As the global push towards renewable energy continues, the United States has been increasingly looking to China for its solar power solutions. With China being the largest producer of solar panels in the world, many American investors are considering buying stock in Chinese solar companies. This article delves into the reasons behind this trend and explores the potential benefits and risks of investing in the Chinese solar market.

The Rise of Solar Energy in China

China has emerged as a leader in the solar energy sector, thanks to its vast manufacturing capabilities and government incentives. Over the past decade, the country has experienced a meteoric rise in solar installations, becoming the world's largest solar market. This growth has been fueled by the Chinese government's commitment to renewable energy and its investment in research and development.

Why Invest in Chinese Solar Stocks?

Several factors make investing in Chinese solar stocks an attractive option for American investors:

Market Potential: The Chinese solar market is projected to grow significantly over the next few years. With the government's support and a growing demand for clean energy, this market presents a promising opportunity for investors.

Cost-Effective Production: Chinese solar companies are known for their cost-effective production methods, which allow them to offer competitive pricing. This has enabled them to capture a significant share of the global solar market.

Government Incentives: The Chinese government has been providing generous subsidies and incentives to encourage the adoption of solar energy. This has helped reduce the cost of solar panels and made them more accessible to consumers.

Technological Innovation: Chinese solar companies are at the forefront of technological innovation, constantly improving the efficiency and performance of solar panels. This puts them in a strong position to capture market share in the global solar industry.

Top Chinese Solar Stocks to Consider

Several Chinese solar companies have caught the attention of American investors. Here are some of the top stocks to consider:

Trina Solar Limited (TSL): Trina Solar is one of the world's largest solar panel manufacturers. The company has a strong track record of innovation and a commitment to sustainability.

JA Solar Holdings Co., Ltd. (JASO): JA Solar is known for its high-efficiency solar panels and has a robust research and development pipeline.

GCL-Poly Energy Holdings Limited (3800.HK): GCL-Poly is a leading integrated solar energy company with a strong focus on cost-effective production and innovation.

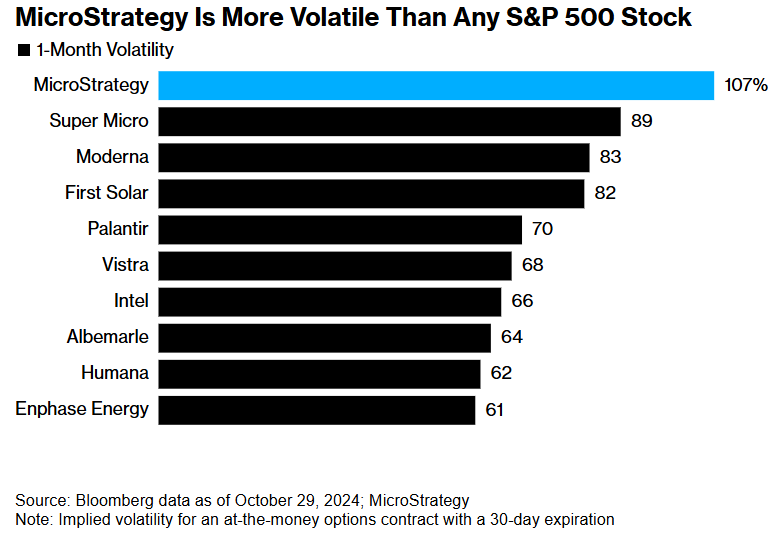

Case Study: First Solar's Expansion into China

First Solar, a U.S.-based solar company, has successfully expanded its operations into the Chinese market. The company has established partnerships with local manufacturers and has been able to leverage the cost advantages of Chinese production. This move has helped First Solar increase its market share and strengthen its position as a global leader in the solar industry.

Risks and Considerations

While investing in Chinese solar stocks offers numerous benefits, there are also risks to consider:

Trade Tensions: The ongoing trade tensions between the United States and China could impact the solar industry, affecting both supply and demand.

Currency Fluctuations: Changes in the value of the Chinese yuan could impact the profitability of Chinese solar companies.

Regulatory Changes: The Chinese government's policies and regulations could change, affecting the solar industry's growth.

In conclusion, investing in Chinese solar stocks presents a promising opportunity for American investors. With the global shift towards renewable energy, the Chinese solar market is poised for significant growth. However, investors should carefully consider the risks and do their due diligence before making any investment decisions.

How Many People Invest in the Stock Market ? us flag stock