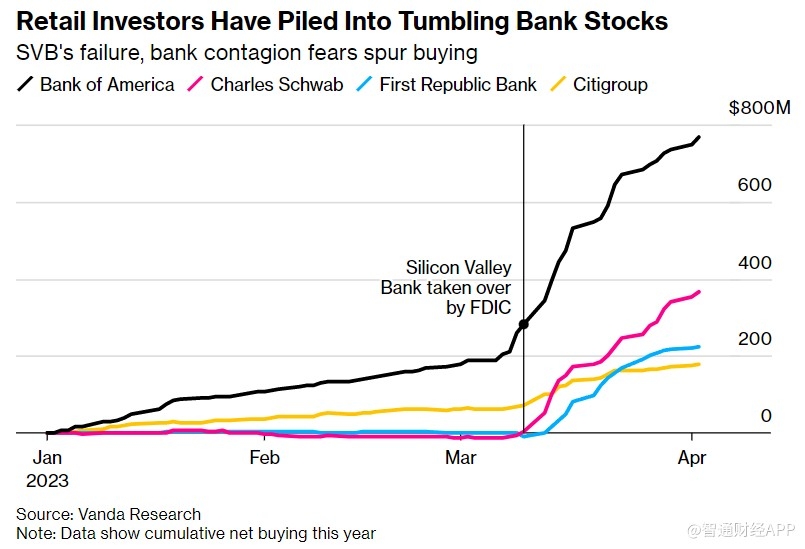

The recent sell-off in US bank stocks has been a topic of intense discussion among investors and financial analysts. Understanding the reasons behind this trend is crucial for anyone looking to navigate the volatile financial markets. In this article, we delve into five key reasons behind the sell-off in US bank stocks.

1. Rising Interest Rates

One of the primary reasons for the sell-off in US bank stocks is the rising interest rates. As the Federal Reserve continues to raise rates to combat inflation, the cost of borrowing for consumers and businesses increases. This, in turn, affects the profitability of banks, as they earn more on loans with higher interest rates. However, the anticipation of higher rates can lead to a sell-off as investors fear potential negative impacts on bank earnings.

2. Regulatory Changes

The implementation of new regulations can also contribute to the sell-off in bank stocks. For instance, the introduction of the Dodd-Frank Wall Street Reform and Consumer Protection Act in 2010 imposed stricter regulations on the banking industry. These regulations increased compliance costs for banks, which can lead to lower profitability and a subsequent sell-off in stock prices.

3. Economic Uncertainties

Economic uncertainties, such as geopolitical tensions and trade wars, can significantly impact the performance of bank stocks. As businesses and consumers become more cautious due to these uncertainties, they are less likely to take out loans, leading to lower revenue for banks. This can result in a sell-off as investors become concerned about the future prospects of the banking industry.

4. Technological Advancements

The rapid advancements in technology have also played a role in the sell-off of US bank stocks. With the rise of fintech companies offering innovative financial services, traditional banks are facing increased competition. This competition can lead to a loss of market share and a subsequent decline in stock prices.

5. Valuation Concerns

Another reason for the sell-off in US bank stocks is valuation concerns. As the stock prices of these banks have risen significantly over the past few years, some investors believe that they are overvalued. When these investors decide to sell their stocks, it can lead to a sell-off in the market.

Case Study: JPMorgan Chase

A prime example of the impact of these factors on bank stocks is JPMorgan Chase. In the first quarter of 2022, JPMorgan Chase reported a decline in net income due to higher expenses related to regulatory compliance and increased interest rates. This led to a sell-off in the company's stock, as investors became concerned about the bank's future profitability.

In conclusion, the sell-off in US bank stocks can be attributed to a combination of rising interest rates, regulatory changes, economic uncertainties, technological advancements, and valuation concerns. Understanding these factors is essential for investors looking to navigate the volatile financial markets and make informed decisions.

How Many People Invest in the Stock Market ? us flag stock