Investing in the US stock market can be a lucrative opportunity for Indian investors. With a diverse range of companies and sectors to choose from, the US stock market offers a wide array of investment options. However, navigating this market can be challenging, especially for those who are new to it. In this article, we will explore the steps Indian investors can take to invest in the US stock market successfully.

Understanding the US Stock Market

The US stock market is one of the largest and most liquid in the world. It is home to some of the most well-known and successful companies, including Apple, Microsoft, and Amazon. The two major stock exchanges in the US are the New York Stock Exchange (NYSE) and the NASDAQ.

Opening a Brokerage Account

The first step for Indian investors to invest in the US stock market is to open a brokerage account. A brokerage account is a type of account that allows investors to buy and sell stocks, bonds, and other securities. There are several online brokers that cater specifically to international investors, such as TD Ameritrade, E*TRADE, and Charles Schwab.

Understanding Risk and Reward

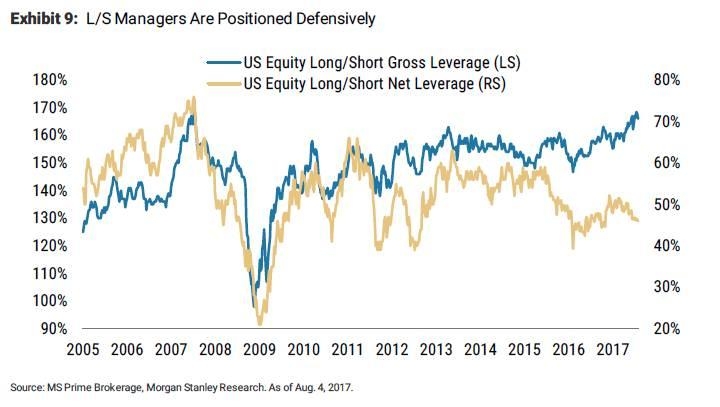

Investing in the US stock market carries both risks and rewards. It is important for Indian investors to understand the potential risks involved, such as market volatility and currency exchange rates. However, with proper research and strategy, investing in the US stock market can offer significant returns.

Researching Companies

Before investing in a particular company, it is important to conduct thorough research. This includes analyzing the company's financial statements, understanding its business model, and assessing its competitive position in the market. Several online resources, such as Yahoo Finance and Google Finance, can be used to gather this information.

Diversifying Your Portfolio

Diversification is a key strategy for reducing risk in any investment portfolio. Indian investors should consider diversifying their investments across different sectors and geographic regions. This can help to mitigate the impact of market volatility and ensure a more balanced portfolio.

Using Stop-Loss Orders

A stop-loss order is an instruction to sell a stock if its price falls to a certain level. This can help to limit potential losses in the event of a market downturn. Indian investors should consider using stop-loss orders as part of their investment strategy.

Monitoring Your Investments

Once you have invested in the US stock market, it is important to monitor your investments regularly. This includes reviewing your portfolio performance, staying informed about market news, and adjusting your strategy as needed.

Case Study: Investing in Apple

Let's consider a hypothetical scenario where an Indian investor decides to invest in Apple, one of the most successful companies in the US stock market. The investor opens a brokerage account, conducts thorough research on Apple, and decides to invest a certain amount of money in the company's stock.

Over the next few years, the investor monitors the performance of their investment and adjusts their strategy as needed. They also use stop-loss orders to limit potential losses. As a result, the investor sees significant returns on their investment, thanks to Apple's strong performance in the market.

Conclusion

Investing in the US stock market can be a rewarding opportunity for Indian investors. By understanding the market, conducting thorough research, and using sound investment strategies, Indian investors can navigate the US stock market successfully and achieve their investment goals.

NYSE US Stocks: Ceramic Industry on the Ris? us flag stock