In recent years, there has been a significant surge in Indian funds investing in US stocks. This trend is driven by various factors, including the strong economic growth in India, the increasing liquidity in the Indian financial markets, and the attractive valuations in the US stock market. This article explores the reasons behind this trend and highlights the potential opportunities and risks for Indian investors.

The Indian Economic Boom

India has been experiencing a period of robust economic growth, driven by factors such as a young and growing population, increased investments in infrastructure, and a favorable demographic dividend. This has led to a significant increase in the country's per capita income, making Indian investors more affluent and financially independent.

Increased Liquidity in Indian Financial Markets

The Indian financial markets have seen a substantial increase in liquidity in recent years. This has been driven by factors such as the demonetization of high-value currency notes in 2016, which led to a shift towards digital payments, and the government's efforts to promote financial inclusion.

Attractive Valuations in the US Stock Market

The US stock market has been offering attractive valuations to investors, especially in sectors such as technology, healthcare, and consumer goods. This has made it an attractive destination for Indian funds looking to diversify their portfolios and achieve higher returns.

Potential Opportunities for Indian Investors

Investing in US stocks through Indian funds offers several potential opportunities for Indian investors:

- Diversification: By investing in a diversified portfolio of US stocks, Indian investors can reduce their exposure to the domestic market and mitigate risks associated with market-specific events.

- Higher Returns: The US stock market has historically offered higher returns compared to the Indian market. This can be attributed to factors such as higher growth rates, more efficient capital allocation, and better corporate governance.

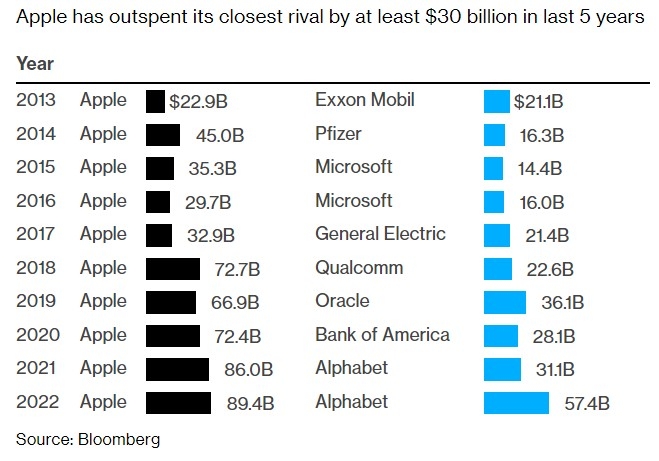

- Access to World-Class Companies: Indian investors can gain access to some of the world's leading companies through their investments in US stocks.

Risks Associated with Investing in US Stocks

While investing in US stocks offers several opportunities, it also comes with certain risks:

- Currency Risk: Fluctuations in the exchange rate between the Indian rupee and the US dollar can impact the returns on investments in US stocks.

- Regulatory Risk: Changes in regulations in the US can impact the performance of US stocks and, consequently, the returns on investments.

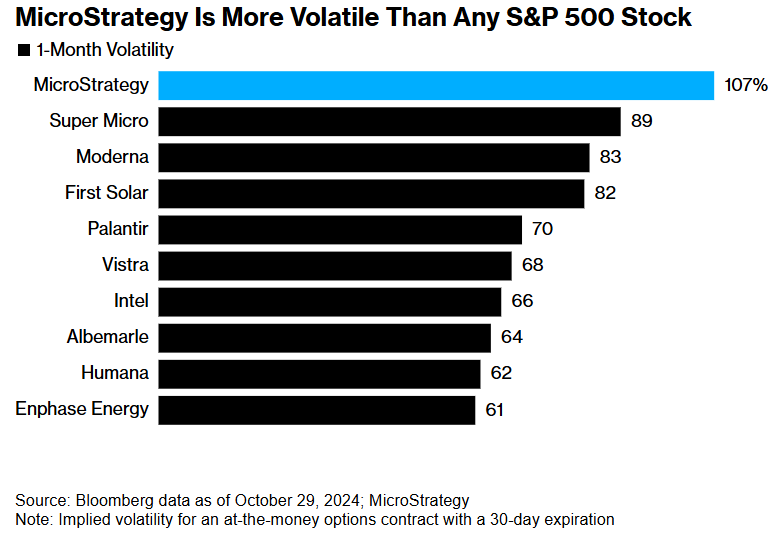

- Market Risk: The US stock market is subject to market-specific risks, such as economic downturns, political instability, and technological disruptions.

Case Studies

Several Indian funds have successfully invested in US stocks, achieving significant returns. For example, the ICICI Prudential US Equity Fund has delivered a compounded annual growth rate (CAGR) of over 17% since its inception in 2008.

Conclusion

Investing in US stocks through Indian funds offers a lucrative opportunity for Indian investors to diversify their portfolios, achieve higher returns, and gain access to world-class companies. However, it is important to be aware of the associated risks and conduct thorough research before making investment decisions.

How Many People Invest in the Stock Market ? us flag stock