In the ever-evolving world of stock markets, investors are constantly on the lookout for opportunities that offer high potential returns. One such area that has caught the attention of many is the realm of cheap volatile US stocks. These stocks, often trading at lower prices relative to their intrinsic value, can present exciting opportunities for those willing to navigate the volatility. In this article, we delve into what makes these stocks appealing, how to identify them, and provide some real-world examples.

Understanding Volatility

First, let's clarify what we mean by volatile stocks. These are stocks that experience significant price swings over a short period of time. While this can be risky, it also means that there is potential for rapid gains. Volatility can be caused by a variety of factors, including market sentiment, news, or even company-specific events.

What Makes a Stock 'Cheap'?

The term cheap refers to stocks that are trading at a price that is lower than their intrinsic value. This can happen for several reasons, such as a temporary setback in the company's performance, negative news, or a broader market downturn. When these stocks become volatile, the potential for significant upside becomes even more pronounced.

How to Identify Cheap Volatile Stocks

Identifying these stocks requires a combination of fundamental and technical analysis. Fundamental analysis involves looking at the company's financial health, earnings potential, and overall business prospects. Technical analysis, on the other hand, focuses on price movements and trading patterns.

Here are some key indicators to look for:

- Low Price-to-Earnings (P/E) Ratio: A P/E ratio that is significantly lower than the industry average can indicate a stock that is undervalued.

- High Beta: A stock with a high beta indicates it is more volatile than the overall market. This can be a sign of potential for high returns.

- Market Sentiment: Paying attention to market sentiment can help identify stocks that are being undervalued due to negative news or sentiment.

Real-World Examples

One notable example is Tesla Inc. (TSLA). Despite facing numerous challenges, including regulatory scrutiny and supply chain issues, TSLA has remained a volatile yet potentially lucrative investment. Its stock price has seen significant ups and downs, but those who bought at the right time have reaped substantial rewards.

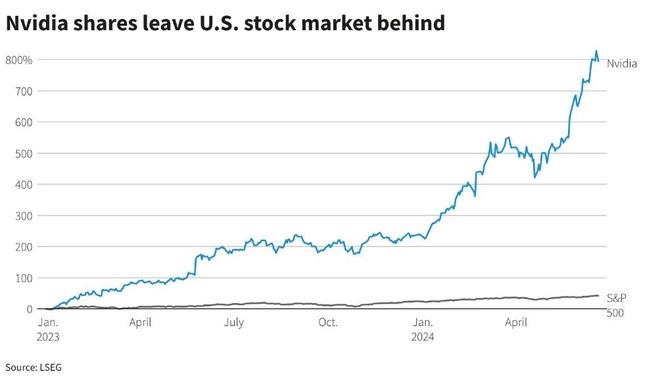

Another example is NVIDIA Corporation (NVDA). NVDA has been known for its volatile stock price, often reacting strongly to news about its graphics processing units (GPUs). Its high beta and low P/E ratio make it an intriguing option for investors looking for cheap volatile stocks.

Conclusion

Investing in cheap volatile US stocks can be a risky endeavor, but it also offers the potential for significant returns. By understanding the factors that contribute to volatility and identifying undervalued stocks, investors can position themselves to capitalize on these opportunities. However, it's crucial to conduct thorough research and consider your risk tolerance before diving into this sector.

How Many People Invest in the Stock Market ? us flag stock