Investing in penny stocks can be a risky endeavor, but it also offers the allure of high potential returns. These stocks, often trading under

Understanding Penny Stocks

Penny stocks are shares of publicly traded companies that trade at a low price per share, typically below $1. These stocks are often associated with small-cap companies or those going through restructuring. While they can offer significant upside, they also come with a higher level of risk due to their volatility and potential for delisting.

The Appeal of Penny Stocks Under $1

Investors are attracted to penny stocks under $1 for several reasons:

- Low Entry Cost: The low price per share makes it more affordable for retail investors to buy a substantial number of shares.

- Potential for High Returns: Some penny stocks have the potential to skyrocket in value, offering substantial gains.

- Market Opportunity: There is a vast pool of penny stocks to choose from, providing investors with a wide range of opportunities.

Identifying Potential Hidden Gems

To find potential hidden gems among penny stocks under $1, it's essential to conduct thorough research. Here are some key factors to consider:

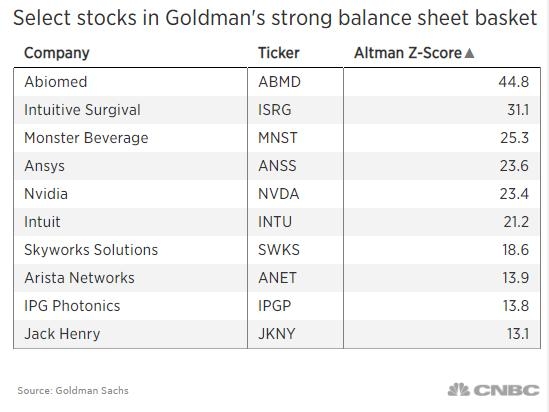

- Financial Health: Examine the company's financial statements to ensure they have a strong balance sheet and are generating revenue.

- Industry Outlook: Research the industry trends and determine if the company is in a growing market.

- Management: Assess the experience and track record of the company's management team.

- News and Updates: Stay informed about the latest news and updates from the company to identify any potential catalysts for growth.

Case Studies: Successful Penny Stock Investments

Several penny stocks under $1 have turned into successful investments over time. Here are a few notable examples:

- Tesla, Inc. (TSLA): Once a small, under-the-radar company, Tesla has become a household name in the electric vehicle industry. Its stock price skyrocketed from around

2 per share to over 1,000 per share. - Facebook, Inc. (FB): Before its IPO, Facebook was a penny stock, trading at just a few cents per share. Today, it's a multibillion-dollar company with a market capitalization of over $500 billion.

Risks and Considerations

While penny stocks under $1 can offer substantial returns, they also come with significant risks:

- High Volatility: The stock price can swing wildly in a short period, leading to significant losses.

- Lack of Research: Many penny stocks receive little to no coverage from analysts, making it harder to gauge their true value.

- Fraud and Scams: The penny stock market is notorious for fraudulent activities, so it's crucial to exercise due diligence.

Final Thoughts

Investing in US penny stocks under $1 can be a lucrative venture, but it requires careful research and a risk tolerance. By understanding the potential hidden gems and the risks involved, you can make informed decisions and potentially capitalize on these undervalued assets. Always remember to do your homework and never invest more than you can afford to lose.

How Many People Invest in the Stock Market ? us flag stock