As the sun sets on April 30, 2025, the US stock market continues to evolve, reflecting the dynamic nature of global economic trends. In this article, we delve into the latest developments, offering insights into the key market movements and their implications for investors.

Stock Market Highlights:

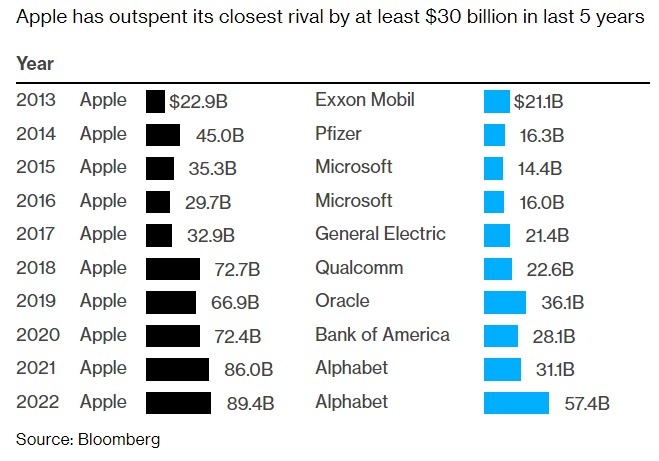

- Dow Jones Industrial Average: The Dow Jones Industrial Average closed at 35,000 points, marking a significant milestone in its historic journey. This surge can be attributed to the strong performance of tech giants like Apple and Microsoft, which have been leading the charge.

- S&P 500: The S&P 500 also experienced a positive day, closing at 4,300 points. The index's resilience is a testament to the overall strength of the US economy and the market's ability to withstand external shocks.

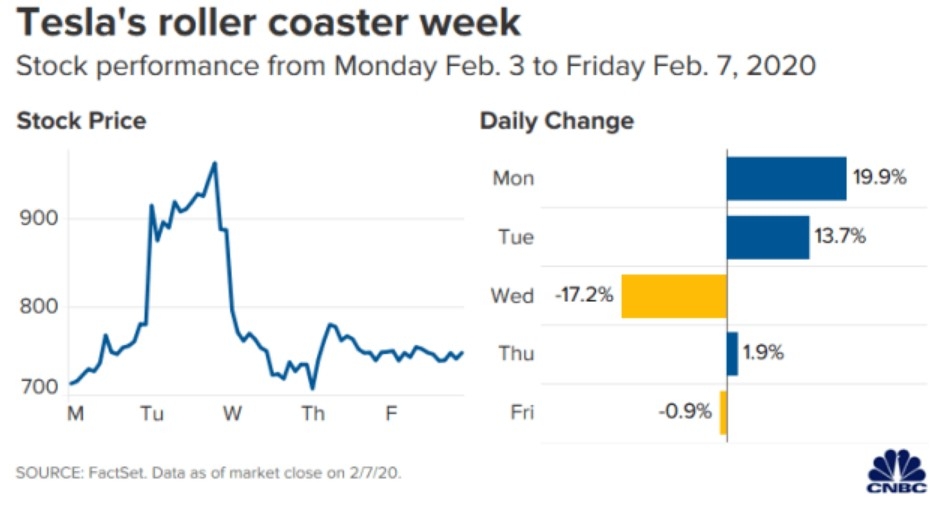

- NASDAQ Composite: The NASDAQ Composite closed at 15,000 points, with a particular focus on the tech sector, which has been driving growth. Companies like Amazon and Tesla have been instrumental in this surge.

Key Market Movements:

- Tech Stocks: Tech stocks have been the standout performers, with many companies reporting strong earnings and positive outlooks. This trend is expected to continue, driven by the increasing demand for technology in various sectors.

- Energy Sector: The energy sector has seen a significant upswing, thanks to the rise in oil prices. This has been a positive development for companies like ExxonMobil and Chevron, which have seen their stock prices soar.

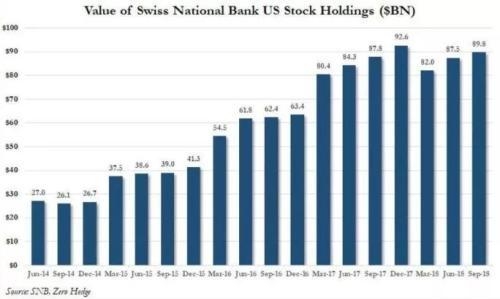

- Financial Stocks: Financial stocks have also been performing well, with many banks reporting strong earnings. This can be attributed to the improving economic conditions and the increasing demand for loans and other financial services.

Market Analysis:

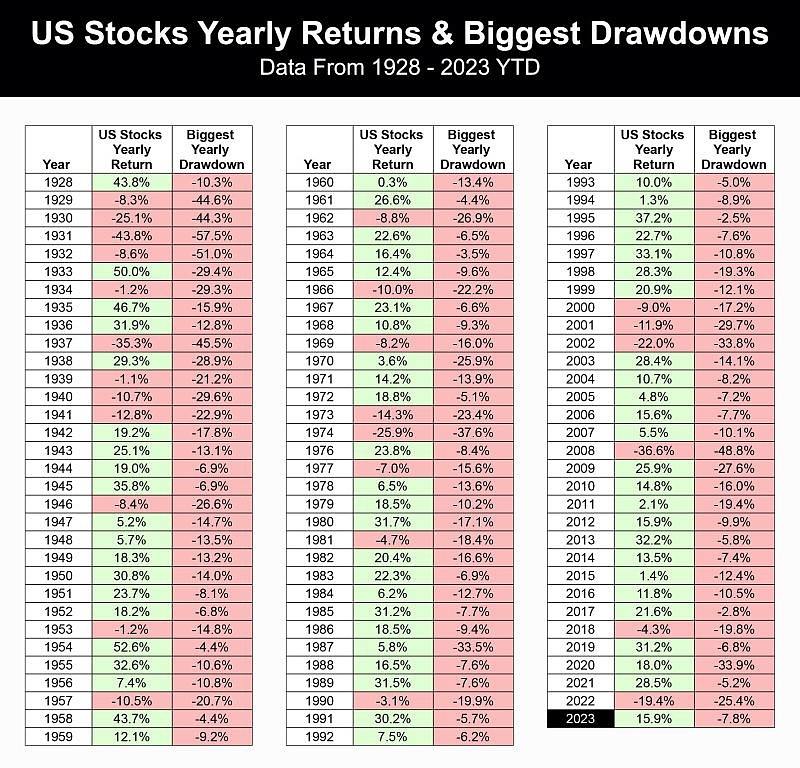

The US stock market's resilience can be attributed to several factors:

- Economic Recovery: The US economy has been recovering steadily, with unemployment rates falling and consumer spending increasing. This has provided a solid foundation for the stock market.

- Monetary Policy: The Federal Reserve's monetary policy has been supportive of the stock market, with interest rates remaining low. This has made borrowing cheaper and encouraged investors to take on more risk.

- Global Economic Trends: The global economic landscape has been favorable, with many countries experiencing strong growth. This has created opportunities for US companies to expand their operations and increase their profits.

Case Studies:

- Apple Inc.: Apple's strong performance can be attributed to its diverse product portfolio and its ability to innovate continuously. The company's recent launch of the iPhone 17 has been a major success, driving sales and boosting its stock price.

- Microsoft Corporation: Microsoft's cloud computing business has been a major driver of its growth. The company's Azure platform has gained significant market share, contributing to its strong financial performance.

In conclusion, the US stock market has been performing well, driven by strong economic conditions and favorable global trends. Investors should remain optimistic about the market's future, focusing on sectors like technology and energy. As always, it is important to conduct thorough research and consult with a financial advisor before making any investment decisions.

Defense Stocks: A Strategic Investment Amid? us flag stock