In the rapidly evolving world of technology, NVIDIA Corporation (NVDA) stands as a powerhouse in the semiconductor industry. With its impressive stock performance, it has become a focal point for investors looking to capitalize on the tech sector's growth. This article delves into the key aspects of NVIDIA US stocks, providing insights into why they are a compelling investment opportunity.

Understanding NVIDIA's Stock Performance

NVIDIA has been a standout performer in the stock market, with its shares consistently rising over the years. As of the latest data, NVDA has seen a remarkable increase in its stock price, making it one of the most sought-after tech stocks in the United States.

Key Factors Driving NVIDIA's Stock Price

1. Strong Revenue Growth: NVIDIA's revenue has been on a steady upward trajectory, driven by its leadership in the GPU market. The company's graphics processing units (GPUs) are widely used in gaming, AI, and data center applications, which have seen a surge in demand.

2. Expansion into New Markets: NVIDIA has been diversifying its product portfolio, entering new markets such as automotive, healthcare, and cloud computing. This expansion has opened up new revenue streams and contributed to the company's growth.

3. Innovative Products: The company's constant innovation in GPU technology has kept it ahead of the competition. NVIDIA's products, such as the GeForce RTX series, have been well-received by consumers and businesses alike.

4. Strong Earnings Reports: NVIDIA has consistently delivered strong earnings reports, which have further boosted investor confidence in the company.

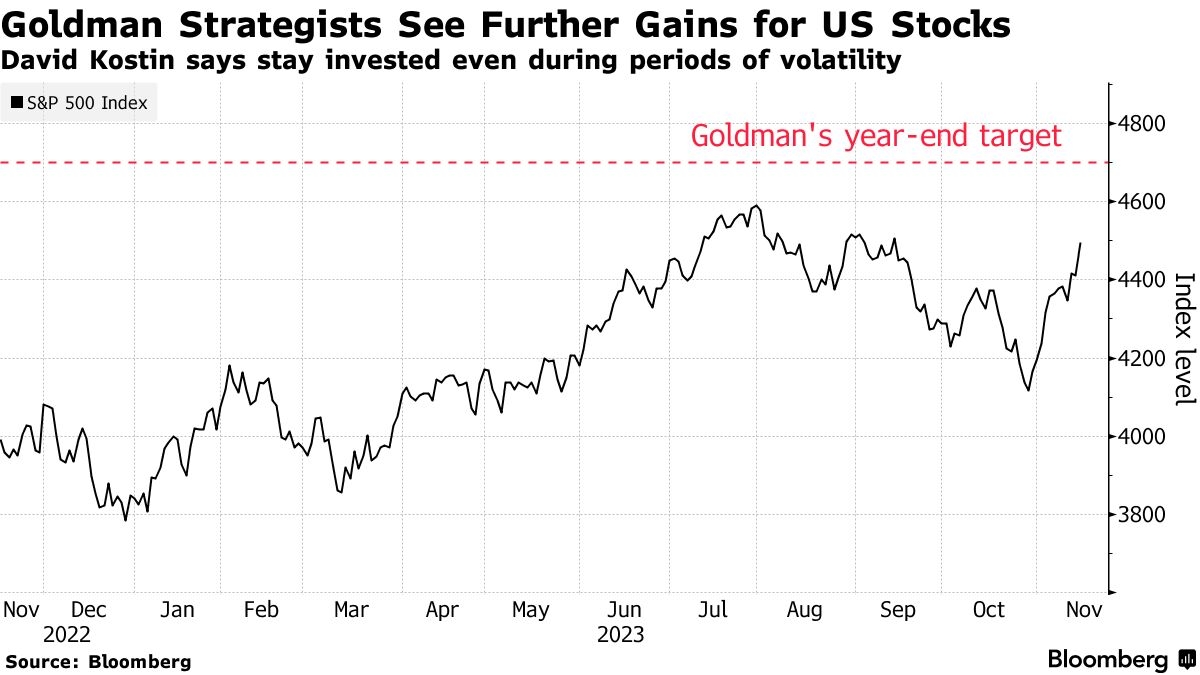

5. Analyst Recommendations: Many Wall Street analysts have a "buy" or "strong buy" rating on NVIDIA stocks, indicating their positive outlook for the company's future.

Investment Opportunities and Risks

Opportunities:

- Long-Term Growth: With the tech sector expected to grow significantly in the coming years, NVIDIA's long-term growth prospects look promising.

- Dividend Yield: While NVIDIA does not currently pay dividends, its strong financial performance could pave the way for future dividend payments.

- Innovation and Diversification: NVIDIA's focus on innovation and diversification makes it a resilient company in the face of market fluctuations.

Risks:

- Competition: The semiconductor industry is highly competitive, with companies like AMD and Intel constantly trying to gain market share.

- Economic Downturns: Economic downturns can negatively impact demand for NVIDIA's products, potentially affecting its revenue and stock price.

- Regulatory Changes: Changes in regulations, particularly in the EU and China, could pose challenges for NVIDIA's global operations.

Case Study: NVIDIA's Acquisition of Arm

One notable case study is NVIDIA's acquisition of Arm, a British-based chip design company, for $40 billion in 2020. This move has been widely praised for its potential to further strengthen NVIDIA's position in the semiconductor industry. The acquisition allows NVIDIA to control the architecture of the processors used in smartphones, servers, and other devices, which could lead to increased revenue and market share.

Conclusion:

Investing in NVIDIA US stocks presents a unique opportunity for investors looking to capitalize on the tech sector's growth. With a strong track record, innovative products, and a promising future, NVIDIA remains a compelling investment choice. However, as with any investment, it's important to consider the risks and do thorough research before making a decision.

US Mega Cap Stocks List: Top Companies to W? us flag stock