The US stock market open is a pivotal moment for investors and traders around the world. It marks the beginning of a new trading day on Wall Street, where millions of shares are bought and sold. Understanding the nuances of the US stock market open is crucial for anyone looking to navigate the financial landscape effectively. In this article, we'll delve into the key aspects of the US stock market open, including its significance, trading hours, and strategies for success.

The Significance of the US Stock Market Open

The US stock market open is more than just the start of a trading day; it's a barometer of the broader economic landscape. When the market opens, investors and traders analyze the opening bell to gauge market sentiment and make informed decisions. The US stock market, particularly the S&P 500 and the Dow Jones Industrial Average, are closely watched indicators of economic health.

Trading Hours

The US stock market operates on a specific schedule. The primary trading session typically opens at 9:30 AM Eastern Time (ET) and closes at 4:00 PM ET. However, it's important to note that there are extended trading hours for some exchanges, allowing investors to trade before and after the regular session.

Strategies for Success

To navigate the US stock market open effectively, investors should consider the following strategies:

Stay Informed: Keeping up with the latest news and economic data is crucial. This includes monitoring corporate earnings reports, economic indicators, and geopolitical events that can impact the market.

Use Technical Analysis: Technical analysis involves studying past market data to predict future price movements. Tools like charts, indicators, and patterns can help investors make informed decisions during the US stock market open.

Diversify Your Portfolio: Diversification is key to managing risk. By investing in a variety of assets, including stocks, bonds, and commodities, investors can mitigate the impact of market volatility.

Set Realistic Goals: It's important to have clear, achievable goals for your investments. This helps in maintaining discipline and avoiding impulsive decisions during the US stock market open.

Case Studies

Let's consider a few case studies to illustrate the impact of the US stock market open:

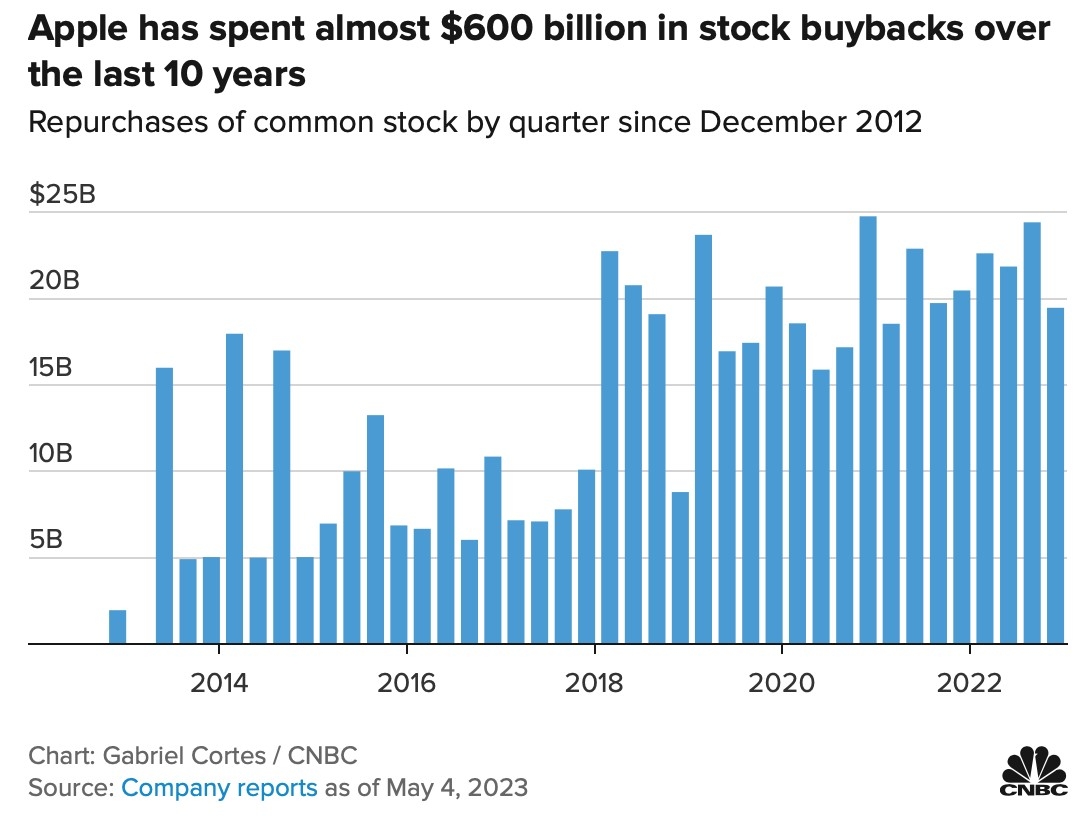

Tech Stocks: During the US stock market open, tech stocks often experience significant volatility. For example, the rise of Apple and Microsoft in the late 1990s was a direct result of the market's enthusiasm for technology during the US stock market open.

Economic Indicators: The release of economic indicators, such as the Consumer Price Index (CPI) or Unemployment Rate, can have a profound impact on the market. For instance, a lower-than-expected unemployment rate can lead to increased optimism and a rise in stock prices during the US stock market open.

Geopolitical Events: Geopolitical events, such as elections or trade disputes, can cause significant market movements during the US stock market open. For example, the 2016 US presidential election resulted in a volatile market as investors weighed the potential impact of a Trump presidency.

In conclusion, the US stock market open is a critical time for investors and traders. By understanding its significance, trading hours, and strategies for success, investors can navigate the financial landscape more effectively. Whether you're a seasoned investor or just starting out, staying informed and disciplined is key to achieving your investment goals.

NYSE Meta: Revolutionizing the Stock Market? us flag stock