In the dynamic world of investing, secular growth stocks have emerged as a beacon for long-term investors. These stocks are not just about short-term gains; they represent companies with sustainable, long-term growth potential. In this article, we delve into the concept of secular growth stocks in the United States, exploring their characteristics, benefits, and strategies for investment.

Understanding Secular Growth Stocks

Secular growth stocks are companies that exhibit a consistent and predictable increase in revenue and earnings over an extended period. Unlike cyclical stocks, which are more sensitive to economic fluctuations, secular growth stocks are driven by fundamental changes in the market or consumer behavior. This long-term perspective makes them a compelling choice for investors seeking stable returns.

Key Characteristics of Secular Growth Stocks

- Strong Revenue Growth: These companies consistently increase their revenue over time, often by expanding their market share or introducing new products.

- Robust Earnings: Secular growth stocks demonstrate a steady increase in earnings per share (EPS) over several years.

- Diverse Industries: While secular growth stocks can be found in various industries, they often come from technology, healthcare, consumer goods, and communication sectors.

- High-Quality Management: Companies with secular growth potential usually have a strong management team that can navigate market changes and drive growth.

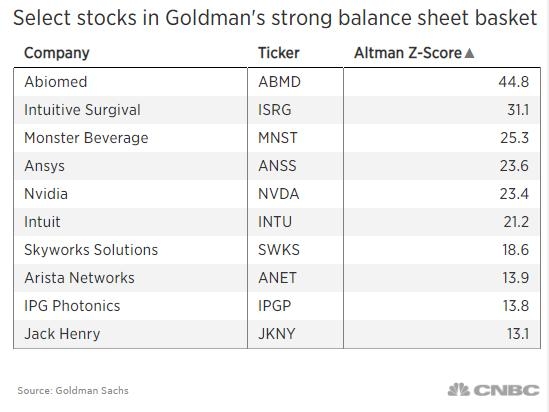

- Strong Balance Sheets: These companies often have strong financial health, with low debt and healthy cash flow.

Benefits of Investing in Secular Growth Stocks

Investing in secular growth stocks offers several advantages:

- Long-Term Returns: Secular growth stocks have the potential to deliver significant returns over time, making them ideal for long-term investors.

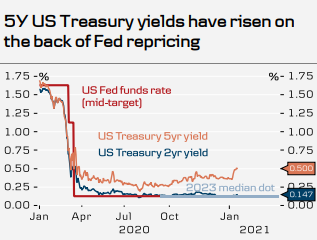

- Inflation Protection: These stocks often have pricing power, allowing them to raise prices and earnings in line with inflation.

- Market Resilience: Secular growth stocks tend to perform well during economic downturns, as they are less affected by short-term market volatility.

Strategies for Investing in Secular Growth Stocks

- Research and Analysis: Conduct thorough research on potential secular growth stocks, considering factors like market trends, competitive landscape, and financial health.

- Diversification: Diversify your portfolio by investing in secular growth stocks across different industries to mitigate risks.

- Long-Term Perspective: Maintain a long-term perspective when investing in secular growth stocks, as they often take time to realize their full potential.

Case Studies: Successful Secular Growth Stocks

- Apple Inc.: As one of the most successful secular growth stocks, Apple has consistently delivered strong revenue and earnings growth, driven by its innovative products and global market presence.

- Amazon.com Inc.: Amazon has transformed the retail industry with its e-commerce platform and cloud computing services, showcasing the potential of secular growth stocks in the technology sector.

- Johnson & Johnson: This healthcare giant has a diversified portfolio of products and a strong track record of sustainable growth, making it a compelling secular growth stock.

In conclusion, secular growth stocks offer a compelling investment opportunity for long-term investors. By understanding their characteristics, benefits, and investment strategies, investors can identify and capitalize on companies with sustainable growth potential. As the market evolves, secular growth stocks will continue to play a vital role in building wealth over time.

How Many People Invest in the Stock Market ? us flag stock