In today's rapidly evolving financial landscape, the role of U.S. participation in the stock market is more crucial than ever. This article delves into the significance of American investors in the stock market, exploring the impact of their decisions, the benefits they derive, and the factors that influence their participation. By understanding these aspects, we can gain valuable insights into the dynamics of the stock market.

The Significance of U.S. Investors in the Stock Market

The United States is home to the world's largest and most influential stock market, the New York Stock Exchange (NYSE). U.S. investors, both individual and institutional, play a pivotal role in driving market trends and shaping the economic landscape. Their participation in the stock market has several key benefits:

- Economic Growth: The stock market serves as a barometer of economic health. When investors perceive a strong economy, they are more likely to invest in stocks, thereby fueling economic growth.

- Capital Formation: By investing in stocks, U.S. investors provide companies with the capital they need to expand, innovate, and create jobs.

- Investment Returns: Over the long term, investing in the stock market has historically provided higher returns than other investment vehicles, such as bonds or savings accounts.

Factors Influencing U.S. Participation in the Stock Market

Several factors influence the level of U.S. participation in the stock market:

- Market Confidence: Investors are more likely to participate in the stock market when they have confidence in the market's stability and the economic outlook.

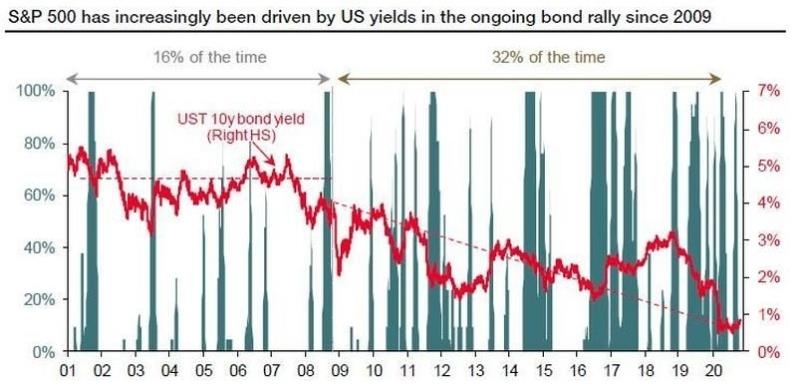

- Interest Rates: Low interest rates can incentivize investors to seek higher returns in the stock market.

- Tax Policies: Favorable tax policies can encourage investors to invest in the stock market by reducing their tax burden.

- Technology and Accessibility: Advances in technology have made it easier for investors to access the stock market, increasing their participation.

Case Studies: The Impact of U.S. Participation in the Stock Market

Several case studies illustrate the impact of U.S. participation in the stock market:

- Tech Boom of the 1990s: The dot-com bubble of the 1990s was fueled, in part, by U.S. investors' enthusiasm for tech stocks. This led to significant growth in the tech sector and the creation of numerous jobs.

- Financial Crisis of 2008: The 2008 financial crisis saw a sharp decline in stock market participation, as investors became wary of market volatility. However, the subsequent recovery in the stock market was driven, in large part, by U.S. investors regaining confidence.

Conclusion

U.S. participation in the stock market is a critical driver of economic growth, capital formation, and investment returns. By understanding the factors that influence their participation, we can better appreciate the importance of U.S. investors in shaping the future of the stock market.

Best Performing US Stocks Last 5 Days: Mome? us flag stock