In the ever-evolving world of finance, staying ahead of the curve is crucial for investors. The US stock index outlook is a key indicator of market trends and potential opportunities. This article delves into the current state of the market, offering insights into what investors can expect in the coming months.

Understanding the US Stock Index

The US stock index is a composite measure of the performance of a selection of stocks, typically representing the broader market. The most well-known US stock index is the S&P 500, which tracks the performance of 500 large companies listed on stock exchanges in the United States. Other prominent indices include the Dow Jones Industrial Average and the NASDAQ Composite.

Current Market Trends

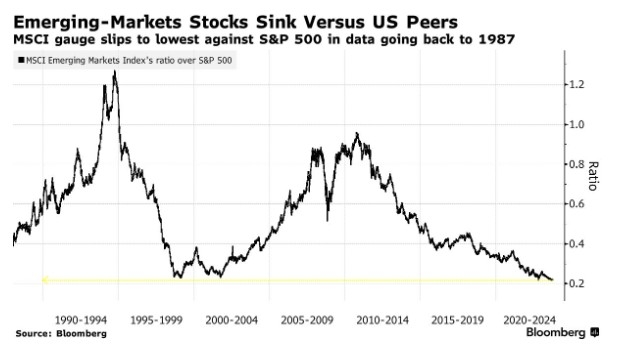

As of early 2023, the US stock market is experiencing a period of volatility. This can be attributed to several factors, including geopolitical tensions, rising inflation, and changes in monetary policy by the Federal Reserve. Despite these challenges, many experts remain optimistic about the long-term outlook for the market.

Key Factors Influencing the Stock Index Outlook

Economic Growth: Economic indicators such as GDP, unemployment rates, and consumer spending play a significant role in shaping the stock index outlook. A strong economy typically leads to higher stock prices.

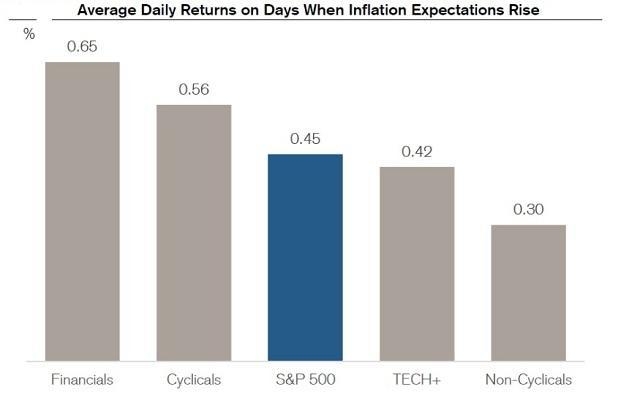

Inflation: Rising inflation can erode purchasing power and negatively impact corporate profits. However, some sectors, such as consumer discretionary and energy, may benefit from higher prices.

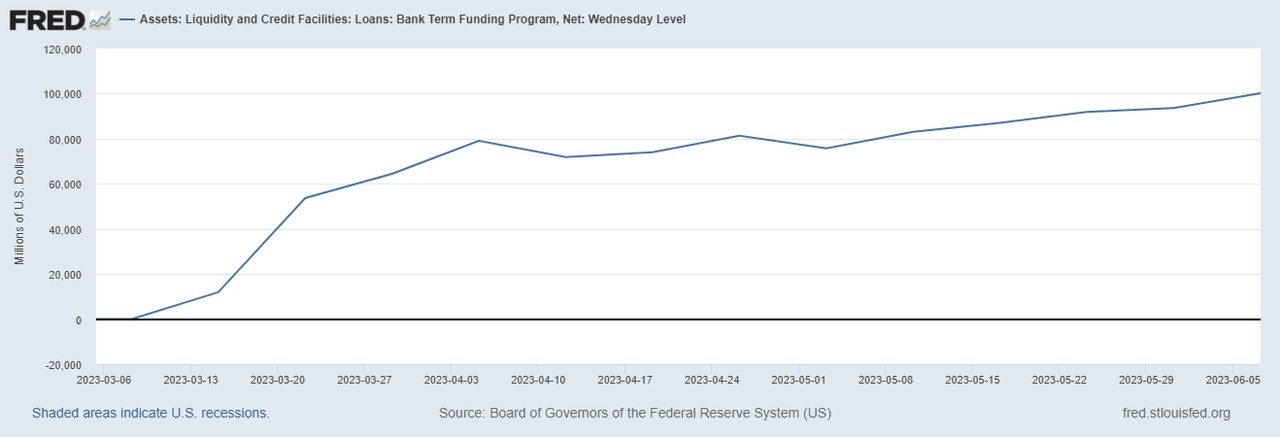

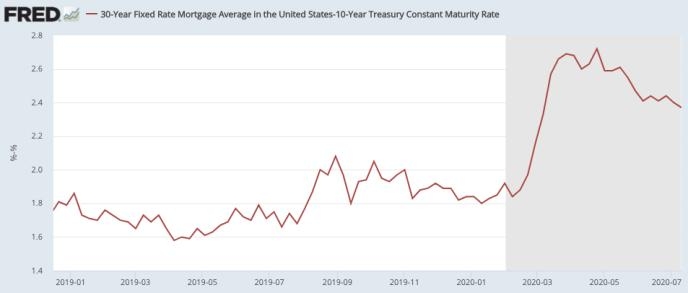

Monetary Policy: The Federal Reserve's monetary policy decisions, including interest rate changes and bond purchases, can have a significant impact on the stock market. A tightening monetary policy can lead to higher borrowing costs and slower economic growth.

Geopolitical Tensions: Global events, such as trade disputes and political instability, can create uncertainty in the market and lead to volatility.

Sector Outlook

Technology: The technology sector has been a major driver of the US stock market's growth over the past decade. However, some investors are concerned about overvaluation and increasing regulatory scrutiny.

Healthcare: The healthcare sector is expected to benefit from an aging population and advancements in medical technology. Companies in this sector may offer stability and growth opportunities.

Financials: The financial sector is sensitive to economic conditions and interest rate changes. However, some financial institutions may benefit from higher interest rates.

Case Study: Apple Inc.

Apple Inc. is a prime example of a company that has significantly impacted the US stock index. Over the past few years, Apple has seen strong growth in its revenue and earnings, driven by its popular products and services. As a result, Apple's stock has outperformed the market, contributing to the overall upward trend in the S&P 500.

Conclusion

The US stock index outlook remains cautiously optimistic, despite the challenges faced by the market. Investors should stay informed about key economic indicators, sector trends, and geopolitical events to make informed decisions. By understanding the factors that influence the stock index outlook, investors can navigate the market with confidence and potentially achieve their financial goals.

Tourmaline Oil Corp US Stock: A Comprehensi? us flag stock