outlook on Meta Platforms, the parent company of Facebook, Instagram, and WhatsApp. Despite facing regulatory challenges, the firm believes that Meta's strong user base and robust revenue growth will drive the company's success. Additionally, Meta's investment in the metaverse and virtual reality is expected to create new revenue streams.

- Microsoft Corporation (MSFT)

Microsoft Corporation, a global leader in technology, has been a consistent performer for investors. Goldman Sachs has a favorable view of Microsoft's cloud computing business, which is expected to drive growth in the coming years. The firm also believes that Microsoft's investments in artificial intelligence and quantum computing will further enhance its competitive advantage.

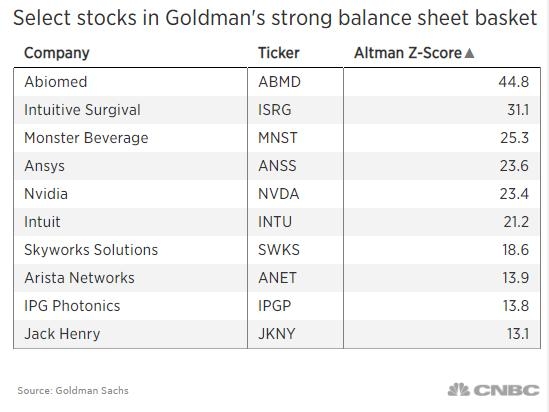

- NVIDIA Corporation (NVDA)

NVIDIA, a leader in graphics processing units (GPUs), has been a significant beneficiary of the increasing demand for high-performance computing. Goldman Sachs has a bullish outlook on NVIDIA, driven by its strong position in the gaming, data center, and automotive markets. The firm expects NVIDIA's continued innovation and expansion into new markets to drive growth.

Conclusion

Investing in the right US stocks can be a game-changer for investors. With Goldman Sachs' insights, investors can gain valuable insights into the potential of these top stocks. By understanding the firm's investment strategy and considering the factors that drive stock performance, investors can make informed decisions to achieve investment success.

How Many People Invest in the Stock Market ? us flag stock